- Bitcoin hit a brand new all-time excessive, boosting crypto as we speak to $3.2 trillion.

- Giant liquidations impacted merchants, whereas macroeconomic components drove optimism.

Whereas the efficiency of crypto as we speak has seen a notable uptick in valuation, it has additionally registered a slight lower.

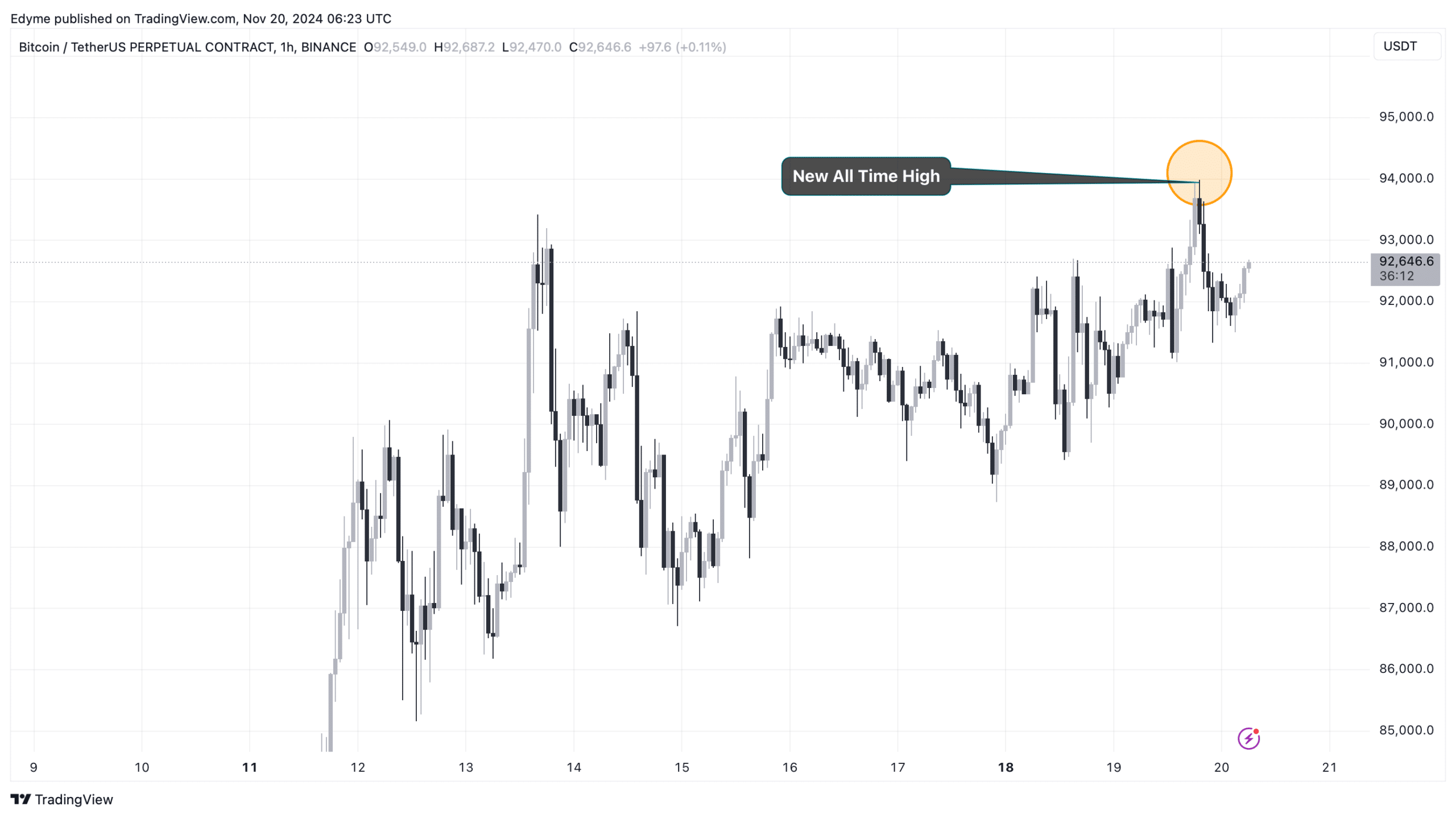

CoinGecko information confirmed that the worldwide crypto market has surged to as excessive as $3.227 trillion in valuation earlier within the day, when Bitcoin hit a brand new all-time excessive of $94,000.

Nonetheless, on the time of writing, this valuation had since decreased by 1.7% to remain at $3.21 trillion at press time.

Out of different components that led to this enhance within the international market of crypto as we speak, essentially the most explicit one is Bitcoin itself.

As earlier talked about, BTC, the biggest cryptocurrency asset by market cap, has registered a brand new ATH bringing its 7-day efficiency to a rise of 5.9%.

On the time of writing, Bitcoin traded at a worth of $92,460 up by 1% up to now day. The continual improve in BTC’s worth now attracts it nearer to a market capitalization of $2 trillion.

For context, as of as we speak, the asset’s market cap is at a valuation of $1.8 trillion, which nonetheless places the asset as one of many largest belongings on the planet.

In the meantime, BTC’s day by day buying and selling quantity has additionally seen a notable enhance in valuation, rising from beneath $50 billion earlier this week to at present at $77.11 billion.

Market influence and liquidations in crypto as we speak

Whereas the efficiency of crypto as we speak has usually been constructive, it has not been useful for all members.

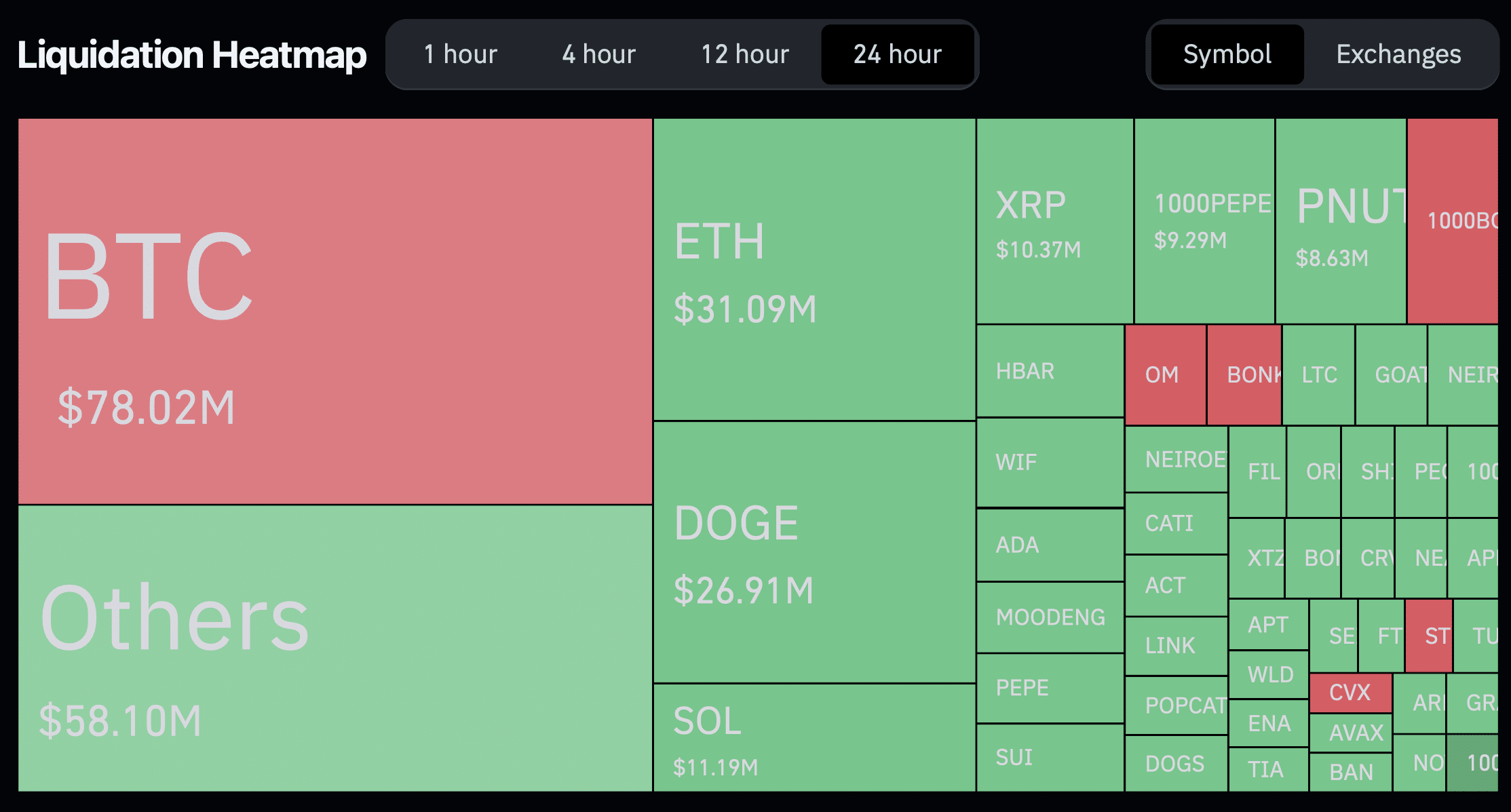

Information from Coinglass indicated that within the final 24 hours, 119,717 merchants confronted liquidation, with a complete worth of roughly $317.33 million.

Liquidation happens when a dealer’s place is forcibly closed by an alternate as a consequence of inadequate funds to keep up a leveraged place.

This usually occurs throughout excessive market volatility when costs transfer in opposition to the place a dealer has taken.

Out of the whole liquidations, $78 million had been attributed to Bitcoin, with brief merchants bearing the brunt of it, accounting for $47 million.

Nonetheless, lengthy merchants weren’t fully spared, contributing $31 million to Bitcoin’s whole liquidations.

This development prolonged to different cryptocurrencies, the place main belongings like Ethereum [ETH] witnessed extra lengthy positions being liquidated.

Such liquidations recommend that whereas Bitcoin’s surge has been a standout, not all belongings out there have skilled parallel features.

Regardless of the challenges confronted by some, sure cryptocurrencies managed to carry out properly. Cardano [ADA] recorded a 4.8% improve, whereas Pepe [PEPE] and Bonk [BONK] noticed features of 1.1% and 12.5%, respectively.

Macroeconomic drivers

A number of macroeconomic components have contributed to the efficiency of crypto as we speak.

Notably, MicroStrategy, led by Michael Saylor, made its largest Bitcoin acquisition thus far, buying almost 52,000 BTC valued at over $4.6 billion.

Such high-profile acquisitions usually propel market confidence, reinforcing Bitcoin’s standing as a key asset.

Moreover, curiosity in crypto as we speak acquired a lift from Rumble, a competitor to YouTube.

The platform’s CEO hinted at exploring the opportunity of including Bitcoin to Rumble’s steadiness sheet, which might additional propel mainstream adoption.

As of the third quarter’s finish, Rumble held $131 million in money and money equivalents, highlighting its capability to make important investments in cryptocurrency.

Regardless of widespread optimism, analysts have urged warning. Cypress Demanincor, a market analyst on X (previously Twitter), shared insights on the broader crypto market chart, warning:

“A break below the $3-$2.9 trillion threshold and a daily close below would likely signal a shift, potentially triggering profit-taking and a “risk-off” pull again or correction of this most up-to-date bullish transfer.”