- Bitcoin’s volatility intensifies as liquidations set off sharp value swings, with $337 million worn out.

- Liquidations amplify Bitcoin’s volatility, creating alternatives and dangers as the worth exams key ranges.

Bitcoin’s [BTC] current surge in the direction of $100,000 has sparked huge market volatility, with over $337 million in lengthy liquidations inside 24 hours.

As the worth dips under $93,000, the specter of additional sell-offs stays excessive, particularly with $772 million in brief positions in danger. With a possible rebound to $98,000 on the horizon, merchants have to be alert to the opportunity of a liquidation cascade driving costs even increased.

Right here’s a take a look at the components behind Bitcoin’s wild value swings.

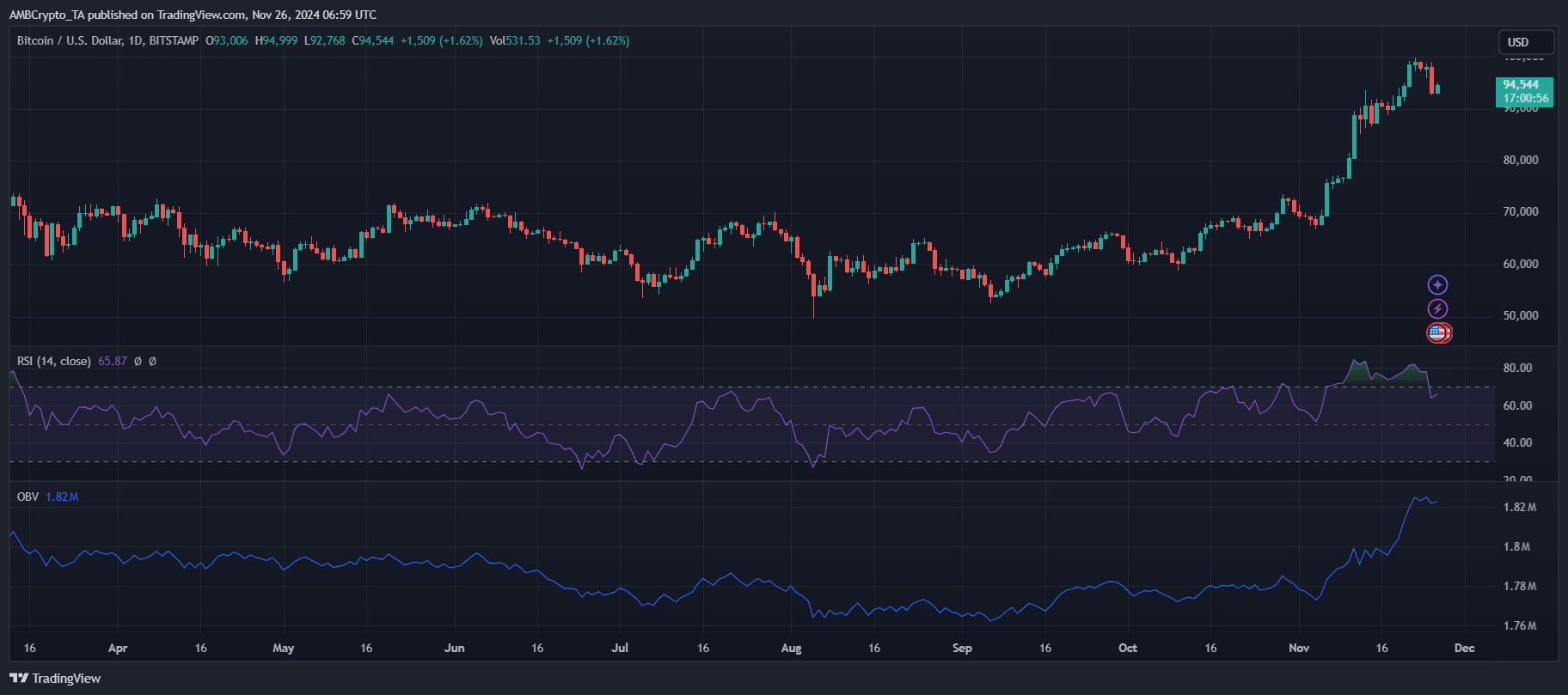

Testing the $100,000 Threshold

Bitcoin’s ascent towards the $100,000 milestone has dominated market conversations, with its current value motion highlighting each bullish momentum and rising warning. The cryptocurrency briefly touched $94,999 earlier than retreating to $94,577.

The RSI at 65.91 signifies Bitcoin stays in a bullish zone, however simply shy of overbought circumstances. OBV, at the moment at 1.82 million, displays robust shopping for curiosity however hints at slowing momentum in comparison with earlier spikes.

Volatility persists as Bitcoin’s buying and selling vary narrows, suggesting a possible consolidation part earlier than one other breakout try.

Whereas the bullish development stays intact, a failure to take care of help above $93,000 may set off sell-offs, particularly with the elevated threat of liquidation-driven value shifts.

Conversely, sustained shopping for strain could push BTC towards $98,000 or increased, preserving merchants on edge on this pivotal part.

The position of liquidation in market volatility

Liquidations are a key driver of Bitcoin’s current market volatility, amplifying value actions as positions are forcibly closed. Previously 24 hours, greater than $337 million in lengthy positions have been liquidated, triggering sharp downward value actions.

As Bitcoin’s value dips under $93,000, the chance of additional sell-offs intensifies, with $772 million in brief positions at stake.

If Bitcoin rebounds towards $98,000, it may spark a cascade of liquidations, additional driving the worth upward.

This liquidation cycle creates heightened volatility, making it essential for merchants to stay vigilant and monitor key value ranges to keep away from being caught in a sudden market shift.

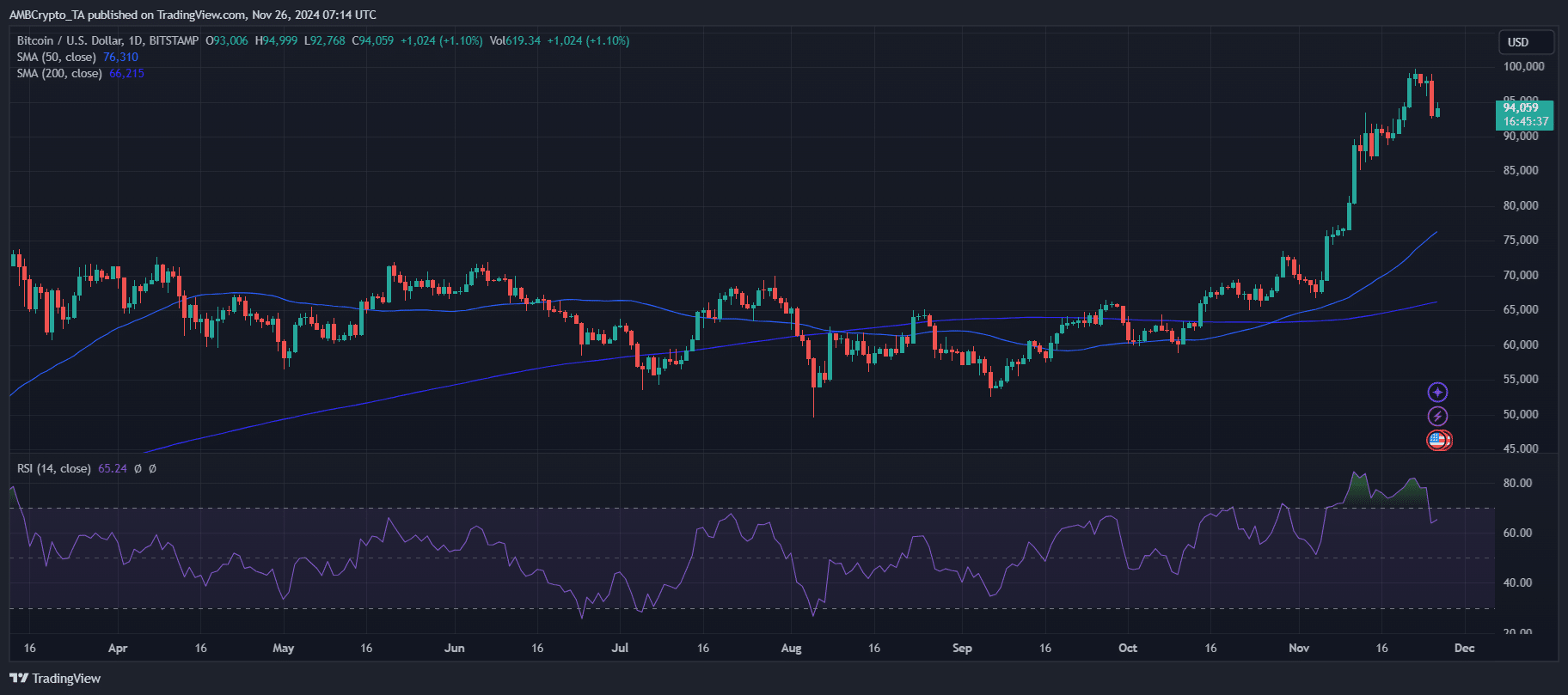

Robust bullish momentum for BTC

Bitcoin’s value stays properly above the 50-day SMA ($76,311) and 200-day SMA ($66,215), reinforcing the long-term bullish development. The broad hole between these shifting averages underscores robust upward momentum, with the 50-day SMA appearing as a key help degree.

Trading quantity reveals constant exercise, however a decline from current peaks suggests a cooling part in shopping for strain. RSI at 65.29 maintains a bullish posture, aligning with present value motion.

These indicators level to a market nonetheless primed for upward strikes, however warning is warranted as decreased quantity may restrict speedy breakouts or amplify volatility on retracements.

Brief-term predictions

As Bitcoin navigates this unstable part, short-term predictions hinge on key help and resistance ranges. If the cryptocurrency can keep help above $93,000, a rebound towards $98,000 appears seemingly, probably triggering a liquidation cascade that would propel costs even increased.

A break under $93,000, nevertheless, could result in additional sell-offs, with $88,000 or decrease changing into the following important help zone.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Merchants ought to look ahead to indicators of sustained shopping for strain or a shift in quantity, as these may sign the following route.

Whereas the long-term bullish outlook stays intact, the short-term value motion may very well be unpredictable, and warning is suggested for these trying to enter positions.