- U.S. Bitcoin ETF holdings are quickly approaching that of Satoshi Nakamoto’s.

- With $3.4 billion influx post-election, Bitcoin ETFs are additionally accumulating 17,000 BTC weekly

Bitcoin’s [BTC] latest transfer in direction of the $90,000 mark has fueled pleasure throughout monetary markets, considerably impacting the spot Bitcoin ETFs within the U.S.

These ETFs are on target to probably eclipse the holdings of Bitcoin’s creator, Satoshi Nakamoto, by turning into the most important collective Bitcoin holders.

Bitcoin ETFs to surpass Satoshi Nakamoto’s holdings?

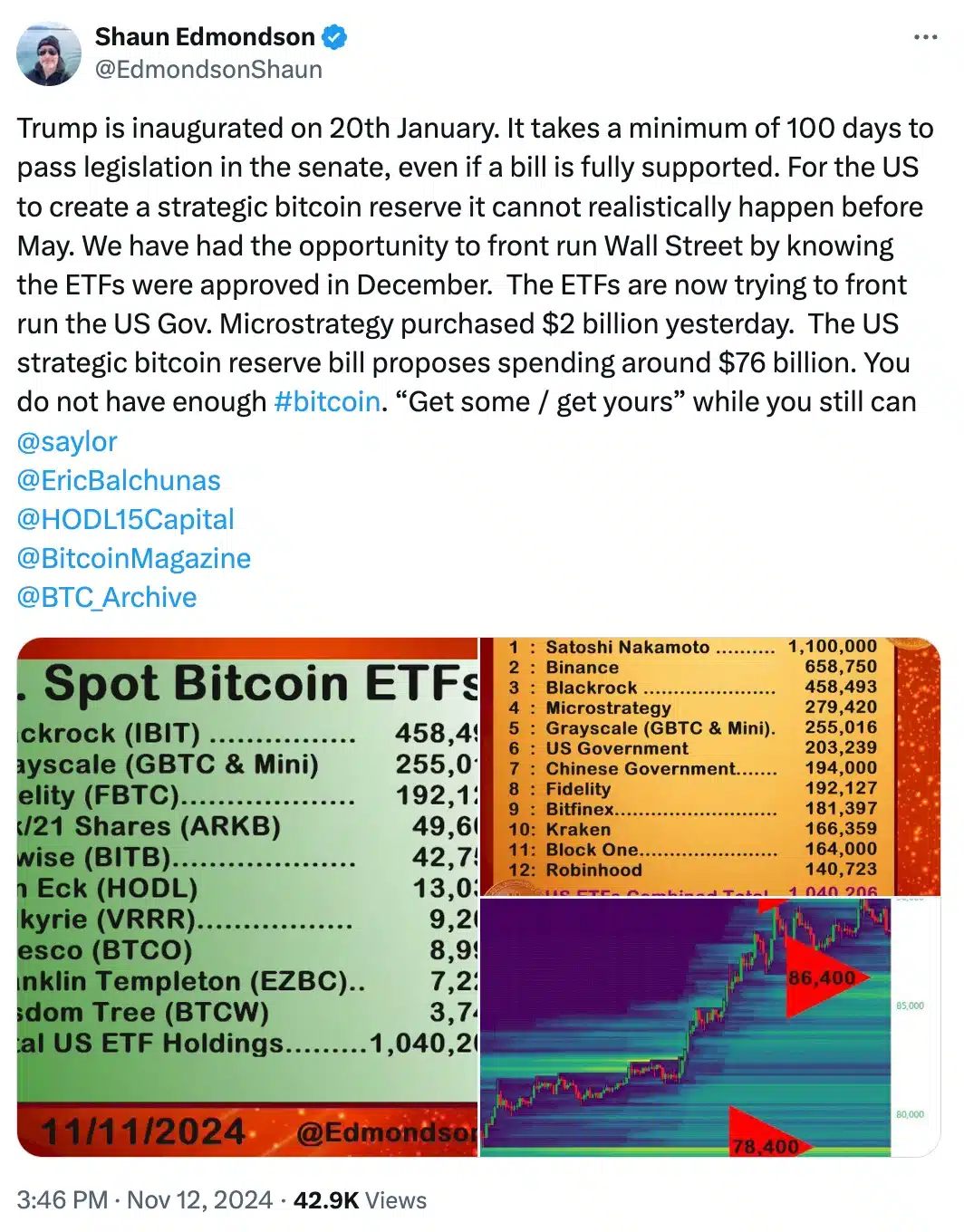

In line with information from analyst Shaun Edmondson and Bloomberg’s Eric Balchunas, U.S. spot Bitcoin ETFs have amassed roughly 1.04 million BTC—simply shy of Satoshi’s estimated 1.1 million BTC.

This accumulation displays a rising institutional urge for food for Bitcoin, because the asset continues to achieve traction inside mainstream funding portfolios.

Remarking on the identical, Edmondson famous,

Including to which, Balchunas mentioned in his prediction,

“ETFs now 95% of the way to passing Satoshi as largest holder. Countdown clock in effect. Thanksgiving feels like a good over/under date.”

Bitcoin ETF replace

As of twenty eighth October, U.S. Bitcoin funds reported a collective holding of 983,334 BTC, indicating a considerable accumulation of over 56,000 BTC inside the previous two weeks.

Addditioanlly, latest information from Farside Buyers highlights the surge in curiosity, with U.S. spot Bitcoin ETFs attracting a powerful $3.4 billion in simply 4 days following Election Day.

That being mentioned, final Thursday marked a document efficiency for Bitcoin ETFs, as buyers injected round $1.3 billion into these funds.

BlackRock’s IBIT alone noticed a staggering $1.1 billion influx, coupled with exceptionally excessive buying and selling volumes.

In line with the most recent information from Farside Buyers, U.S. Bitcoin ETFs on twelfth November continued to see sturdy inflows, with a complete of $817.5 million, whereas IBIT accounted for the most important share at $778.3 million.

What’s behind this?

Analyst Eric Balchunas famous that these funds are accumulating Bitcoin at a fast tempo of about 17,000 BTC per week, placing them on observe to surpass Satoshi Nakamoto’s estimated holdings by December 2024.

Actually, some credit score of this accelerated accumulation additionally goes to Donald Trump’s election win.

Nevertheless, some consider the election isn’t the one issue at play. The fourth Bitcoin halving can be a major affect, as highlighted by Jesse Myers, co-founder of OnrampBitcoin.