- Bitcoin dominance is a key indicator for figuring out the long run trajectory of altcoins.

- Presently, Bitcoin and altcoins are rising as two distinct asset courses.

Many distinguished analysts have famous that this market cycle is completely different from earlier ones, with a shift from speculative buying and selling to a extra sustained, fundamental-driven rally. This optimism is fueled by the idea that Bitcoin’s subsequent section may result in a bull run reaching $100K.

Because of this, in just below per week, Bitcoin [BTC] surged to a brand new all-time excessive of $93K, with its market dominance hitting round 70%. This was pushed by a confluence of things together with post-election liquidity, FOMC fee cuts, and, most importantly, the post-halving influence.

Nevertheless, regardless of the preliminary optimism, speculative stress has emerged, stopping Bitcoin from reaching its goal, because it has now consolidated under $90K for 2 consecutive days.

Sometimes, such consolidation at this “high-risk” vary may sign a shift of capital away from Bitcoin into different lower-risk property. Nevertheless, as per AMBCrypto, a hidden sample means that this shift may very well be occurring.

Historical past exhibits altcoins poised to interrupt resistance

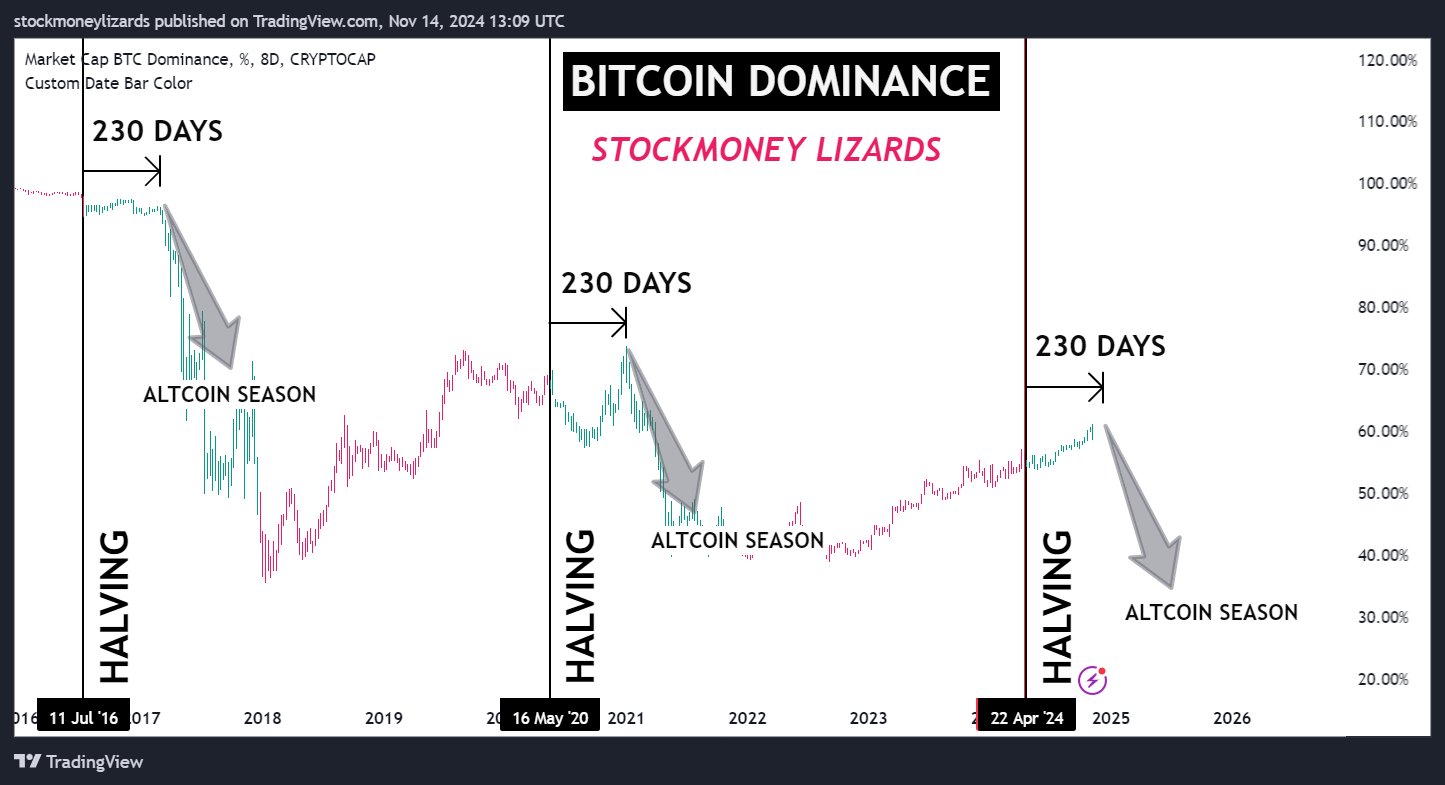

Based mostly on historic patterns noticed in earlier market cycles, a 230-day sample has been noticed following Bitcoin halvings.

After the preliminary post-halving bull run, which regularly drives Bitcoin dominance to new highs, market individuals look to altcoins for added revenue alternatives.

In 2020, the availability shock brought on by the post-halving occasion materialized throughout the first 150 days, with Bitcoin reaching $40K for the primary time.

Nevertheless, after Bitcoin’s momentum slowed, altcoins started to outperform, with many altcoins posting substantial good points about 60 days later.

Equally, the April halving this yr, which diminished the miner reward to three.125 Bitcoins, triggered an financial imbalance. This induced a pointy enhance in demand, fueled by post-election liquidity, whereas the diminished provide led to tighter market situations.

The ensuing decrease liquidity, mixed with Bitcoin’s managed provide, has created the perfect setting for pushing Bitcoin dominance close to 70%, additional fueling its rise to a brand new ATH.

Thus, if the aforementioned pattern repeats, many altcoins may very well be positioned to interrupt previous main resistance ranges earlier than the tip of This fall. With Cardano gaining vital traction, this additional reinforces AMBCrypto’s speculation.

Proof to again this concept

As famous earlier, Bitcoin’s consolidation under $90K displays a rising ‘risk-averse’ sentiment out there.

Regardless of bulls countering bearish stress, the failure to set off a parabolic run – one which many anticipated as a result of robust backing from the brand new administration and the social-media buzz surrounding a $100K goal – raises considerations.

In different phrases, the market’s hesitation to interrupt key resistance ranges means that Bitcoin’s dominance could also be stalling, creating a really perfect setting for buyers to diversify into high-cap tokens.

These tokens, with robust neighborhood help and extra enticing valuations, may provide an interesting various.

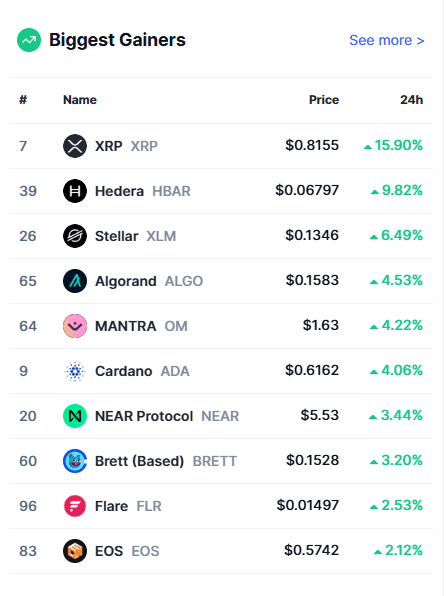

Because of this, within the final 24 hours, as Bitcoin posted an roughly 4% decline, dropping to $86K – its lowest level of the day – main altcoins reaped the advantages, with XRP alone gaining over 15%.

Due to this fact, until Bitcoin dominance rebounds, supported by each institutional and retail backing to solidify BTC’s long-term prospects, altcoins might proceed to dominate the gainer charts.

Nevertheless, on the flip aspect, altcoins may expertise short-term good points if Bitcoin dominance climbs again to close 70%. But, a full-fledged altcoin season may stay restricted, elevating the crucial query:

Will Bitcoin regain its weakening dominance?

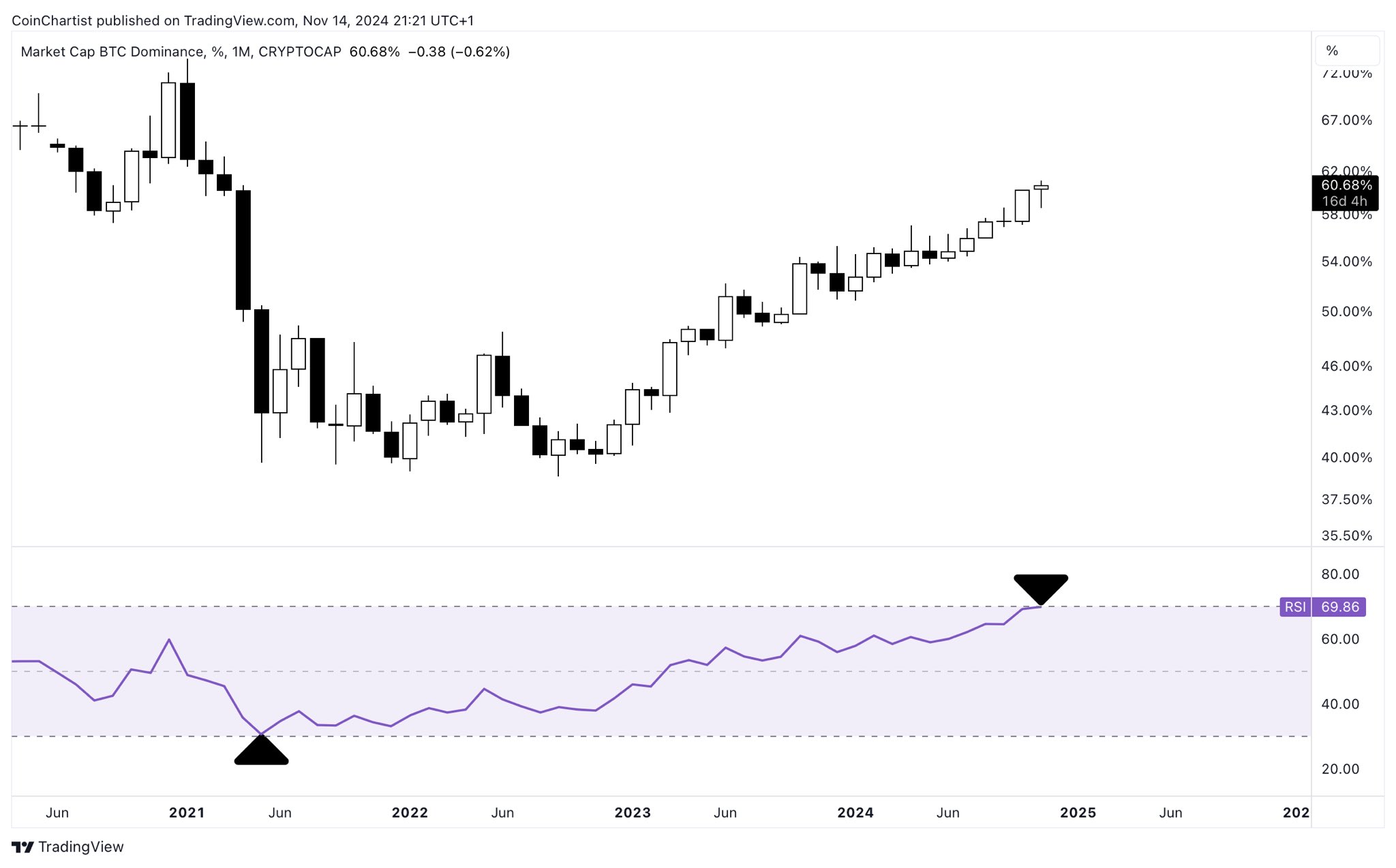

On the month-to-month RSI, Bitcoin dominance has entered overbought territory, signaling a possible correction. This might point out that the dominance of Bitcoin might quickly expertise a pullback, probably paving the best way for altcoins to achieve traction.

In the meantime, institutional help for Bitcoin is weakening, as main gamers exit the cycle after locking in large good points from this bull run. For Bitcoin dominance to regain management, these gamers are possible ready for a “dip,” the place costs are extra possible for re-entry.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Till then, it presents a first-rate alternative for bulls to capitalize on an altcoin rally.

With historic patterns supporting this pattern, altcoins look set to interrupt key resistance ranges within the coming days, doubtlessly triggering an altcoin season by the tip of Q1 subsequent yr.