What is the Distinction Between SPX and SPY Choices?

What Is SPX?

SPX is the S&P 500 index, which is a inventory market index that measures the efficiency of 500 giant cap publicly traded corporations in the USA. The S&P 500 index is extensively thought to be top-of-the-line measures of the general efficiency of the U.S. inventory market.

SPX is a numerical worth that represents the extent of the S&P 500 index. It’s calculated by taking the weighted common of the inventory costs of the five hundred corporations included within the index, with the weights decided by the market capitalization of every firm. SPX is commonly used as a benchmark for the efficiency of enormous cap U.S. shares.

The S&P 500 index is maintained by S&P Dow Jones Indices. It is among the most generally adopted inventory market indices on the planet and is used as a benchmark by buyers, analysts and monetary professionals.

What Is SPY?

The SPDR S&P 500 ETF Belief (SPY), also called SPY, is an exchange-traded fund that tracks the efficiency of the S&P 500 index. The S&P 500 is a inventory market index that measures the efficiency of 500 giant cap publicly traded corporations in the USA.

SPY was launched in 1993 and is among the oldest and largest ETFs on the planet, with over $375 billion in property below administration as of Could 1, 2023. SPY trades on the NYSE Arca change and will be purchased and offered like a inventory by a brokerage account.

Investing in SPY supplies buyers with publicity to a diversified portfolio of enormous cap U.S. shares, making it a preferred selection for these trying to put money into the U.S. inventory market. As a result of it tracks the S&P 500 index, SPY is commonly used as a benchmark for the general efficiency of the U.S. inventory market.

Dividends

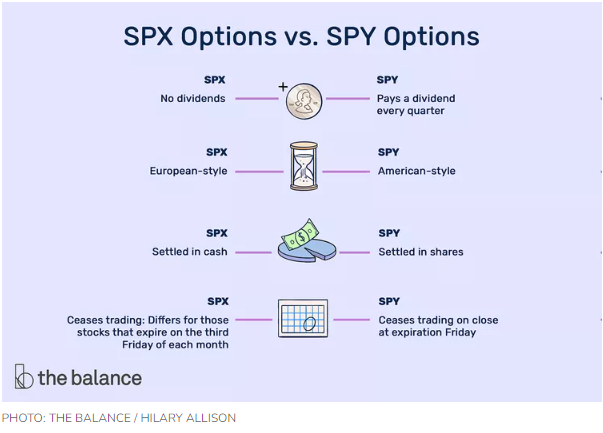

Dividends aren’t usually paid to choices holders. Nevertheless, SPY pays a dividend each quarter. That is important as a result of for those who commerce with in-the-money (ITM) name choices, you possibly can train them to gather the dividend. To do that, it is advisable to train your choices on SPY earlier than the ex-dividend date or personal shares and place a name (referred to as a lined name possibility).

It is very important be alert when buying and selling ITM calls as a result of most calls are exercised for the dividend on expiration Friday. Subsequently, for those who personal these choices, you can not afford to lose the dividend.

The ex-dividend day for SPY is the third Friday of March, June, September, and December. If that day does not fall on a enterprise day, it’s pushed to the following enterprise day.

Trading Model

There are two completely different buying and selling kinds, European and American. European model choices can solely be exercised on the expiration date, whereas American choices will be exercised any time earlier than the expiry date.

SPY choices are American-style and could also be exercised at any time after the dealer buys them (earlier than they expire).

Expiration

SPX choices that expire on the third Friday cease buying and selling the day earlier than the third Friday (the third Thursday). On the third Friday, the settlement worth is decided by the opening costs of every of the index’s shares. This worth is the closing worth for the expiration cycle. SPY choices stop buying and selling on the shut of enterprise on expiration Friday.

Be aware

All SPX choices expire on the shut of enterprise on expiration Friday. Nevertheless, those who expire on the third Friday of the month don’t.

Settlement

SPY choices are settled in shares. Once you train your choices, you will purchase (or promote) shares of the ETF. Money is used to settle SPX choices, so for those who train and are within the cash, you will obtain money in your brokerage account.

Worth

An SPX possibility can also be about 10 occasions the worth of an SPY possibility. For instance, on April 9, 2020, SPX closed at 2,789.82 factors, and SPY closed at $278.20.34

It is vital to know that one SPX possibility with the identical strike worth and expiration is roughly 10 occasions the worth of 1 SPY possibility. Subsequently, every SPX level was the identical as $100.5

For instance, suppose SPX was at 2,660 factors, and SPY traded close to $266. One in-the-money SPX possibility offers its proprietor the suitable to purchase $266,000 price of the underlying asset ($100 x 2,660).

One SPY possibility offers its proprietor the suitable to purchase $26,600 price of ETF shares (10% of $266,000).

Liquidity

SPY has very “tight” bid/ask spreads. This helps planning as a result of one has a fairly may concept of the execution worth. It additionally permits the usage of market orders that are simpler and may execute a lot faster than restrict orders. When utilizing market orders, many brokers (I do know Constancy does) provide worth enhancements that may end up in favorable execution costs.

SPX, alternatively, has a comparatively broad bid/ask unfold when in comparison with SPY. Which means that restrict orders are a should. Meaning some “bargaining” with the worth and far slower execution. It’s extra time intensive, much less exact and one by no means actually is aware of in the event that they obtained one of the best worth.

Some merchants desire ETFs like SPY as a result of higher liquidity. What they usually neglect is the truth that Index choices are 10 occasions greater product, so 20 cents unfold on RUT is equal to 2 cents unfold on IWM. For instance, unfold of 10.00/10.50 on RUT can be equal to 1.00/1.05 on IWM. The slippage on RUT is often not more than 10-15 cents which is 1-1.5 cents on IWM.

Commissions

Shopping for much less contracts means a major distinction in commissions. For instance: for those who purchase one lot of 10 strike SPX Iron Condor, you’ll commerce 8 spherical journey contracts. At $1/contract, that is $8 or 0.8% of the $1,000 margin. Purchase 10 a lot of 1 strike SPY Iron Condor – and the commissions bounce to $80 or 8% of the $1,000 margin.

Tax Remedy Variations

Right here there’s a substantial plus to Index choices. The IRS treats these indexes otherwise from shares (or ETFs).

The Index choices get particular Part 1256 remedy which permits the investor to have 60% of a achieve as long run (at a 15% tax fee), and the opposite 40% handled as quick time period (on the common 35% quick time period capital good points fee) even when the place is held for lower than a yr.

Against this, the ETFs are handled as peculiar shares, and thus if held lower than a yr, all good points are taxed on the much less favorable 35% short-term capital good points fee.

Thus the Index choices will be higher from a tax standpoint. It’s best to in fact seek the advice of together with your tax advisor to see how these tax implications could or might not be important in your scenario.

Verdict: SPX tax remedy is considerably higher than SPY. SPY has a bonus in LEAPS, however from a sensible standpoint, it may well’t even come near the benefits provided SPX. Keep in mind, it is not what you make it is what you retain that issues.

Which Is Proper For You?

The property inside SPX don’t commerce, so there are not any shares in the stores or promote. The choices are written in order that merchants can guess on the S&P 500’s worth actions. SPX features as a theoretical index with a worth calculated as if it have been a real index.

Be aware

The five hundred particular shares within the index are rebalanced as soon as per quarter in March, June, September, and December.6 It’s best to look ahead to these occasions when buying and selling choices, as there is perhaps new alternatives to enter and exit positions.

This implies it has precisely the variety of shares of every of the five hundred shares. So, whereas the SPX itself could not commerce, each futures contracts and choices primarily based on the index do. Because of this SPX choices are settled in money.

The SPY choices are settled in shares as a result of shares are being traded on an change. Subsequently, the choices contracts are written so that you just take possession of shares if you train your possibility.

Which choices are greatest for you relies upon upon your technique and objectives. If you wish to take possession of shares to carry or commerce once more, SPY may work greatest. Should you’d somewhat commerce for worth and obtain money in your account, SPX is a superb selection.

Trading SPY choices does carry some extra danger. For instance, on the Monday following expiration, you find yourself proudly owning shares. You may owe the worth of these shares on the expiry time, not the worth on Monday. So if the worth for the shares strikes decrease on Monday, you are paying greater than they’re price on that day. Nevertheless, if the worth strikes greater, you pay lower than the present market worth.

The Backside Line

The 2 key variations between SPY vs. SPX choices are that they’re both American or European model, and SPY choices are on an ETF whereas SPX choices are on the costs of the index itself. It’s best to perceive the distinction this makes for exercising your choices. Moreover, the distinction in worth (and settlement) makes how a lot capital you must purchase the choices essential.

SPX clearly wins the “assignment risk” battle, the “trading costs” battle and the “taxable account” battle. It loses on flexibility and comfort. For those who commerce choices in IRAs and ROTHs, SPX must be very significantly thought of. Generally it is higher to pay a bit of and NOT be sitting on a time-bomb.

For these with taxable accounts the tax benefits afforded SPX dwarfs any enhance in prices. Ultimately it comes down to 1’s willingness to spend further effort and time to realize tax financial savings..

You probably have extra capital to spare and do not require dividends, SPX is perhaps a good selection. However, SPY is perhaps a better option for those who’re a bit quick on funds and may use the dividends.

Mark Wolfinger has been within the choices enterprise since 1977, when he started his profession as a ground dealer on the Chicago Board Choices Trade (CBOE). Since leaving the Trade, Mark has been giving buying and selling seminars in addition to offering particular person mentoring through phone, electronic mail and his premium Choices For Rookies weblog. Mark has printed 4 choices buying and selling books. His Choices For Rookies e-book is a basic primer and a should learn for each choices dealer. Mark holds a BS from Brooklyn Faculty and a PhD in chemistry from Northwestern College.

Associated articles