- Ethereum has plunged 12% this week, mirroring the broader battle as altcoins face double-digit losses.

- Its restoration now hinges greater than ever on a wider market rebound.

Ethereum[ETH] has misplaced over half of its post-election positive aspects and is now caught in a high-stakes tug-of-war.

With Bitcoin’s consolidation holding again any main breakout, buyers are enjoying it secure. So, given the present panorama, is it time to train warning or seize the chance?

The size is tipping in favor of…

Historically, Bitcoin’s[BTC] stagnation signaled the beginning of an altcoin season – however not this time. Altcoins are struggling to achieve traction, with 70% of the highest 10 high-caps (excluding stablecoins) struggling double-digit losses in only a week.

Ethereum hasn’t escaped the downturn both, with a 12% weekly drop, partly as a result of robust U.S. financial information. The ETH/BTC pair is hitting day by day lows, making ETH’s rebound look tied to a broader market restoration.

However the stress doesn’t cease there. Whales are feeling the warmth, dumping 10,070 ETH at $3,280, locking in a $1M loss. Consequently, ETH was down by 1.15%, sitting at $3,227, at press time. Nonetheless, the stakes are increased than ever.

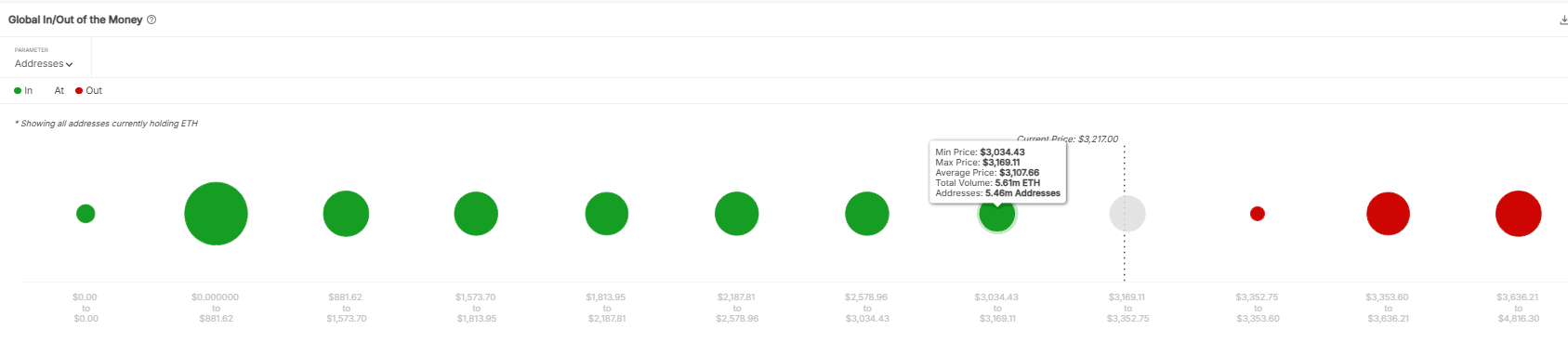

If capitulation continues, ETH might dip to $3,169. At this degree, 5.46 million addresses, holding 5.61 million ETH, had been purchased at that worth.

What these HODLers do subsequent might be essential to ETH’s subsequent transfer. It’s a high-stakes gamble: HODL and await a market rebound, or money out earlier than one other crash hits.

Will Ethereum whales take the chance?

The choice includes a mix of psychology and information. Statistically, ETH continues to be 33% above its post-election ranges, a worth level that has served as robust assist prior to now.

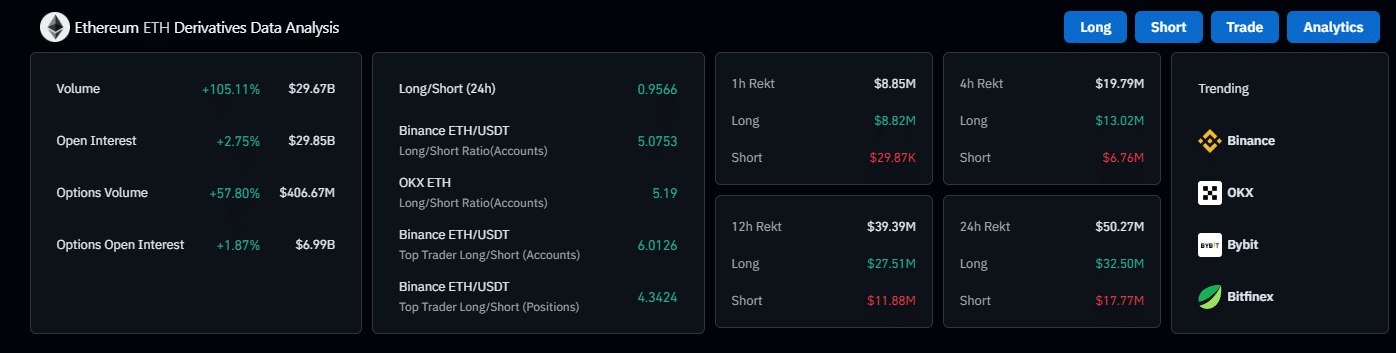

Moreover, futures markets are buzzing, with spinoff quantity hovering by 105% and Open Curiosity (OI) climbing by 2%.

However there’s extra at play – buyers are banking on a repeat of the This autumn cycle, hoping for an additional ‘Trump pump.’ Little doubt, the psychological momentum is there, however will or not it’s sufficient? In accordance with AMBCrypto, a transparent ‘Yes’ continues to be far off.

Learn Ethereum’s [ETH] Worth Prediction 2025–2026

Why the uncertainty? Main gamers are dropping confidence, which might deplete the FOMO, fueling the present market optimism. Retail and institutional capital has but to movement again in, and concern is excessive.

Not like the final Trump rally, which despatched Ethereum hovering to $4K, the same response this time feels more and more unlikely. Even with the Trump pump, it may not be sufficient to spark a robust restoration for Ethereum.

Briefly, warning is essential proper now. Ethereum’s restoration is tightly tied to the broader market rebound. The optimism surrounding the potential for a Trump pump is tempting, but it surely’s essential to not get swept away by the “hype.”