Market Overview: NASDAQ 100 Emini Futures

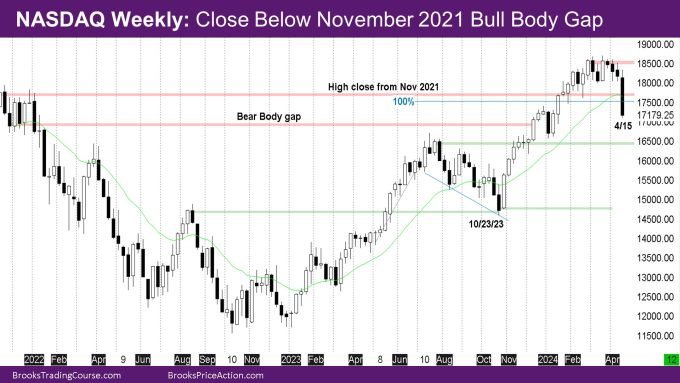

The NASDAQ Emini futures week is an enormous bear bar closing on its low far under the exponential transferring common (EMA). The market additionally had an in depth under November 2021 bull physique hole.

On the every day chart, the market had a bear micro-channel with bear development bars on 4 of the 5 days. The market has closed the bull hole from the November 2021 excessive with a number of bear development closes under it.

To date, the month is an enormous bear development bar reversing the bull our bodies of the prior 3 months. For the reason that month-to-month chart is in a bull micro-channel, there ought to be consumers under prior bull development bars like February. With a bit over every week left within the month, the issue for the bears is that the month-to-month bar is already the dimensions of a median month (over previous 10 bars or so), so probably some a part of the remainder of the month will probably be sideways.

NASDAQ 100 Emini futures

The Weekly NASDAQ chart

- The week is an enormous bear development bar closing far under the EMA.

- As has been talked about earlier than, the November 2021 shut was a magnet and merchants needed to see how the market would take a look at it.

- The bull state of affairs was that the market examined the EMA and the November 2021 hole as a bull leg in a buying and selling vary and closed above it, basically retaining the bull development intact.

- The bear state of affairs was that the market broke via and closed far under the EMA and the November 2021 hole, concluding that the market is in a buying and selling vary.

- Bears want a follow-through bar or two to verify the shut of the bull physique hole, however to this point it’s trying just like the latter is the case.

The Day by day NASDAQ chart

- The market broke under the buying and selling vary that has been happening since March.

- Bulls needed the take a look at of November 2021 bull hole to be as a leg in a buying and selling vary.

- As a substitute, the market broke via the November 2021 bull hole with severak closes under it.

- The market closed under a whole lot of bars throughout February-March to the left.

- Prior reviews had talked about the bear targets if the market breaks under the EMA – The primary one was the November 2021 excessive shut.

- The subsequent one is the shut of 1/4/2024 – which was a bear microchannel that was by no means sufficiently examined.

- The week had 4 bear development bar days, 3 being giant.

- Monday was a bear development bar whose physique matched Friday’s bear development bar.

- This was additionally the primary successive development bar closes under EMA since October.

- Tuesday was a doji bar, probably a pause for a 2nd leg. Wednesday was a breakout under, with Thursday a superb follow-through bar.

- Friday was one other massive bear bar.

- The bear breakout of Wednesday, Thursday and Friday ought to have a 2nd leg, presumably 2 legs.

Market evaluation reviews archive

You’ll be able to entry all weekend reviews on the Market Evaluation web page.