- BTC’s rally comes as its trade reserve continues to say no.

- Sentiment suggests BTC may drop additional till it finds a important level for a rebound.

Bitcoin [BTC] market efficiency isn’t what you’d count on after a big upswing final month, which introduced it to a brand new all-time excessive with a 33.14% improve.

Presently, the 24-hour achieve is minimal at 0.78%. Whereas this means extra shopping for exercise than promoting, the upward transfer is much from assured, as AMBCrypto reviews.

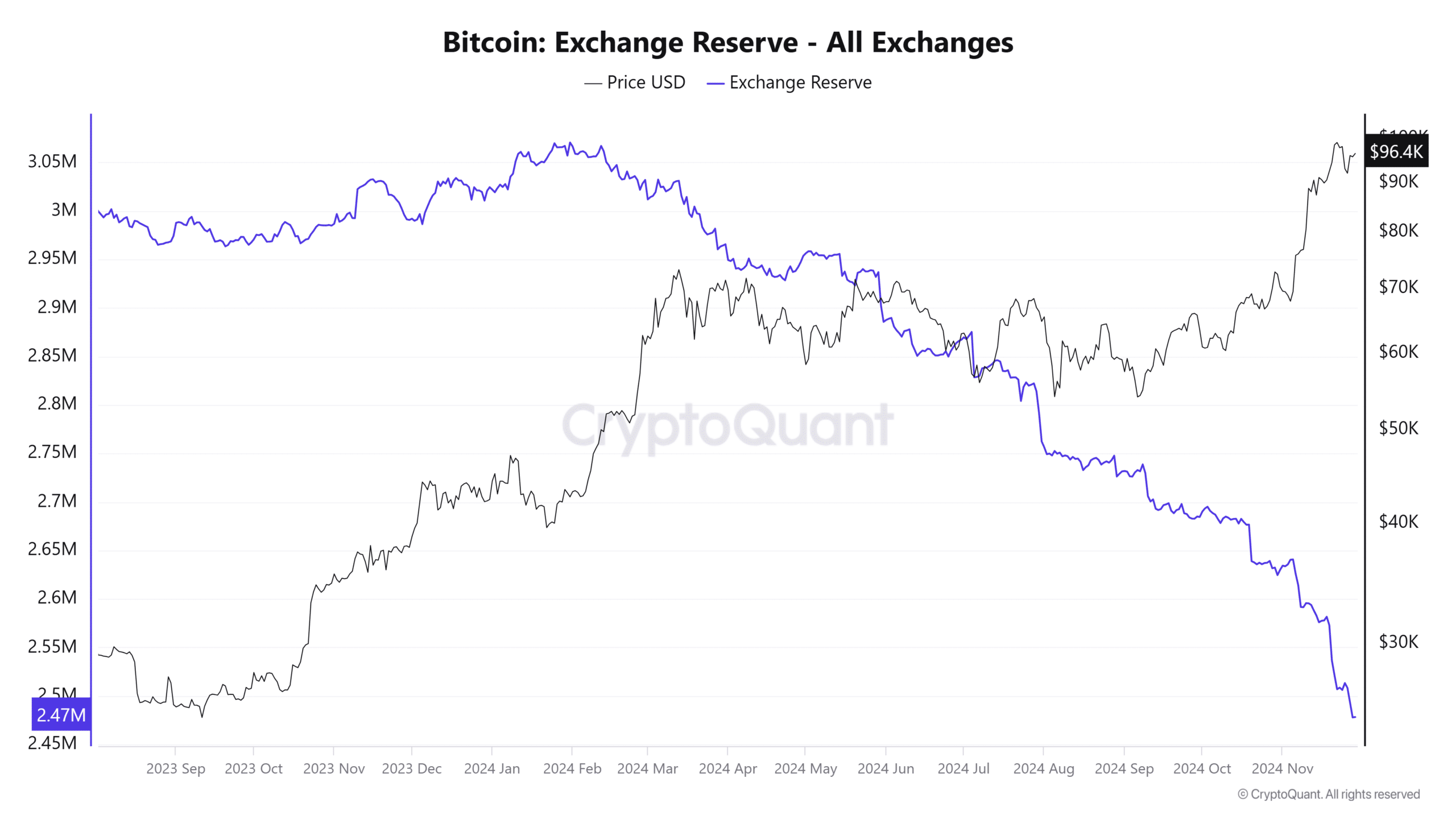

BTC provide on exchanges drops additional

Knowledge from CryptoQuant reviews a continued decline in Bitcoin availability on cryptocurrency exchanges. The Trade Reserve has fallen by 0.61% prior to now 24 hours and 1.53% over the past week.

A drop in Trade Reserve sometimes signifies a lowered circulating provide of BTC on exchanges, an element that usually helps value will increase attributable to shortage.

This decline has performed a job in BTC’s latest good points on the each day chart. Nonetheless, the sustainability of this rally stays unsure, with AMBCrypto outlining key components to observe.

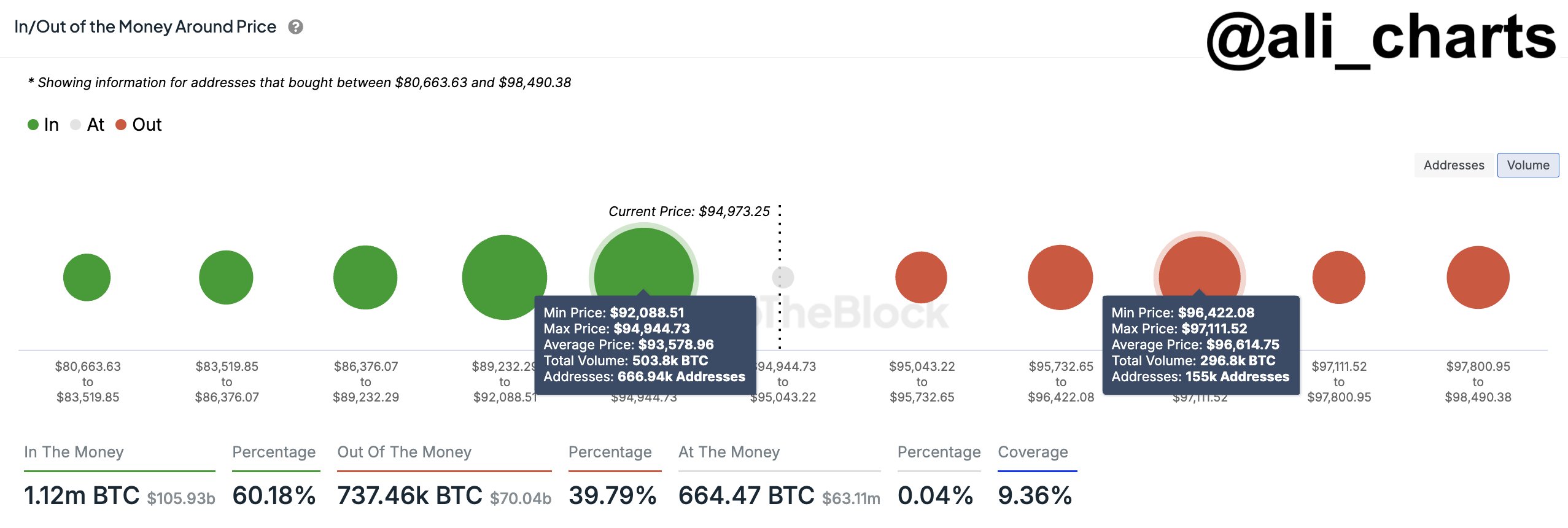

Promoting stress builds as BTC hits provide zone

In accordance to analyst Ali, BTC is at a important juncture, having entered a provide zone at $96,614.75. Right here, vital promoting stress exists, with promote orders totaling 296.8K BTC.

If BTC faces a drop, Ali highlighted the significance of the following key demand zone at $93,578.96, the place purchase orders for 503.8K BTC from 666.94 addresses are concentrated.

He acknowledged:

“Staying above this support level is a must to prevent these holders from selling.”

Whereas the stronger purchase orders at this degree counsel it may maintain, the end result is determined by the depth of promoting stress.

AMBCrypto additionally famous a warning signal, with a pointy rise in BTC inflows to exchanges—2,678 BTC moved within the final 24 hours—including weight to the opportunity of a value decline.

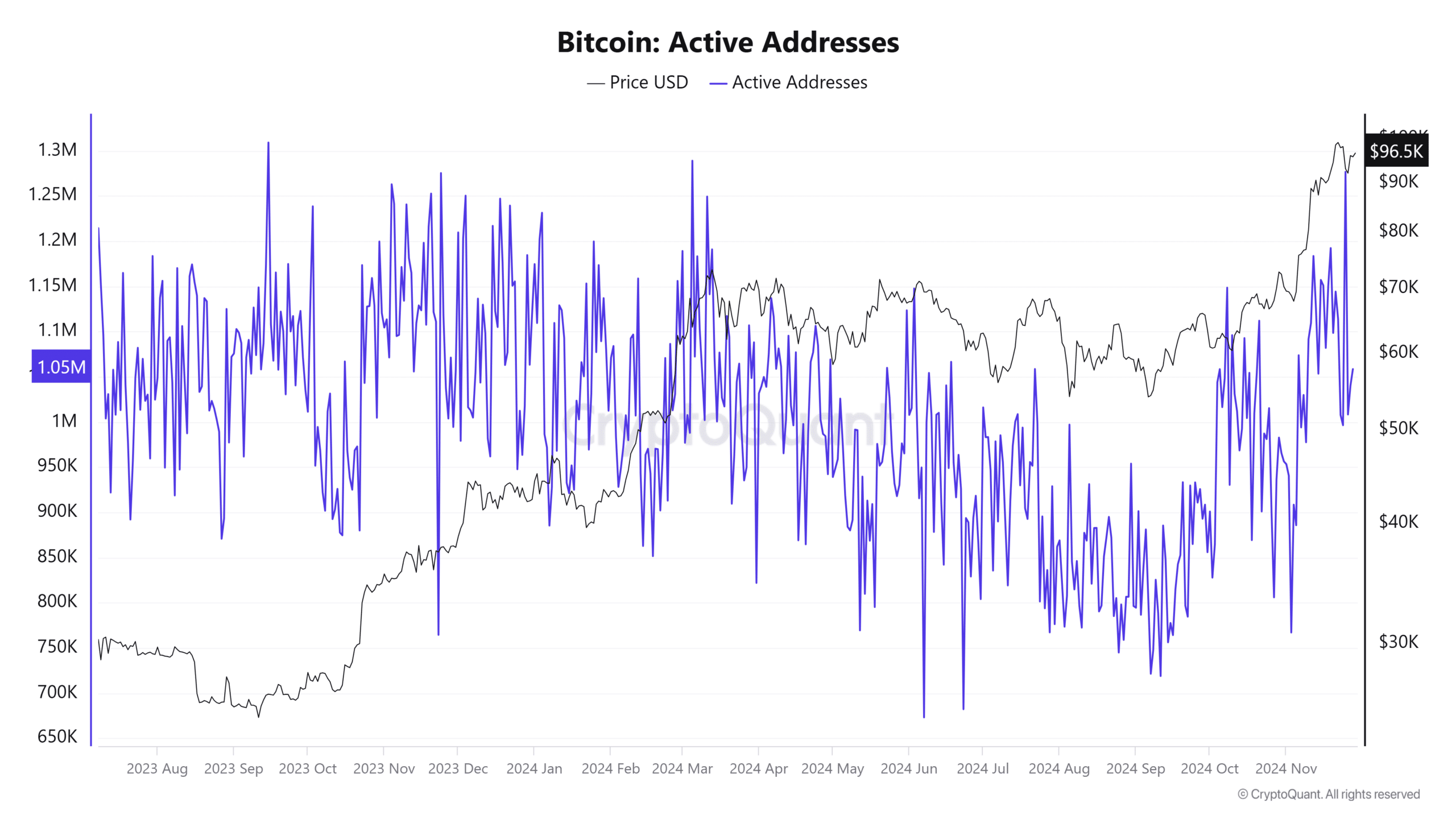

Retail participation weakens

Retail traders, who play a significant function in asset value actions, present indicators of weakening curiosity because the variety of energetic addresses has considerably declined by 35,03%.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

A drop in energetic addresses sometimes means lowered shopping for exercise, which may contribute to a possible value dip for BTC, presumably towards the earlier-mentioned demand zone.

If the demand zone maintains its present purchase order quantity and handle exercise, a value reversal from that degree stays attainable.