- The crypto worry and greed index hit ‘extreme greed’ as bullish bets on +$100K intensified.

- The retail market was again and will compound a worth pullback situation for BTC.

Bitcoin [BTC] has fluctuated round $90K for some time, however the market curiosity has remained elevated, hitting an ‘extreme greed’ standing per the Crypto Concern and Greed Index (FGI).

In response to Soso Worth knowledge, this was the fifth ‘extreme greed’ sign (above 80) on FGI since 2021.

Per historic tendencies, an FGI above 80 coincided with BTC’s native and cycle tops. In early 2024, BTC hit an area high above $73K when an ‘extreme greed’ standing was hit.

In 2021, an analogous sign correlated with an area high in February, adopted by a cycle high in August.

Will the development repeat and set off a worth pullback? Excessive bullish sentiment within the choices market disagreed with such a situation, a minimum of till BTC hit +$100K.

BTC choices merchants eye $95K — $110K targets

In response to the most recent knowledge insights from Deribit, massive gamers’ positioning remained bullish as they dumped $75K and $85K places (bearish bets) and elevated $95K-$110K calls (bullish bets).

A part of the Deribit replace learn,

“Notional roll-up of Nov 84k to Dec 90k Calls. Additional early buying of Nov90, Dec90+95k Calls.2-way action Nov+Dec 100k Calls. Later dumping of Dec 75+80k Puts + 90k Calls+ Straddles. Buying across Dec+Mar 110k+ Call spreads. Positioning remains bullish bias.”

Put otherwise, most hedge funds didn’t anticipate BTC to drop under $80K or $75K (promoting of Dec 75+80K places).

Quite the opposite, they eyed additional rally, with potential targets of $95K-$110K between December and early 2025.

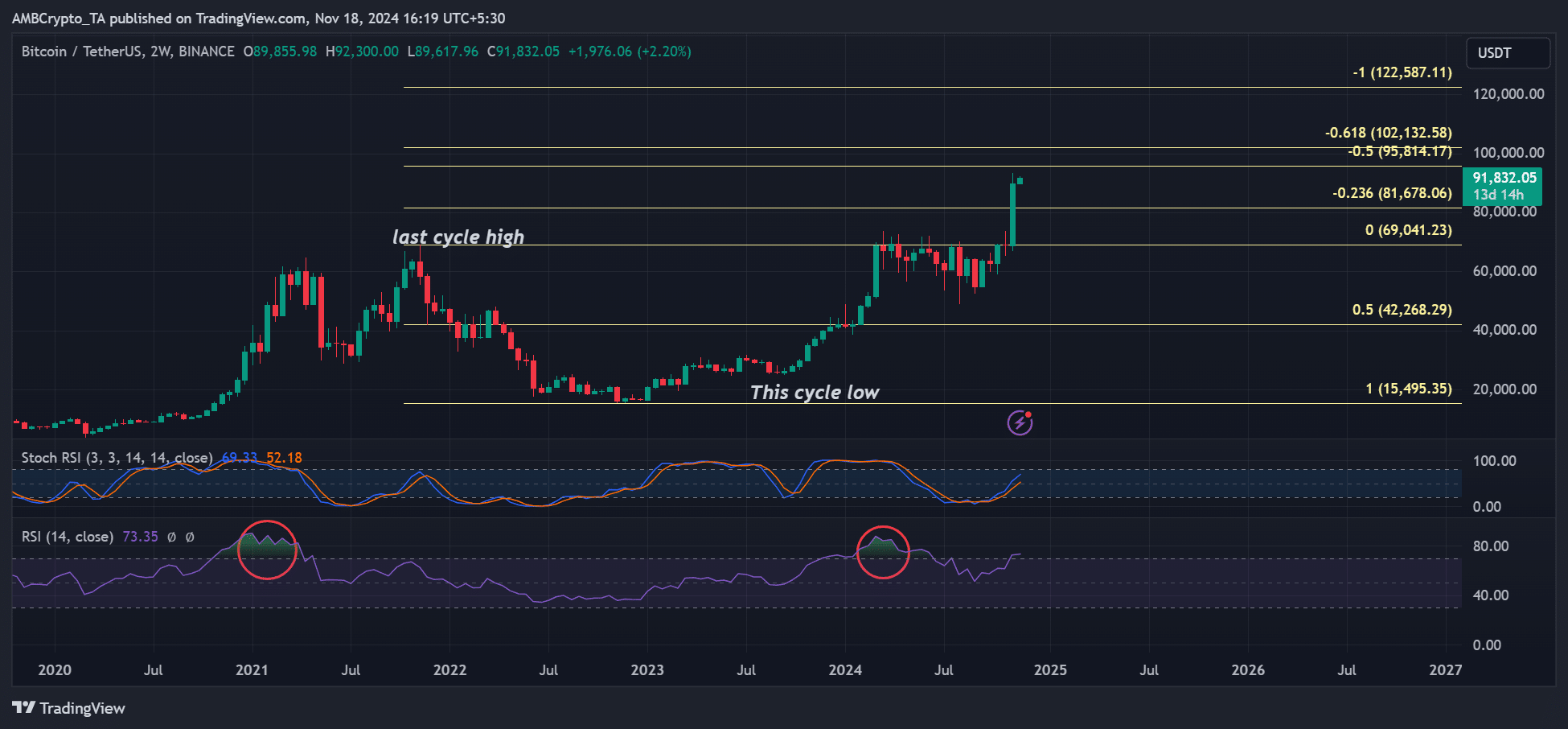

Comparable worth targets have been painted on the BTC’s 2-week chart. The following key upside targets have been at $95.8K and $102K.

With the value momentum, the Stochastic RSI, inches away from hitting an overbought situation, BTC might try to eye these targets.

Nevertheless, the retail was again available in the market, one of many loudest alerts of a possible native or cycle high, as whales all the time use them as exit liquidity.

Learn Bitcoin [BTC] Value Prediction 2024-2025

Nevertheless, CryptoQuant founder, Ki Younger Ju, cautioned {that a} worth correction may very well be probably however won’t mark the start of a bear part. He stated,

“If I were a giga whale, I’d wait for more exit liquidity. It’s just starting. Imagine retail in FOMO joining at $100K. We might see some corrections, but it wouldn’t mark the start of a bear market, imo.”