- Bitcoin breaks previous key resistance ranges, surpassing the 2015-2018 cycle’s excessive factors.

- Institutional adoption and macroeconomic traits drive Bitcoin’s momentum towards a $100K goal.

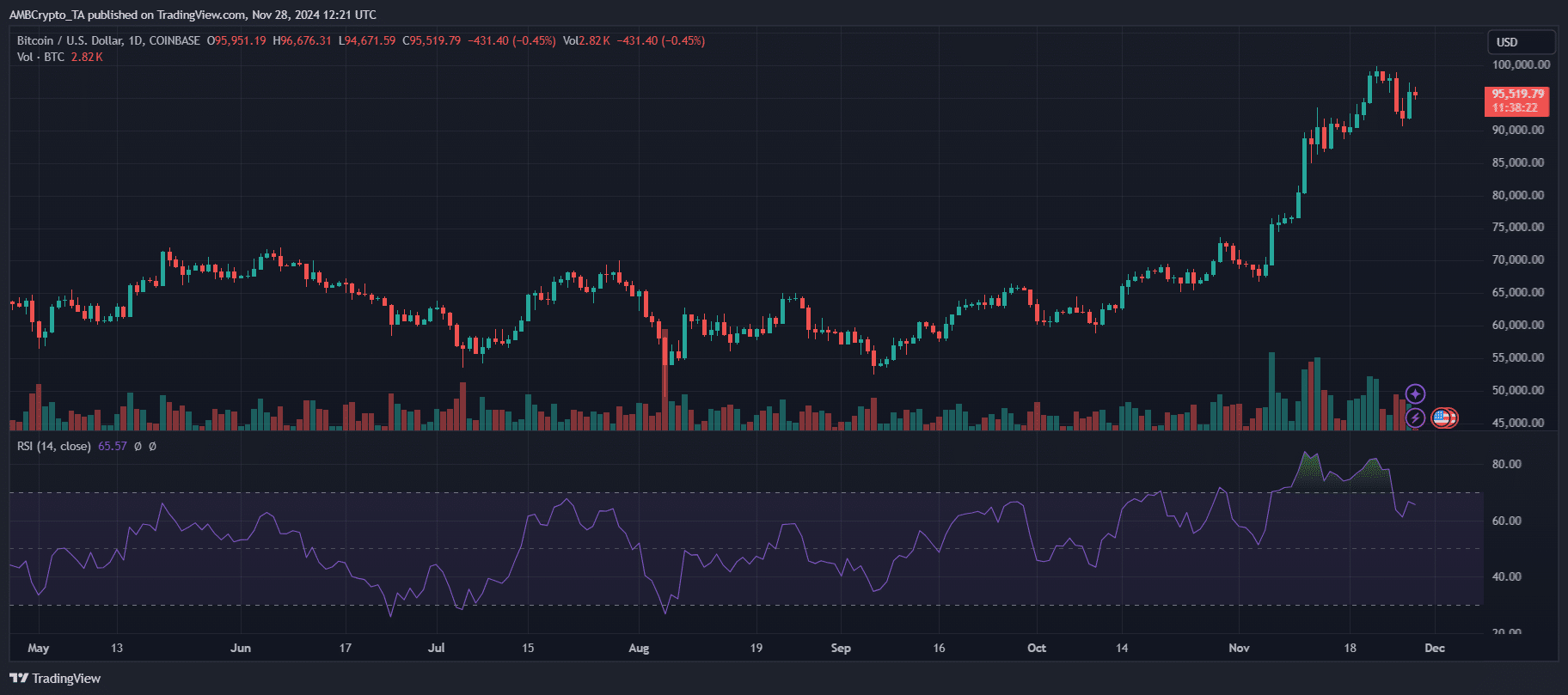

Bitcoin [BTC] has surged previous a crucial value milestone — surpassing key resistance ranges that beforehand outlined its cyclical habits in the course of the 2015-2018 bull market.

This newest breakout highlights the cryptocurrency’s resilience and rising maturity in a market that has developed considerably since its early speculative days.

Not like the dramatic peaks and valleys of the 2015-2018 cycle, Bitcoin’s present trajectory seems extra measured, underpinned by stronger fundamentals and broader adoption.

With its value now exceeding ranges that many believed would act as insurmountable resistance, questions come up about whether or not this surge marks the start of a brand new bull cycle — or perhaps a run towards a six-figure valuation.

Breaking previous historic cycles

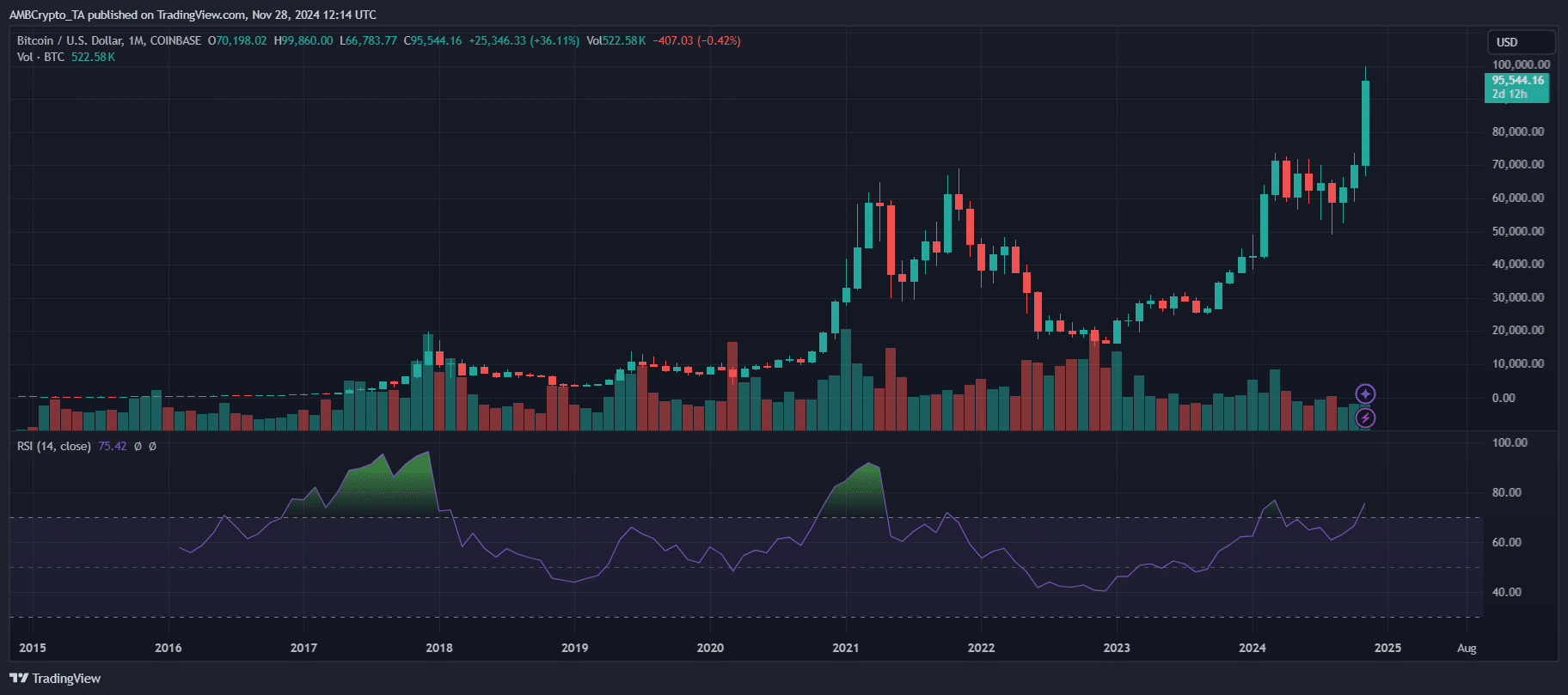

Bitcoin’s present cycle is progressing quicker than its 2015-2018 counterpart. After peaking at $20,000 in 2017, Bitcoin took almost three years to recuperate, consolidating at decrease ranges earlier than its subsequent bull run.

In distinction, the 2022 backside has been adopted by a a lot faster rebound, with Bitcoin surpassing $50,000 inside two years — almost a yr quicker than the earlier restoration.

The chart reveals Bitcoin sustaining momentum, with month-to-month RSI readings above 75 signaling robust bullish circumstances.

Trading volumes have additionally exceeded these from the sooner cycle, reflecting elevated market participation.

This milestone represents an 80% restoration from 2022 lows, supported by long-term holder accumulation and lowered alternate balances.

These on-chain shifts spotlight stronger fundamentals in comparison with prior cycles, suggesting much less speculative exercise and extra sustained development. Bitcoin’s accelerated restoration units it other than historic patterns.