Jamie Coutts, Chief Crypto Analyst at Actual Imaginative and prescient, has offered helpful insights into what actually triggers an altcoin season, shifting the main focus away from Bitcoin’s dominance.

Fairly than relying solely on Bitcoin’s market share, Coutts highlighted the significance of market breadth – particularly, the efficiency of altcoins relative to Bitcoin.

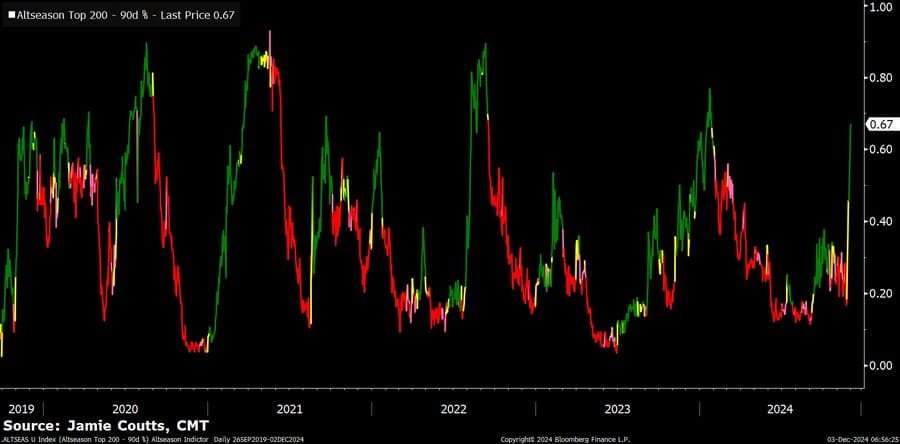

At the moment, the Altseason indicator sits at 67%, signaling rising altcoin energy. Nonetheless, Coutts notes {that a} full-fledged altcoin season solely begins when this indicator reaches 75%, providing a extra complete method to understanding market cycles.

His viewpoint challenges standard knowledge and encourages merchants to broaden their evaluation past Bitcoin’s dominance.

Does altcoin season now not hinge on asset rotation?

Ki Younger Ju, CEO of CryptoQuant, has emphasised that the altcoin season narrative is evolving past conventional asset rotation from Bitcoin.

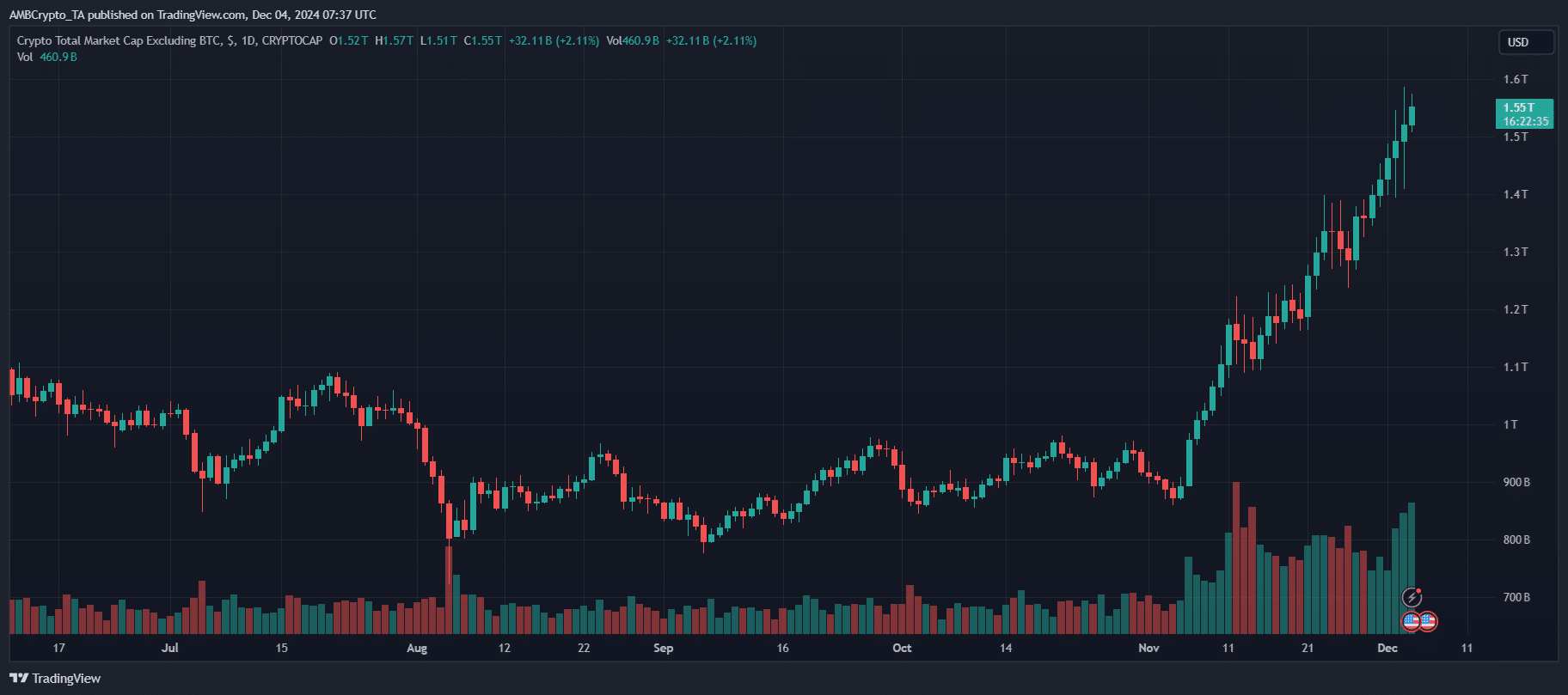

He argues that the rising utility of altcoins individually, together with distinct market drivers, are reshaping this cycle. Based on Ju, the surge in altcoin buying and selling quantity is now being pushed by Stablecoin and fiat pairings somewhat than Bitcoin pairings, signaling actual market growth somewhat than easy asset rotation.

This shift highlights the rising significance of stablecoin liquidity as a key indicator of market course, suggesting that the dynamics behind the present altcoin rally are extra advanced than earlier cycles dominated by Bitcoin.

The position of market sentiment within the altcoin motion

Market sentiment performs an important position within the present altcoin rally, as investor confidence shifts away from Bitcoin and embraces altcoins.

Constructive sentiment in the direction of new developments, such because the rise of decentralized finance (DeFi) and revolutionary blockchain tasks, fuels nice demand.