- ETF inflows for the previous week had been the fourth-highest in its historical past

- Throughout this era, BTC’s value crossed $72,000 in an try to cross its ATH

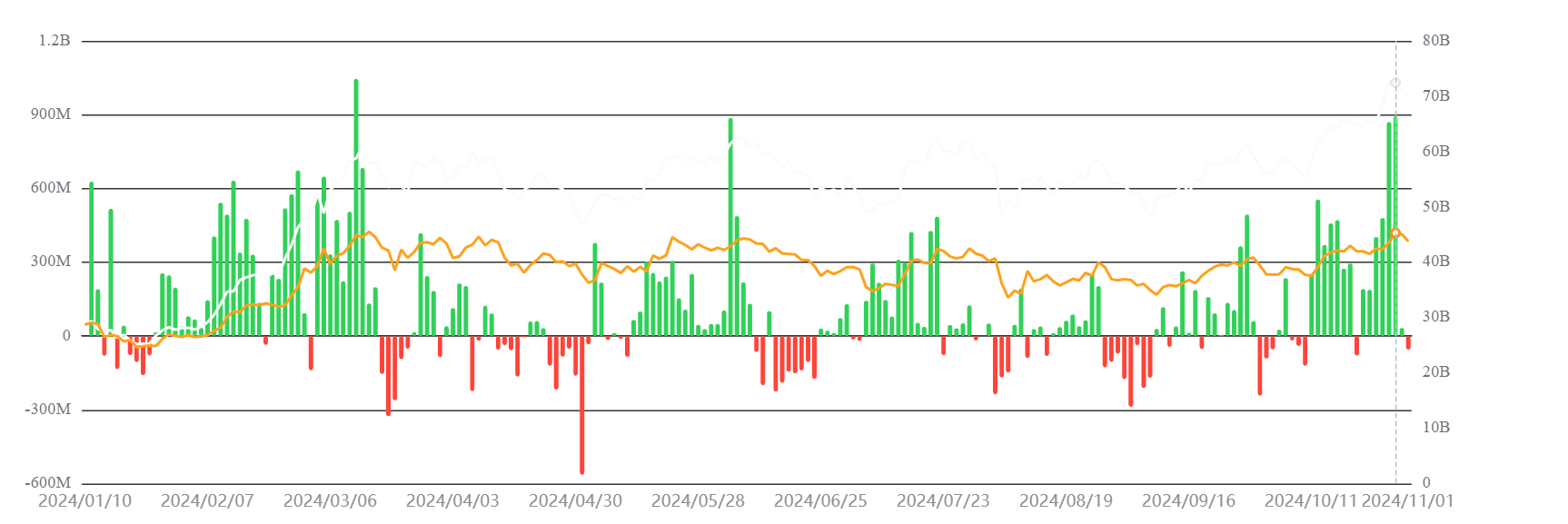

In current weeks, Bitcoin’s market has been carefully intertwined with the inflow of funds into Bitcoin ETFs. October noticed important exercise as investor curiosity in Spot Bitcoin ETFs continued to mount.

The ETF flows for the week ending 1 November, specifically, mirrored a strongly bullish sentiment, setting a noteworthy pattern towards earlier weeks.

Bitcoin ETF’s record-setting inflows in current weeks

Knowledge from Sosovalue revealed that Bitcoin ETF flows for the week ending 1 November noticed substantial web inflows of $2.22 billion. This determine is among the many highest for 2024 – An indication of robust demand from traders.

The market noticed greater inflows in mid-March, with figures of $2.57 billion. Through the week ending 16 February too, figures of $2.27 billion had been recorded.

The current inflow is an indication of rising optimism, positioning these product choices as a most popular choice for gaining Bitcoin publicity.

This regular stream of capital is an indication of an increase in confidence from institutional and retail traders, doubtlessly making a stable demand base for BTC in the long run.

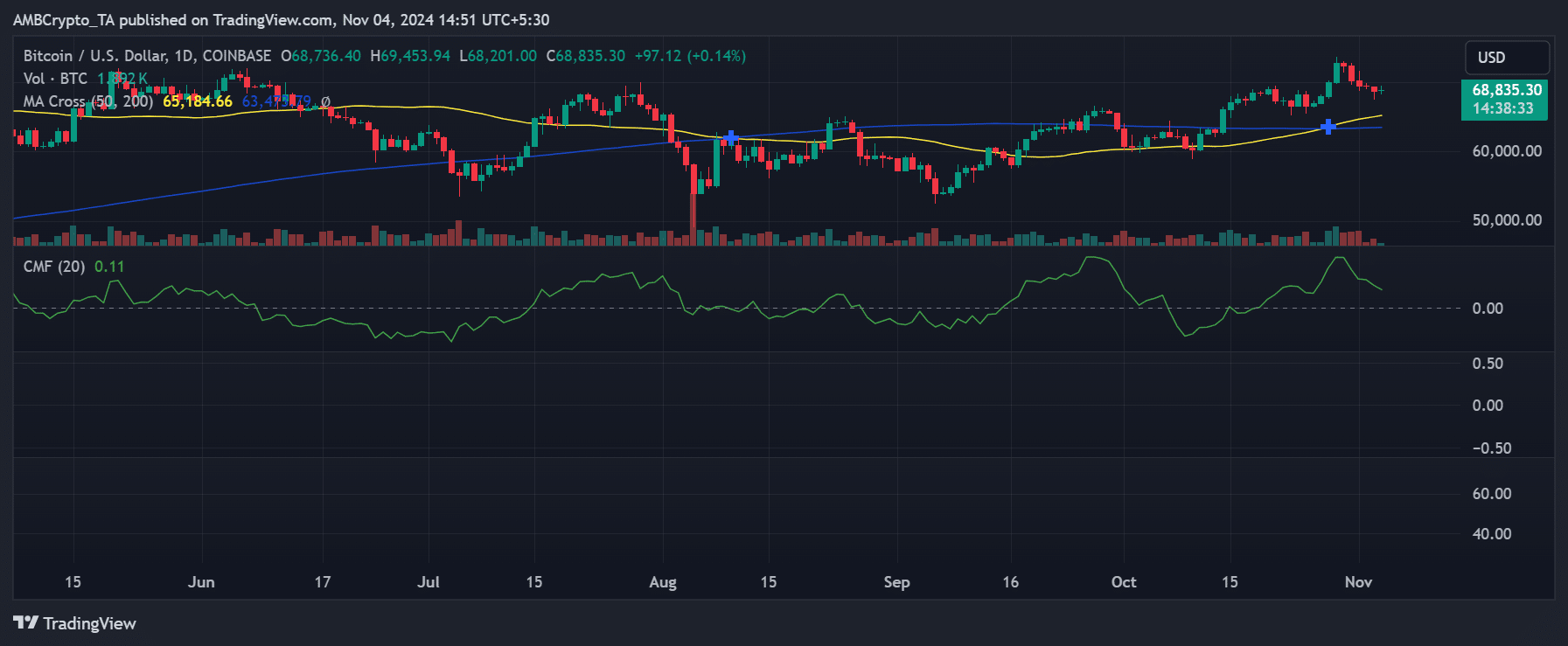

Worth response to ETF inflows

Bitcoin’s current value motion highlighted the affect of ETF inflows. Over the previous week, BTC peaked at $72,724, earlier than barely retracting to round $68,835.30.

This momentum aligned with a hike in ETF funding, suggesting that bullish sentiment from ETFs is influencing Bitcoin’s value. The optimistic value pattern could proceed as extra capital flows into the market, particularly if regulatory situations stay favorable.

The correlation between Bitcoin’s value and ETF exercise appears to point that this funding supply could contribute to the present market uplift.

This response could possibly be an early signal that Bitcoin is gaining momentum from ETF-driven curiosity, a pattern that might persist relying on future regulatory developments.

Are Bitcoin ETF inflows an enduring sign?

Whereas Bitcoin ETF inflows are a promising signal, questions stay about whether or not this pattern may have an enduring impression on Bitcoin’s value or not. Traditionally, inflows of this magnitude have led to cost rallies. And but, elements like regulation, macroeconomic tendencies, and liquidity nonetheless affect the broader crypto market.

Bitcoin ETFs are opening doorways for conventional traders to enter the crypto market extra simply, doubtlessly resulting in sustained value ranges and even additional beneficial properties. Nonetheless, with this momentum could come short-term volatility as profit-taking will increase.

– Learn Bitcoin (BTC) Worth Prediction 2024-25

For now, the current surge in Bitcoin ETF inflows highlights robust bullish sentiment, which has supported BTC’s current value beneficial properties. Whether or not this curiosity can gas a longer-term rally stays unsure. Nonetheless, the sustained ETF exercise is prone to reinforce Bitcoin’s standing available in the market.