1. What’s Thena (THE)?

Thena (THE) is a decentralized trade (DEX) and liquidity platform working on the BNB Chain and opBNB. It simplifies token swaps, cross-chain transfers, and liquidity administration, making a seamless expertise for DeFi customers.

Imaginative and prescient

Thena goals to revolutionize decentralized finance by changing into the final word “SuperApp” for on-chain customers, delivering a seamless, CEX-grade expertise in a totally decentralized atmosphere.

The platform’s imaginative and prescient extends past buying and selling, positioning itself as probably the most adaptable liquidity layer within the ecosystem. Thena is constructed to deal with a variety of liquidity wants for its companions, together with stablecoins, liquid staking tokens (LSTs), tokenized real-world belongings (RWAs), memecoins, AI tokens, and extra.

2. Thena Ecosystem

THE Spot DEX

Thena’s Spot DEX gives customers quick, low-cost swaps throughout a variety of digital belongings. Powered by ODOS routing expertise, it ensures optimum trades with minimal slippage via Thena’s liquidity swimming pools, all inside a safe and user-friendly interface.

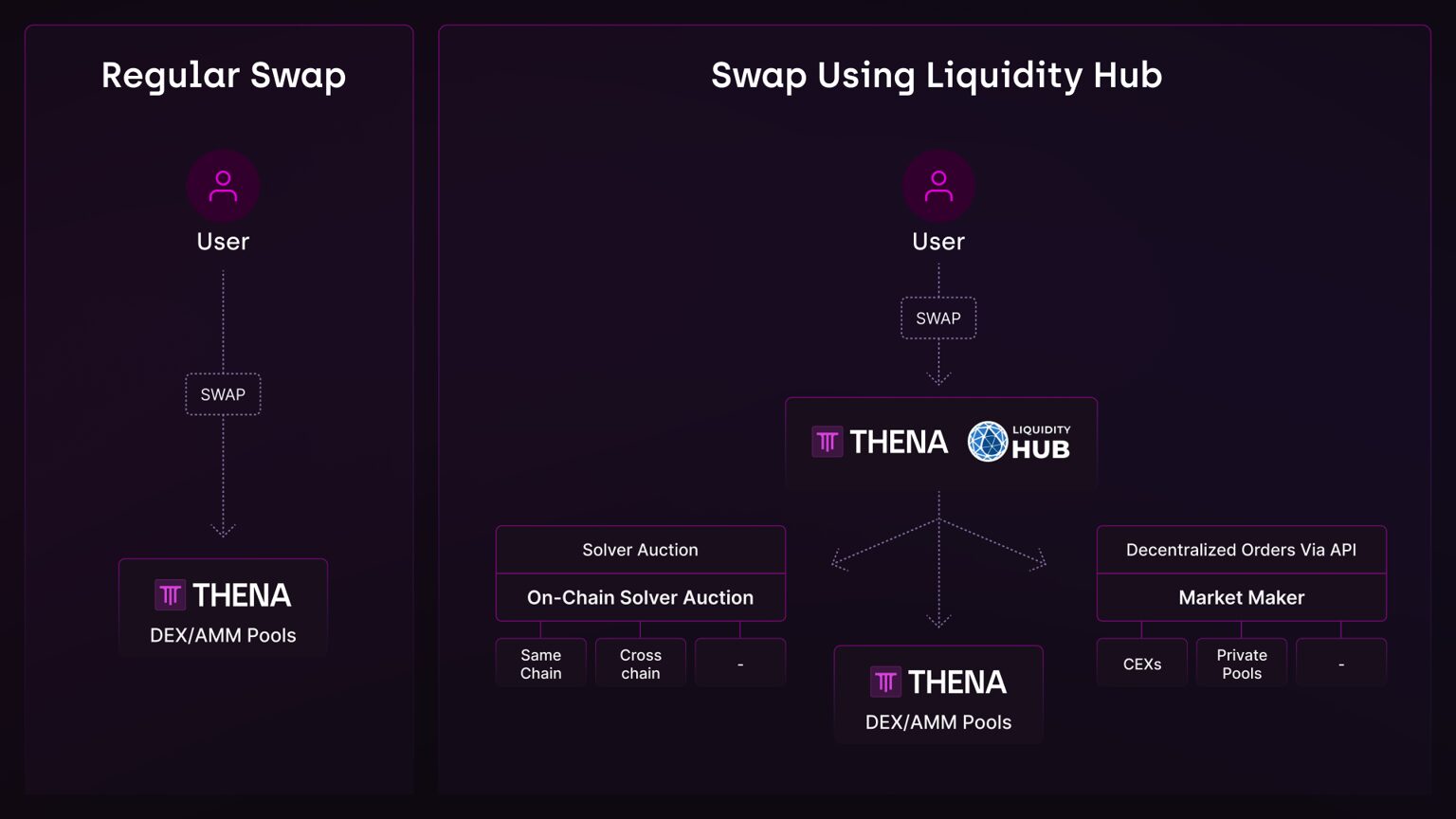

The platform additionally integrates the ORBS Liquidity Hub, a sophisticated optimization layer that faucets into exterior liquidity sources for higher worth execution and diminished worth impression. If exterior sources can not present a greater charge, trades seamlessly default to Thena’s AMM contracts for execution.

ALPHA: The Perpetual DEX

ALPHA is a cutting-edge perpetual DEX created by Thena, providing as much as 60x leverage on 150+ crypto belongings.

The platform options the Automated Market For Quotes (AMFQ) engine, mixing order books and AMMs for higher capital effectivity. With remoted counterparty threat and collateral-backed agreements, ALPHA ensures a safe and trustless buying and selling expertise.

ARENA: The place SocialFi Meets Trading

ARENA is a social hub for buying and selling competitions, totally built-in into the Thena ecosystem. It permits whitelisted companions to create customizable, permissionless buying and selling competitions throughout spot and perpetual markets.

Designed as a growth-hacking software, ARENA helps companions enhance group engagement, improve model consciousness, and drive consumer acquisition and retention. It additionally enhances web site site visitors and deepens liquidity inside Thena, providing invaluable advantages for each companions and customers.

WARP: Upcoming Launchpad

WARP is an upcoming launchpad throughout the Thena ecosystem, designed to assist new tasks and tokens. It should present a platform for revolutionary ventures to launch, achieve publicity, and develop throughout the DeFi house, serving to to foster the subsequent wave of decentralized tasks.

3. Key Options of THENA

ve(3,3) Governance Mannequin

Impressed by Solidly and Aerodrome, THENA’s emissions allocation system empowers veTHE holders to vote on liquidity pool incentives. This mannequin fosters alignment amongst stakeholders, selling an environment friendly and sustainable ecosystem.

Superior Liquidity Instruments

THENA V3,3 introduces cutting-edge options like Plugins (similar to Uniswap V4’s Hooks), modular designs, Weighted Swimming pools, and Metastable Swimming pools. These instruments improve customization and optimize liquidity administration.

Cross-Chain Governance

THENA expands its governance framework throughout a number of networks, starting with opBNB. This enables veTHE holders to form liquidity methods past a single blockchain.

Neighborhood-Pushed Success

Working with out enterprise capital, THENA has redistributed over $25 million in whole income on to token holders. Its progress is powered by its group and strategic collaborations with ecosystem companions.

4. Thena Tokenomics

By its $THE utility token, veTHE governance token (as an NFT), and theNFT assortment, Thena creates a sustainable and rewarding ecosystem for customers, liquidity suppliers, and token holders.

$THE – BEP-20 Utility Token

$THE is the core utility token of the Thena protocol. It’s primarily used to:

- Facilitate liquidity: Emitted as farming rewards to encourage deep liquidity for optimum buying and selling.

- Decentralized governance: $THE can be utilized in platform governance, supporting the trail in direction of decentralization.

veTHE – Governance Token (NFT)

veTHE is a vote-escrowed model of $THE, issued within the type of an NFT. Customers lock their $THE tokens for as much as 2 years to obtain veTHE, with longer lock intervals granting extra voting energy.

- Dynamic rewards: The veTHE stability decreases over time, selling sustained participation.

- Income share: veTHE holders earn 90% of buying and selling charges and 10% of protocol voting incentives.

theNFT – Founders’ Token (NFT)

theNFT is a non-dilutive assortment that may be staked for income sharing.

- Income share: Staking theNFT provides holders 10% of whole buying and selling charges and royalties from secondary gross sales of theNFT.

5. Thena Token (THE) on Binance Airdrop HODLER

Image: THE

Blockchain: BNB Chain

Sensible Contract: 0xF4C8E32EaDEC4BFe97E0F595AdD0f4450a863a11

Present Value: $3.67

Market Cap: $281.61 million

Circulating Provide: 78.14 million THE

Knowledge fetched from CoinMarketCap, 28 November 2024

THE Token Allocation

Thena’s preliminary token distribution is structured as follows:

- Person & Associate Airdrops: 25%

- Ecosystem Growth Fund: 25%

- Protocol Airdrops: 19%

- Growth Group: 18%

- TheNFT Minters: 9%

- Preliminary Liquidity Provision: 4%

Token Emission Schedule

Every week, $THE releases 2.6 million tokens, with emissions reducing by 1% each week. This gradual discount goals to regulate token inflation over time. The last word impact of this strategy on the ecosystem will hinge on consumer engagement and protocol exercise.

- Weekly Emissions: 2,600,000 THE (diminished by 1% weekly).

- Most provide based mostly on 1% weekly decay: 310,000,000 $THE.