- Over 43% of Ethereum’s provide is concentrated in three whale addresses

- Concentrated possession dangers value manipulation, volatility, and decentralized governance erosion

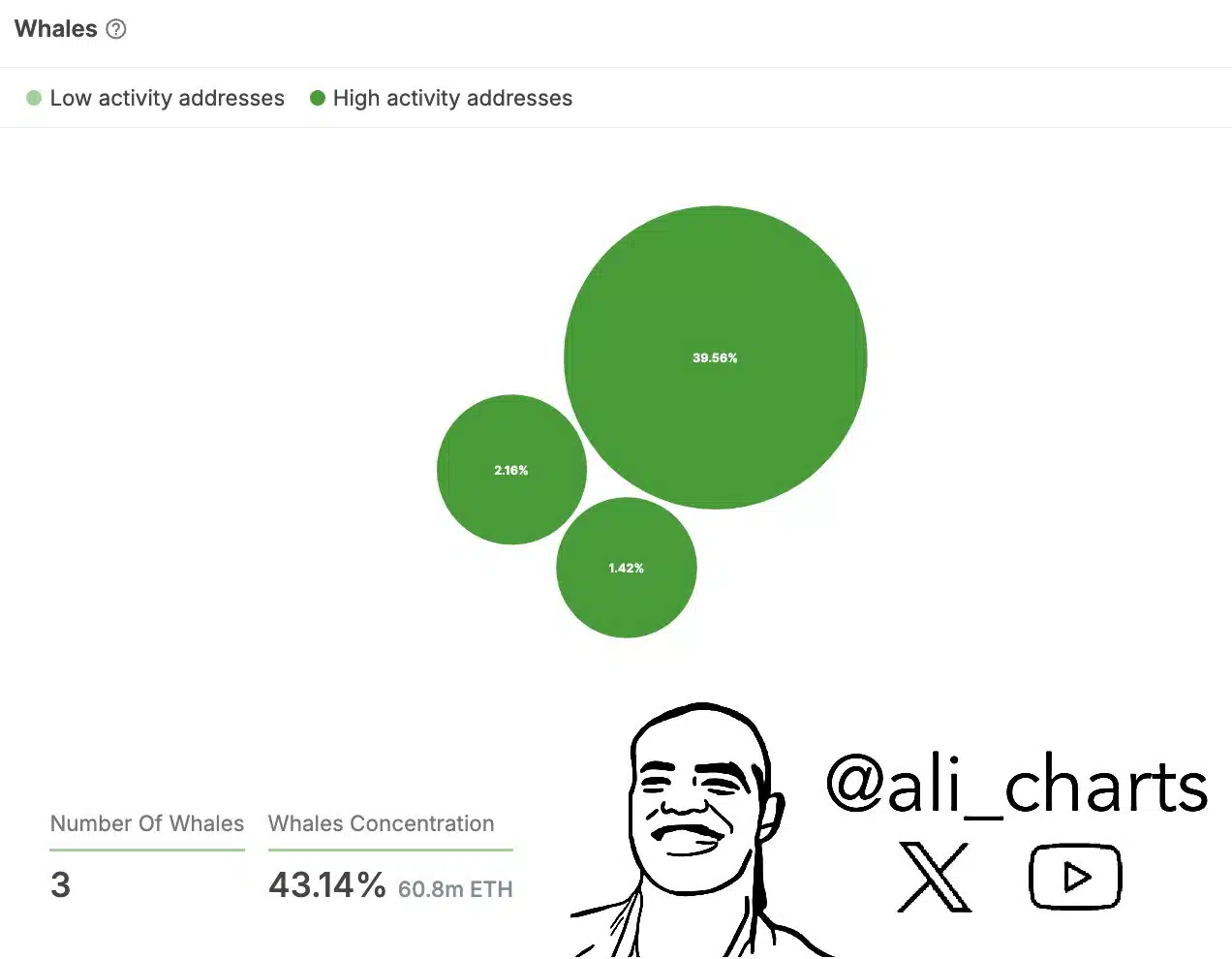

Ethereum’s [ETH] provide is now extremely concentrated, with simply three whales holding over 43% of the full ETH provide.

This stage of focus is much from typical in decentralized networks and raises important issues concerning the potential for value manipulation, market volatility, and the general well being of the Ethereum ecosystem.

Because the market continues to evolve, understanding the implications of this centralized possession turns into essential for each buyers and the long run stability of Ethereum.

The present state of Ethereum’s provide

Supply: X

As of now, Ethereum’s provide is notably centralized, with simply three whales collectively controlling 43.14% of the full ETH provide, amounting to 60.8 million ETH.

The most important whale alone accounts for 39.56%, highlighting the numerous affect a single entity can have on the community.

Such concentrated possession raises issues about potential market manipulation, particularly if these whales have interaction in coordinated promoting or staking.

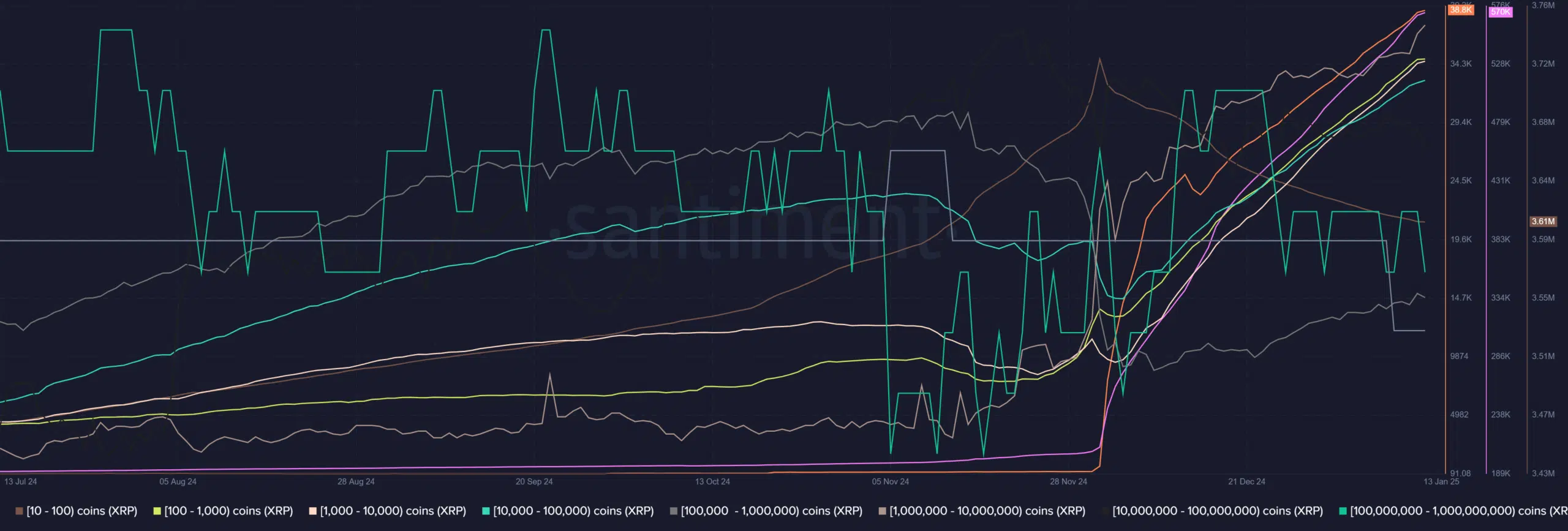

Latest tendencies in staking actions by high-activity addresses and their affect on Ethereum’s value volatility underscore the vital function these whales play in shaping market conduct and stability.

Ethereum: How centralization impacts retail buyers

The focus of Ethereum’s provide within the arms of three whales poses important challenges for retail buyers. Value manipulation turns into a looming risk, as even slight actions of those large holdings can set off sharp market swings, wiping out smaller buyers’ positive aspects.

Furthermore, such centralization undermines the ethos of decentralization, decreasing retail individuals’ affect in community governance, notably in staking and voting mechanisms.

On a psychological stage, retail buyers would possibly hesitate to interact, perceiving the ecosystem as skewed in favor of dominant gamers. This imbalance may stifle broader adoption and innovation, as belief within the community’s equity diminishes.