- BTC is forming the same technical sample on the chart to the one seen in 2020, which preceded a market rally.

- On the similar time, a number of liquidity clusters above and under the present worth ranges place BTC at a crossroads.

Bitcoin [BTC] has seen a gradual restoration after experiencing a 2.54% drop over the previous week, a results of a broader market decline. It has since posted a every day achieve of 1.48%, attracting renewed consideration from buyers.

Whereas market circumstances are bettering, there stays uncertainty about Bitcoin’s subsequent transfer. This evaluation from AMBCrypto sheds gentle on doable eventualities.

Is BTC following the 2020 sample?

Perception from analyst, Mister Crypto signifies that BTC is presently mirroring the technical sample it adopted in 2020, which led to a big rally after the asset broke via the $20,000 resistance stage.

In accordance with this sample, BTC first experiences a rally, then drops to type a backside, adopted by one other rally that creates a symmetrical triangle sample earlier than an explosive upward transfer.

At the moment, BTC seems to be within the midst of this sequence. After a rally, it has now retraced and forming a backside—completely aligning with the earlier cycle.

If this sample continues, it might sign that BTC will finally break via the $100,000 resistance stage.

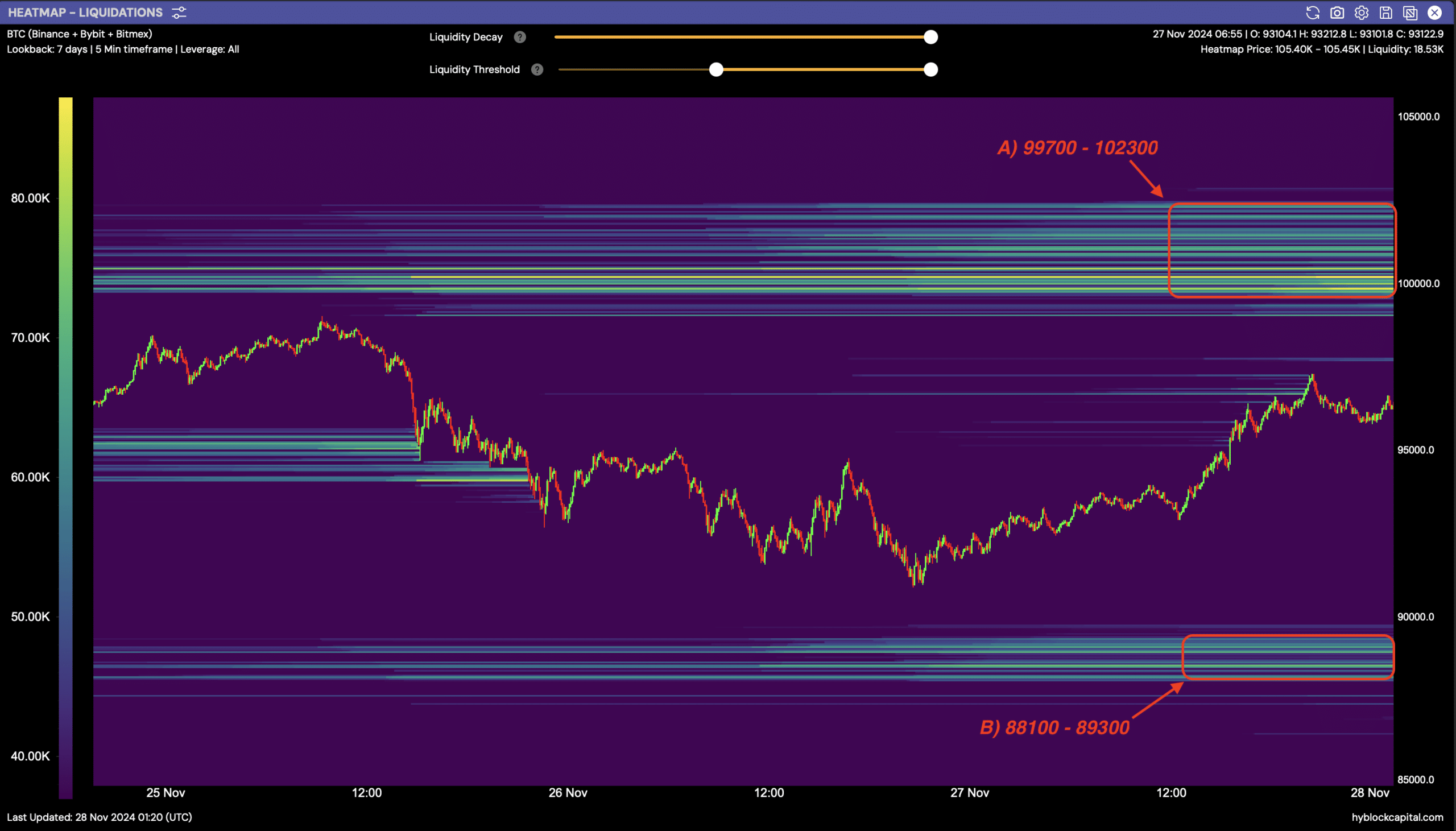

BTC faces two-way stress amid liquidity clusters

In accordance with Hyblock Capital, Bitcoin is presently beneath important stress, with liquidity clusters each above and under its present worth, making a state of affairs the place the asset might transfer in both route.

Above, the liquidity cluster is between $99,700 and $102,300, whereas under, it spans from $88,100 to $89,300.

Liquidity clusters usually act as worth magnets, drawing the market towards these ranges to filter out orders earlier than persevering with its development.

AMBCrypto’s evaluation means that BTC is extra more likely to break upward, clearing the cluster above, somewhat than decline. This view is supported by the funding price and long-to-short ratio.

The Funding Price, which tracks the steadiness between lengthy (consumers) and brief (sellers) positions, has elevated, signaling that consumers are gaining management. At 0.0206%, this means continued upward momentum.

Moreover, the long-to-short ratio exhibits extra lengthy positions than brief positions, with a studying of 1.0090, reinforcing the bullish sentiment.

Bullish confluence builds for BTC

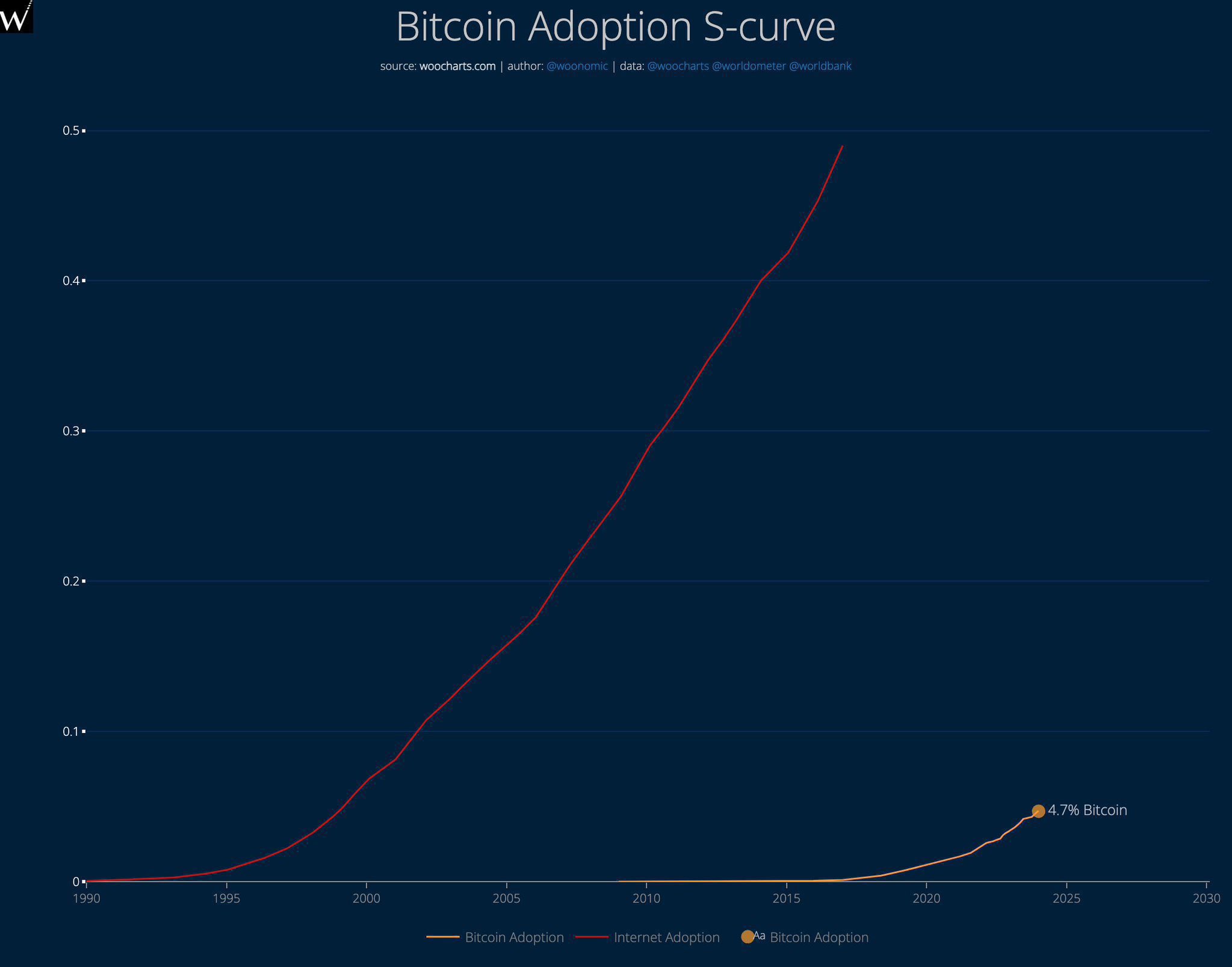

Bitcoin is at the same adoption stage to the web in 1999, in response to the Bitcoin Adoption S Curve.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

This means that the market has but to completely embrace Bitcoin, and as adoption continues to develop, the probability of additional worth appreciation will increase, together with larger liquidity flowing into the asset.

Collectively, these indicators recommend that BTC is extra more likely to development upward somewhat than expertise a pointy decline.