- The excessive Bitcoin spot ETF netflows showcased the bullish perception.

- The weekly value motion of BTC remained firmly bullish.

Bitcoin [BTC] noticed its spot ETF accepted within the U.S. on the tenth of January 2024.

The U.S. Securities and Exchanges Fee accepted the buying and selling of the primary 11 Bitcoin spot ETFs, marking a key milestone in Bitcoin’s historical past.

Supply: Coinglass

The cryptocurrency, initially envisioned to be a decentralized, trustless, peer-to-peer community, has modified vastly over the previous decade and a half.

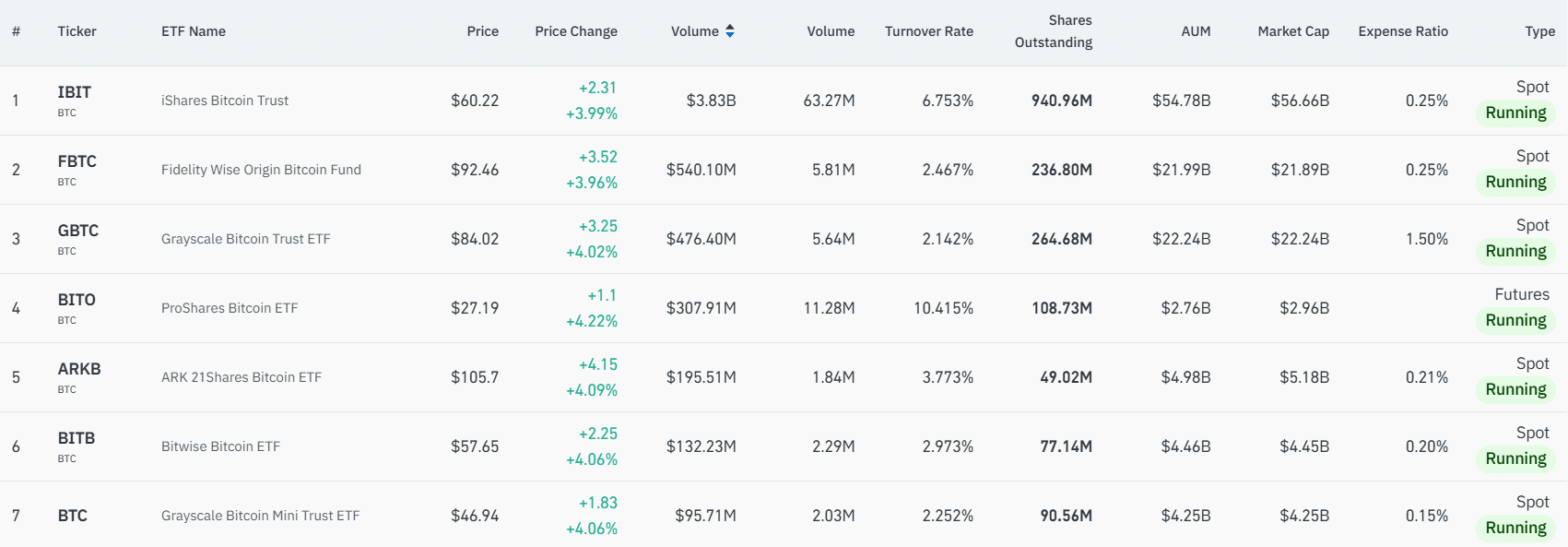

The biggest BTC spot ETF, IBIT, has a market cap of $56.66 billion (value x shares excellent).

Supply: Farside Buyers

The spot ETF netflow desk confirmed that BlackRock’s iShares Bitcoin Belief noticed constant inflows over the previous two weeks of buying and selling. Total, these inflows confirmed that sentiment was strongly constructive.

Bitcoin ETF traders are a big revenue

Supply: Yahoo Finance

Since it’s the largest spot ETF, we will take the worth chart of IBIT. The information above confirmed that the buying and selling started on the eleventh of January and reached a excessive of $30 on that day.

If an investor had purchased $1000 price of shares on that, how a lot revenue would they’ve seen by now?

With out accounting for buying and selling commissions, taxes, or upkeep charges, shares purchased on the excessive of the eleventh of January would have appreciated by 100.7%, and be price $2,007.

In the event that they had been purchased at $22.02, the low on the twenty third of January, the investor could be up 173.46% earlier than prices. The $1000 would now have been $2,734.6.

Weekly chart hints at $152k

The Fibonacci retracement ranges confirmed that extra good points had been seemingly. On the weekly chart, the market construction was strongly bullish. Almost a month’s price of consolidation was seen below the $100k mark.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Over the previous week, BTC has climbed increased, and appeared to flip the $103.8k stage to help. A weekly session shut above this mark could be a strongly bullish signal.

The following bullish targets had been at $122.4k, $133.9k, and $152.5k. Bitcoin traders, whether or not within the spot ETFs or the coin itself, could be seemingly be much more overjoyed within the coming months.