- Bitcoin surged to $94,000 and hit a brand new ATH, following Donald Trump’s presidential election victory.

- As each short- and long-term drivers converge, Bitcoin’s rally faces questions of sustainability.

Bitcoin [BTC] reached a brand new all-time excessive, surpassing $94,000 on the nineteenth of November, extending its outstanding rally that started after Donald Trump’s presidential election victory.

The king coin has surged almost 35% from round $70,000 on election evening.

Quick-term catalysts behind the Bitcoin ATH

Bitcoin’s surge to an ATH of $94,000 — the coin’s value had dropped to the $92,000 mark at press time — has been pushed by a confluence of short-term elements.

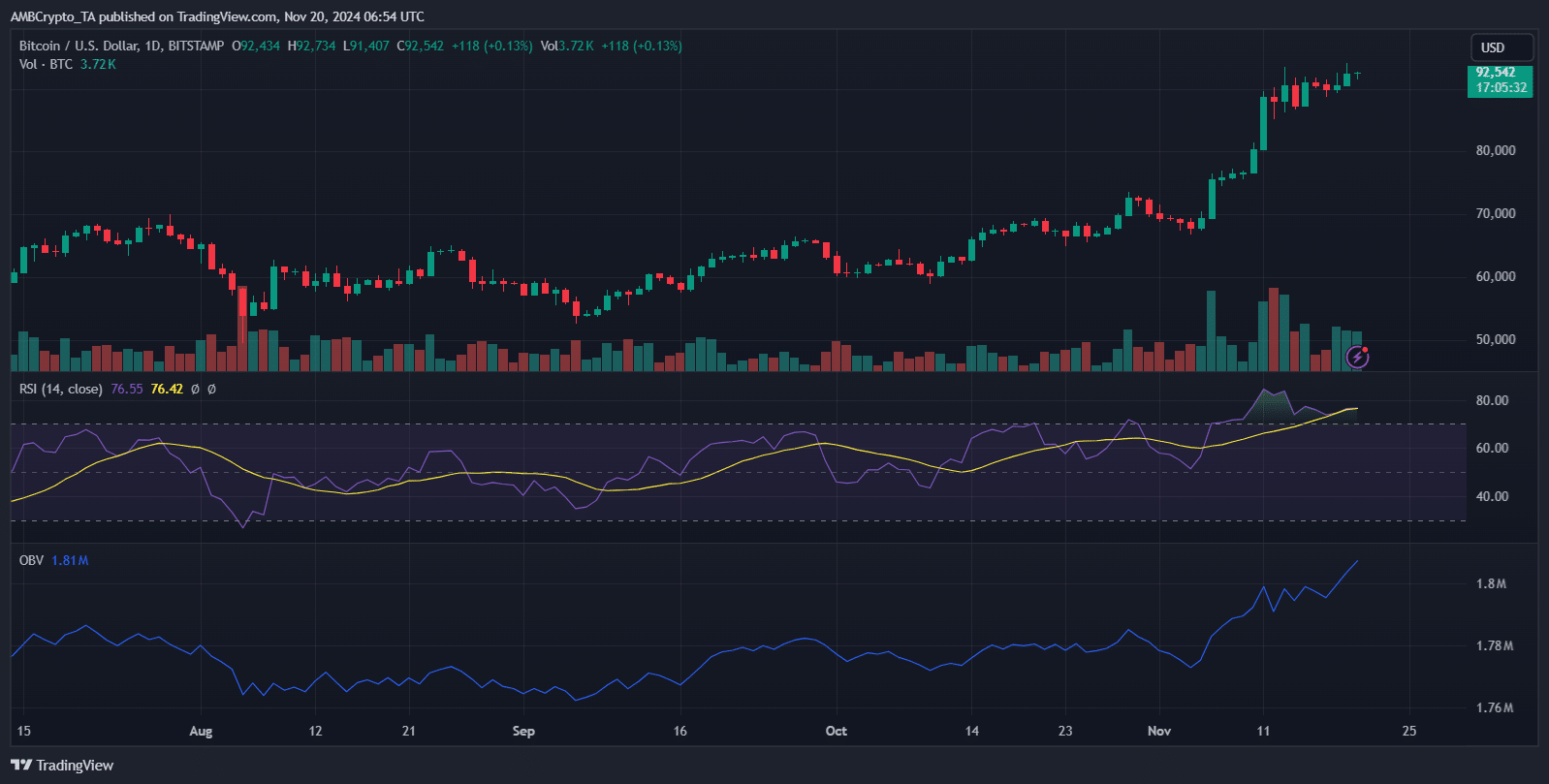

The RSI climbed to 76.74, signaling sturdy bullish momentum but coming into overbought territory, suggesting potential warning for merchants.

OBV has risen sharply, reflecting sustained accumulation by massive gamers, whereas buying and selling volumes have remained sturdy, highlighting elevated market exercise.

Media consideration has performed a pivotal function, with the presidential election sparking renewed curiosity in cryptocurrencies as speculative belongings.

The mix of elevated mainstream visibility and institutional demand has fueled market enthusiasm.

Hypothesis surrounding Bitcoin as a hedge in opposition to potential macroeconomic instability below Trump’s presidency has additional amplified its rise.

Moreover, whale exercise available in the market has been notable in the previous couple of weeks, with massive purchase orders offering a basis for the rally.

Nonetheless, with RSI approaching vital ranges, merchants may have to observe for consolidation or short-term corrections.

Lengthy-term drivers of Bitcoin’s progress

Whereas short-term catalysts have fueled Bitcoin’s current surge, long-term elements have steadily supported its ascent.

Over the previous two months, institutional investments have surged, with asset managers like BlackRock rising publicity to Bitcoin-backed ETFs, signaling rising mainstream acceptance.

Company treasuries, together with Tesla’s, have bolstered holdings as Bitcoin solidifies its standing as a digital retailer of worth.

Adoption has additionally expanded, with main cost platforms integrating Bitcoin into retail transactions.

Notably, in the course of the presidential election, hypothesis round Trump’s coverage stance on crypto regulation reignited curiosity.

Moreover, stories of Trump Media & Know-how Group’s discussions to amass the Bakkt platform have amplified market optimism.

This potential acquisition is seen as a transfer to combine Bitcoin into mainstream monetary and media ecosystems, additional legitimizing its function in international markets and sustaining bullish sentiment.

What’s subsequent for BTC?

As Bitcoin basks in its historic rally, potential challenges lie forward. Regulatory responses are anticipated to take middle stage, with international policymakers prone to scrutinize the cryptocurrency’s fast ascent.

Trump’s administration might affect crypto rules, both bolstering adoption or dampening sentiment relying on its strategy.

In the meantime, market corrections are additionally on the radar. With the RSI in overbought territory and whale-driven momentum vulnerable to cooling, short-term pullbacks are a chance.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Many analysts have prompt that $90,000 might function a key assist degree, however any breach might spark a deeper correction.

Nonetheless, Bitcoin’s long-term fundamentals stay sturdy, offering a powerful basis for continued progress, even amidst short-term volatility.