- Ethereum loses extra floor on Bitcoin in NFT quantity.

- Apecoin continues to say no.

Ethereum [ETH] stays distinguished within the NFT dialog; nevertheless, current information signifies a discount in its dominance.

ApeCoin [APE], the ecosystem token related to Bored Ape Yacht Membership (BAYC) – an Ethereum-based NFT assortment – has skilled a decline in relevance, mirroring the current downturn in BAYC’s ground value.

Ethereum NFT quantity continues to slip down

NFTs have been primarily related to Ethereum up to now, given the multitude of initiatives hosted on the platform. Nevertheless, the emergence of different platforms has disrupted this monopoly.

In current months, Bitcoin has emerged as an surprising competitor within the NFT house regardless of working otherwise.

Evaluation of NFT quantity on Crypto Slam revealed that Bitcoin has surpassed Ethereum in quantity during the last 30 days.

Particularly, the NFT quantity on the Bitcoin community was over $455.59 million, whereas it amounted to $291.15 million on Ethereum.

Information indicated that Bitcoin collections occupy the highest three spots in quantity. In distinction, fashionable ETH collections like Bored Ape Yacht Membership (BAYC) solely rank sixth.

A have a look at how BAYC has trended

An evaluation of the general value pattern of Bored Ape Yacht Membership (BAYC) on NFT Worth Flooring confirmed a big decline within the BAYC ground value over the previous few months.

Notably, in April, there was a noticeable drop within the ground value.

On the time of writing, the ground value was round 10.89 ETH. The ground value represents the bottom value for the Ethereum-based NFT assortment, and the chart signifies a decline of over 67% over the previous 12 months.

The decline in BAYC and different Yuga collections has additionally impacted ApeCoin, bringing it near its lowest value.

APE near ATL

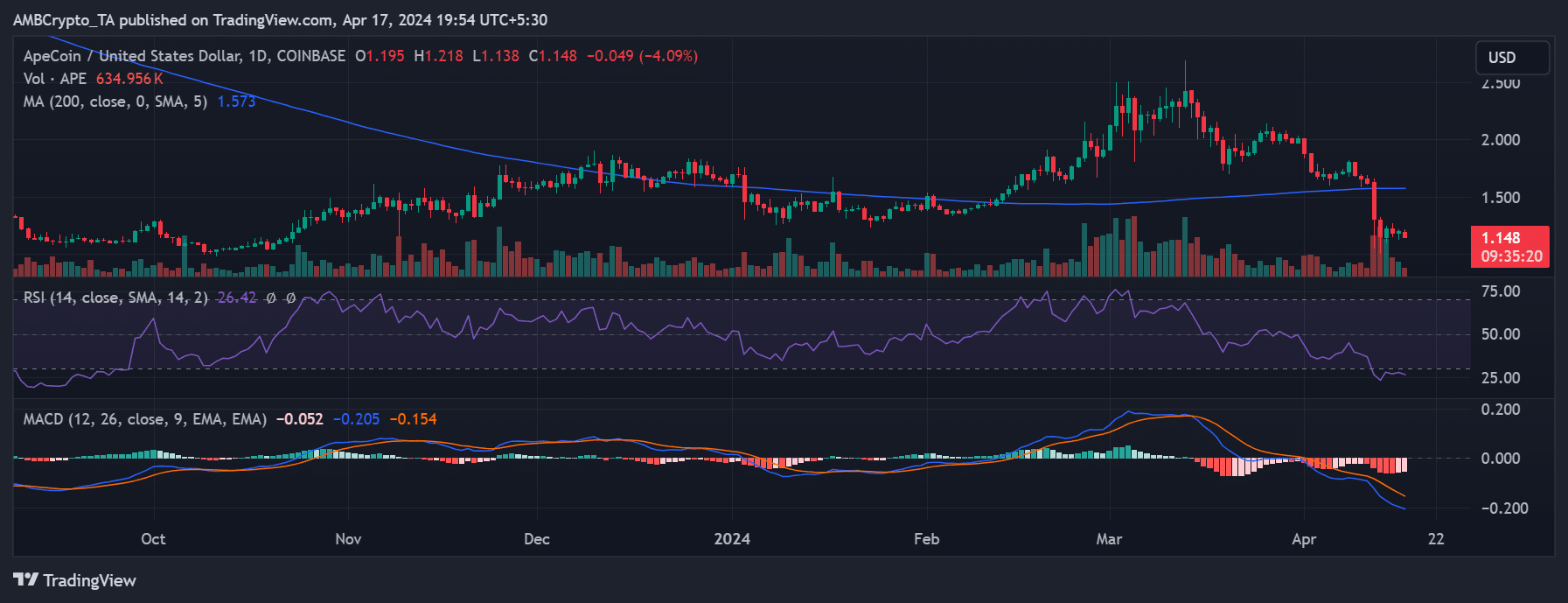

The evaluation of ApeCoin signifies a destructive pattern for the de facto ecosystem coin of Ethereum-based collections. Examination of the Relative Power Index (RSI) confirmed an oversold situation.

Life like or not, right here’s APE market cap in BTC’s phrases

On the time of writing, the RSI was beneath 30, signaling a robust bear pattern and an oversold state. Moreover, APE was buying and selling round $1.15, reflecting a greater than 4% decline.

Additional evaluation confirmed that APE’s all-time low was round $1.01, suggesting an additional drop might deliver the worth to this area.