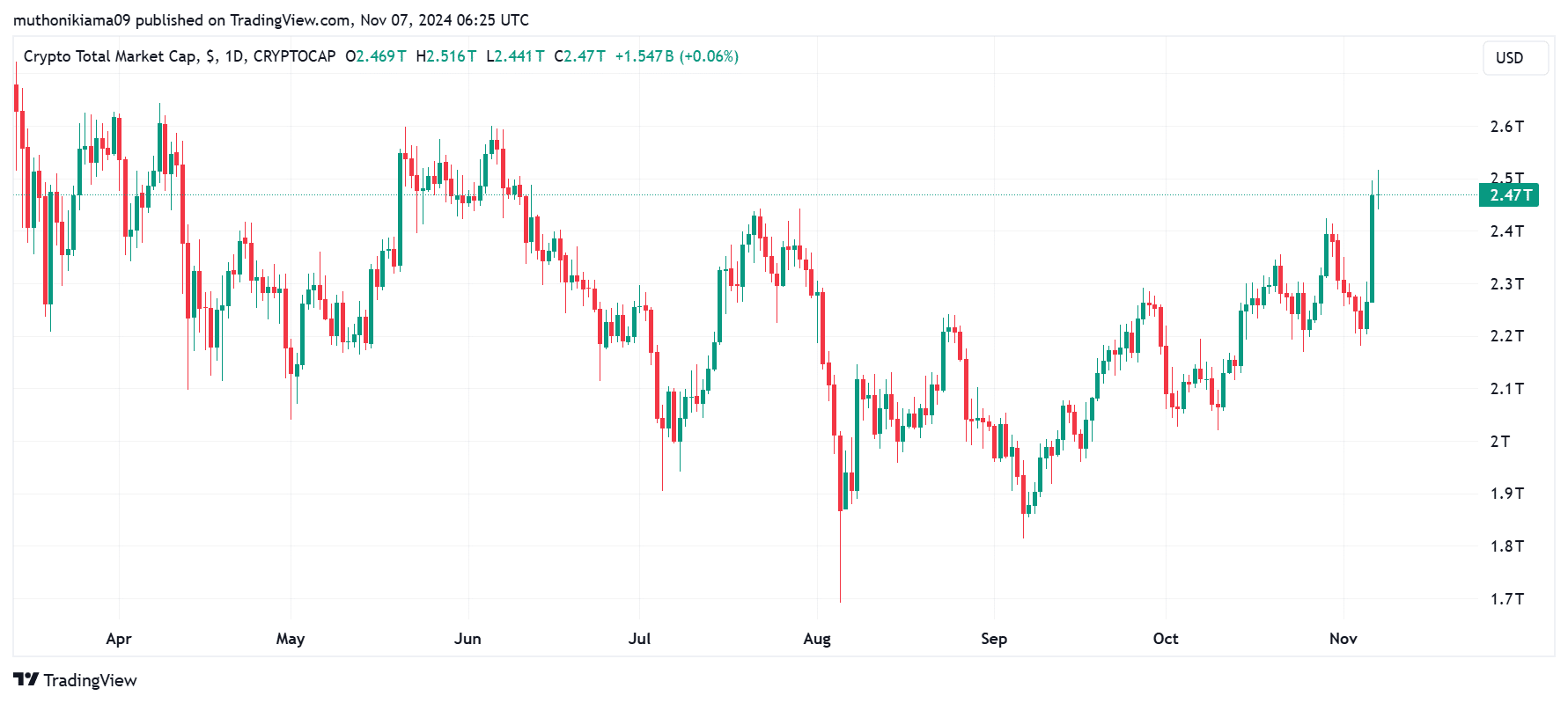

- The whole cryptocurrency market capitalization has surged to a five-month excessive above $2.47 trillion.

- The latest good points got here as merchants purchased into Trump’s election win.

The cryptocurrency market continues to make important good points this week on condition that in simply 24 hours, the entire market capitalization has elevated by greater than $231 billion.

At press time, the market capp stood at $2.47 trillion, its highest degree since June, as Bitcoin [BTC] and most altcoins edged larger.

The widespread good points have been accompanied by rising volatility that induced large liquidations within the derivatives market per Coinglass. Prior to now 24 hours, greater than $380 million was liquidated from the cryptocurrency market, with quick sellers taking the largest blow.

Out of those liquidations, $234 million have been quick positions whereas $169 million have been lengthy positions. Bitcoin had the best liquidations of $150 million adopted by Ethereum [ETH] with $64 million in liquidated positions.

The crypto worry and greed index has additionally risen to 77, displaying “extreme greed.” So, what’s driving this renewed investor confidence, and can the momentum proceed?

US election pump

The US Presidential election is the principle issue fueling these good points. Professional-crypto candidate Donald Trump received by a landslide and he’s now the President-elect.

Trump has made many guarantees to the US crypto group together with establishing a Bitcoin strategic reserve and firing the Chair of the US Securities and Trade Fee (SEC) Gary Gensler.

The group is already banking on these guarantees being fulfilled. Ripple CEO Brad Garlinghouse, has opined that in his first 100 days, Trump ought to change the SEC management, push for a pro-crypto invoice, and supply readability on Ethereum’s standing as a non-security.

Gemini co-founder Cameron Winklevoss additionally believes that over the subsequent 4 years, the crypto trade could have extra room for progress with pleasant insurance policies.

“Imagine how much we are going to accomplish in the next 4 years now that the crypto industry won’t be hemorrhaging billions on legal fees fighting the SEC,” Winklevoss acknowledged.

Gemini co-founders had donated $2 million to the Trump marketing campaign.

The optimism round a crypto-friendly SEC, Senate, and White Home is driving the bullish sentiment within the crypto trade.

Inflows to crypto ETFs soar

On the election day, there was additionally a sudden surge in exercise round US-listed crypto exchange-traded funds (ETFs). Information from SoSoValue confirmed that the entire volumes traded for Bitcoin ETFs hit $6.07 billion, the best degree since March.

The whole inflows to Bitcoin ETFs in the course of the day additionally reached $621 million, marking the best degree in a single week.

Ethereum ETFs additionally had their finest day since September with $52 million inflows. The optimistic information noticed ETH soar to a two-month excessive above $2,800.

A rise in ETF inflows helps to drive demand for the underlying product. If robust inflows proceed, Bitcoin and Ethereum may pattern larger.

Crypto shares are additionally rising

The bullish wave throughout the cryptocurrency market has additionally boded properly for crypto shares. On Wednesday, Coinbase (COIN) gained by 31% to $254, its highest degree since July.

MicroStrategy additionally noticed a 13% acquire and traded at $257 by market shut. MSTR has been one of many best-performing crypto shares this 12 months with year-to-date good points of 276%.

Jack Dorsey’s Block additionally noticed its inventory surge to a 6-month excessive after a 7% acquire, whereas Bitcoin mining firm MARA Holdings posted an 18% inventory acquire.