- The Pi Cycle High indicator revealed that BTC was close to its market backside.

- BTC was testing a resistance, and a breakout would possibly start a bull rally.

Bitcoin [BTC] continued to stay bearish as each its each day and weekly charts remained purple. Nonetheless, the newest evaluation advised a pattern reversal quickly. Subsequently, AMBCrypto investigated additional to seek out whether or not a pattern reversal is feasible.

Bitcoin to the touch $120k within the coming months?

The king coin witnessed a 3% worth drop final week. The bearish pattern continued within the final 24 hours, and at press time it was buying and selling at $68.4k. Whereas the bears remained dominant, a CryptoQuant evaluation hinted at a serious rally forward.

CoinLupin, an writer and analyst at CryptoQuant, just lately posted an evaluation that took under consideration BTC’s MVRV ratio. As per the evaluation, the MVRV stood round 2, indicating that the market’s floor worth was twice the on-chain estimated worth.

The analyst used the 365-day Bollinger Band for MVRV and the 4-year common. The metric usually displays Bitcoin’s cycle. This metric’s studying revealed that the upward pattern stays intact, and customarily, the cycle peak tends to happen when the MVRV reaches ranges between 3 and three.6.

The evaluation talked about {that a} 43%–77% rise is required if the realized worth (RV) stays the identical. This corresponds to an purpose of $95k to $120k when utilized to Bitcoin.

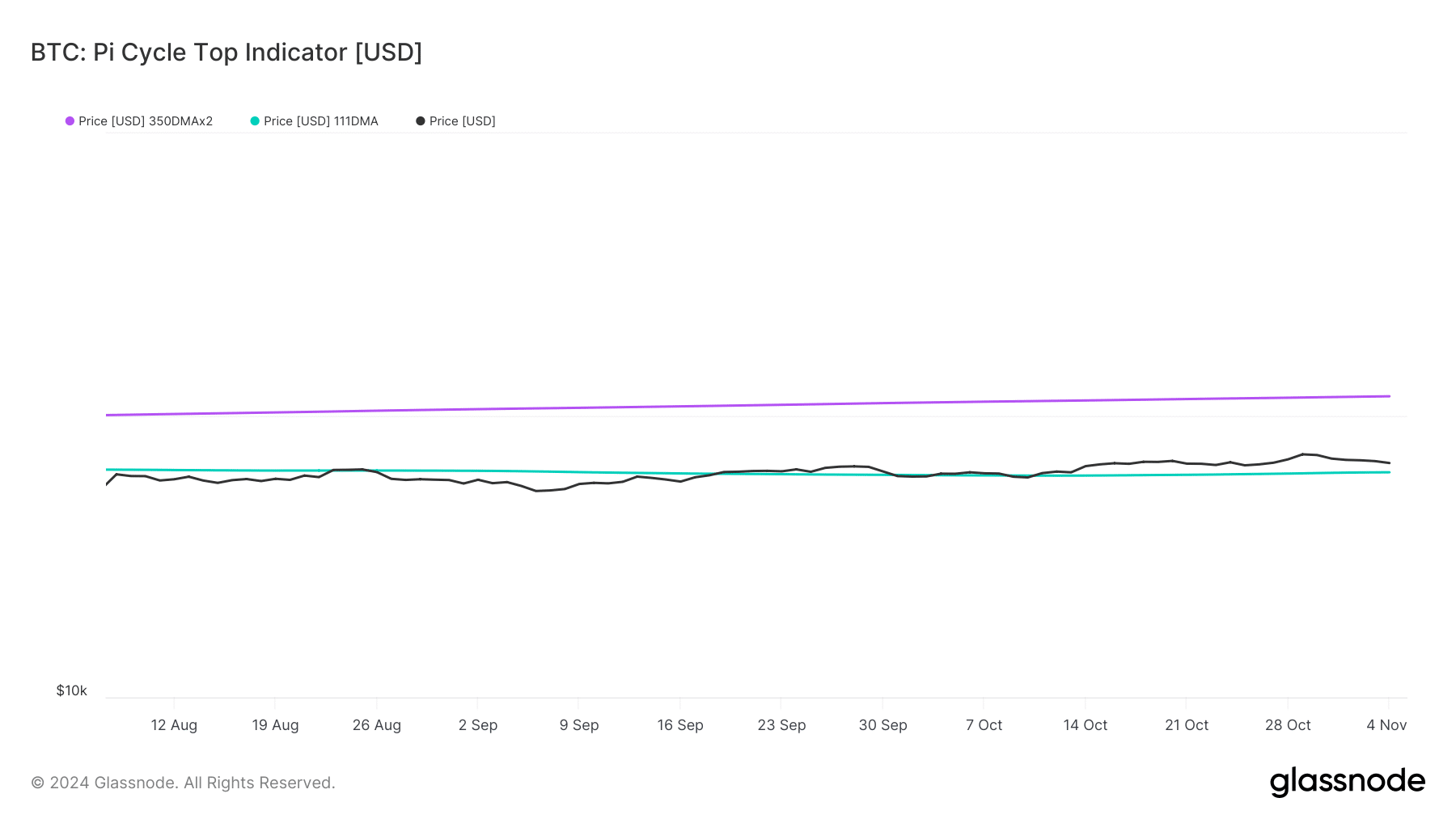

To examine the probability of BTC transferring in direction of $120k, AMBCrypto assessed Glassnode’s information. The Pi Cycle High indicator revealed that Bitcoin’s worth was quick approaching its attainable market backside of $62.7k.

If the metric is to be believed, then BTC’s attainable market prime was close to $116k.

Subsequently, contemplating the Pi Cycle High indicator and the CryptoQuant evaluation, anticipating BTC to start its journey in direction of $120k within the coming months didn’t appear too formidable.

What’s subsequent for BTC within the short-term

Although the longer term prospect of BTC seemed optimistic, the current state of affairs remained questionable.

Subsequently, AMCrypto assessed its on-chain information to seek out extra about the place BTC was headed because the world awaits the U.S. presidential election outcome. Our evaluation revealed that BTC’s binary CDD turned purple.

This meant that long-term holders’ motion within the final 7 days was decrease than the typical. They’ve a motive to carry their cash. Its NULP was additionally bearish, because it indicated that traders had been in a perception part the place they’re presently in a state of excessive unrealized earnings.

Learn Bitcoin (BTC) Value Prediction 2024-25

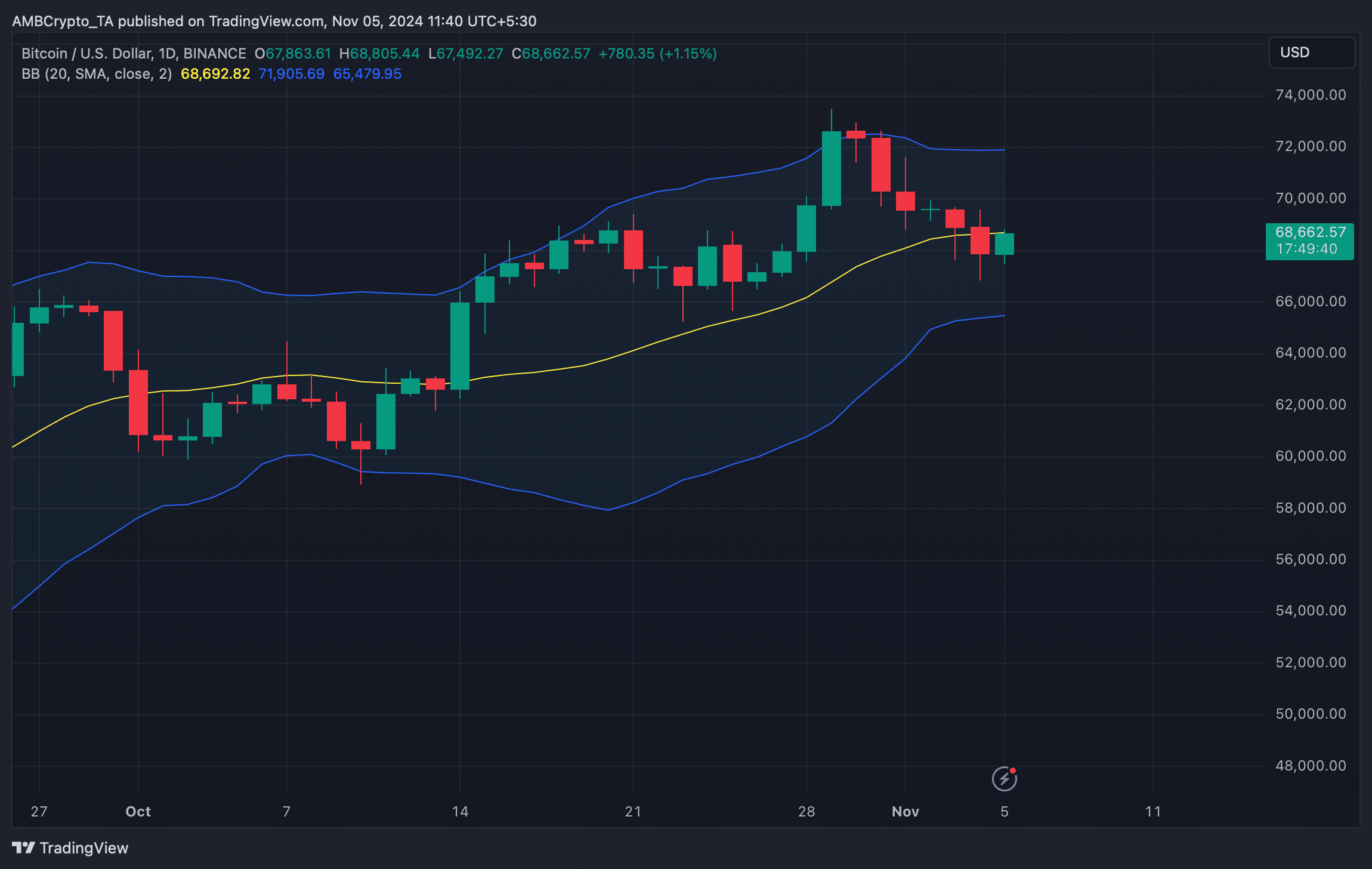

We then took a fast take a look at BTC’s each day chart to see what market indicators advised. On the time of writing, Bitcoin was testing its resistance at its 20-day Easy Shifting Common (SMA).

A profitable breakout might start a bull rally. But when it will get rejected, then BTC would possibly fall to $65k once more.