- Variety of addresses holding over 1 BTC has fallen for the reason that begin of the 12 months

- Metrics revealed that buyers may need been promoting to earn income

After a snug uptrend, Bitcoin [BTC] noticed a worth drop on the charts and began to consolidate underneath $70,000. In the meantime, it could appear that big-pocketed gamers diminished their holdings in 2024 too.

Does this imply they’ve been shedding confidence in BTC? Or had been they decreasing their positions to earn income?

Are whales promoting Bitcoin?

Right here, it’s price noting that whereas BTC’s worth dropped, its worth was nonetheless hovering shut its all-time excessive at press time. With Bitcoin performing as it’s, IntoTheBlock shared a tweet revealing an attention-grabbing growth. In response to the identical, 1,013,120 addresses held greater than 1 BTC. This quantity fell from 1,024,437 for the reason that begin of the 12 months.

At first look, this would possibly counsel that whales could also be shedding confidence within the king coin. Nonetheless, the fact may be totally different. The whales may need chosen to promote their property in an effort to earn income. Particularly as BTC’s worth was significantly excessive on the charts.

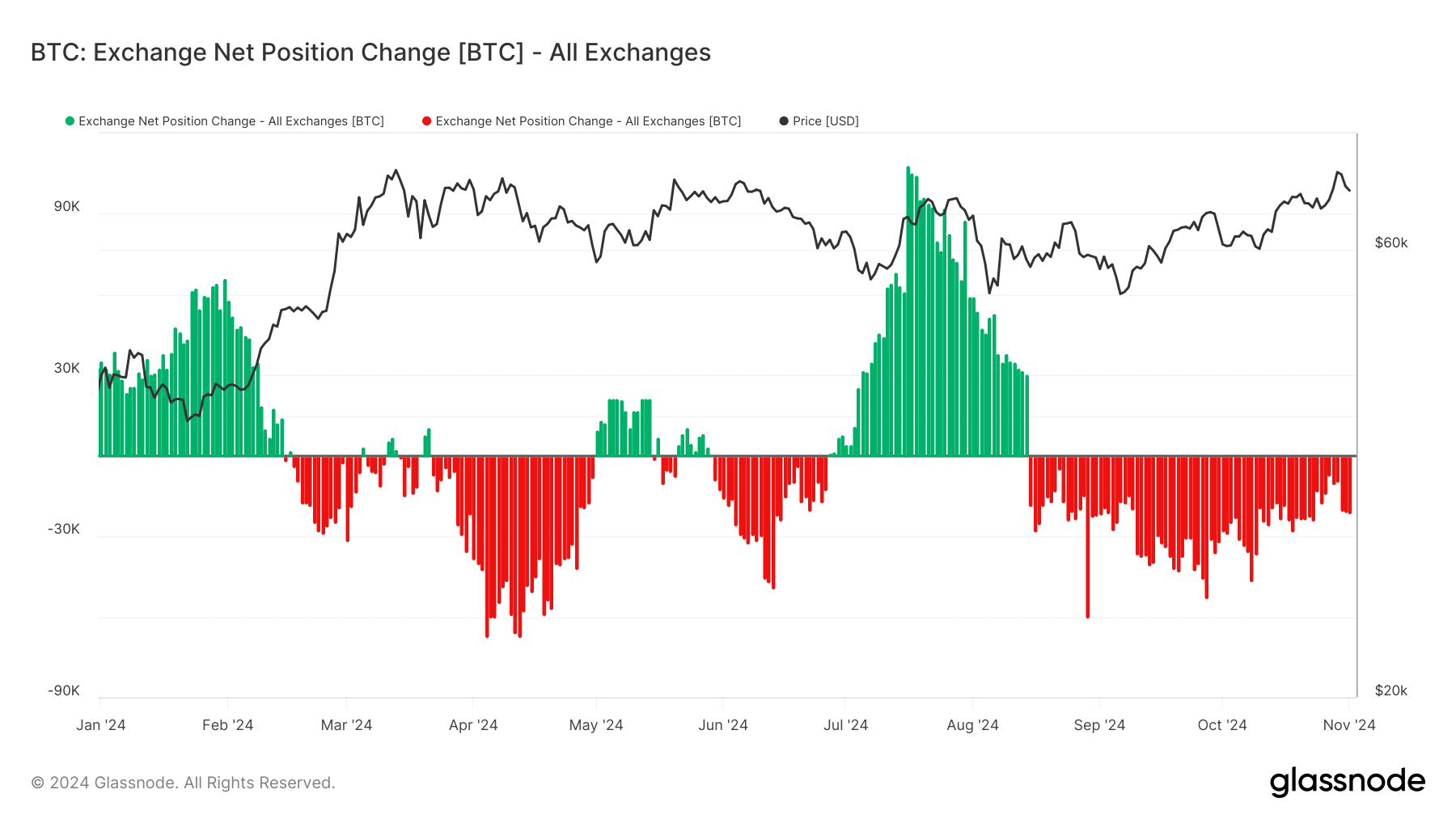

To examine the identical, AMBCrypto assessed the crypto’s on-chain knowledge. As per AMBCrypto’s evaluation of Glassnode’s knowledge, Bitcoin’s web place change remained within the adverse zone over the previous few months. A significant cause behind this may very well be BTC’s worth rise throughout the identical interval. Usually, when costs strategy ATHs, buyers usually select to promote their holdings in an effort to take income.

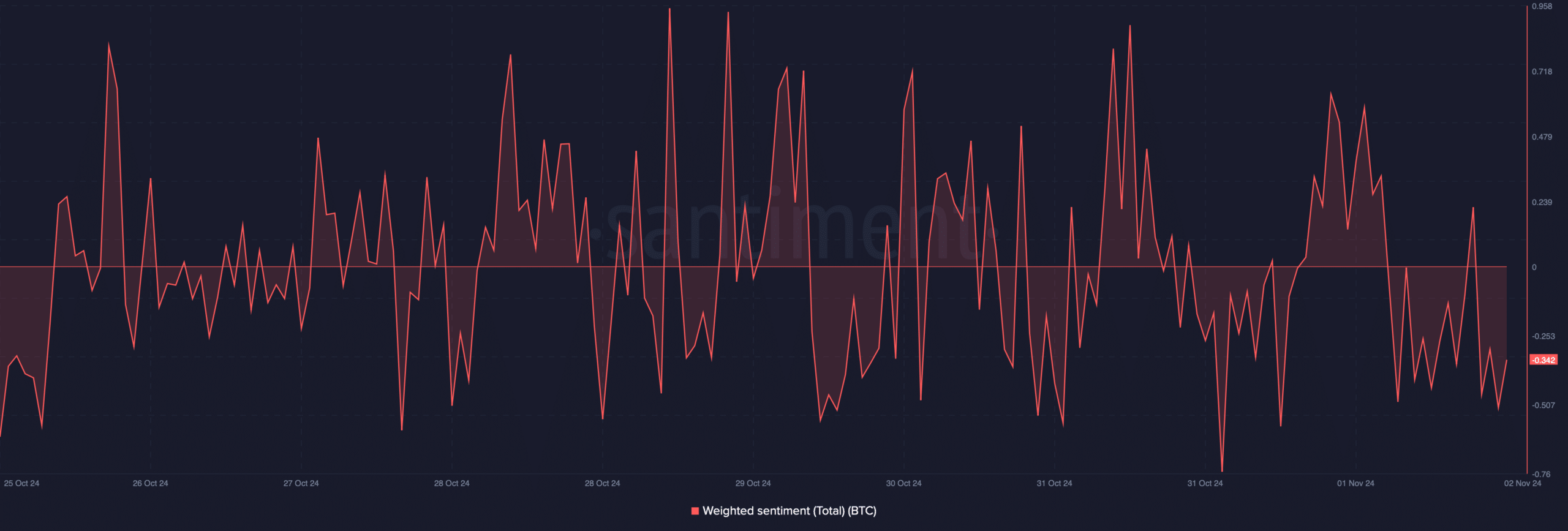

AMBCrypto then checked Bitcoin’s social metrics to seek out out whether or not confidence within the coin has really been dwindling. In response to our evaluation, BTC’s weighted sentiment saved transferring within the constructive and adverse zones continuously over the previous week.

This meant that there was not a selected sentiment that was dominant available in the market. Due to this fact, the potential for whales promoting to earn income appeared excessive.

Mapping BTC’s future

For the reason that big-pocketed plates had been taking income and decreasing their holdings, AMBCrypto then assessed how this would possibly have an effect on the crypto’s worth.

As per our evaluation of CryptoQuant’s knowledge, Bitcoin’s aSORP was pink. This indicated that extra buyers have been promoting at a revenue. In the course of a bull market, it might probably trace at a market prime.

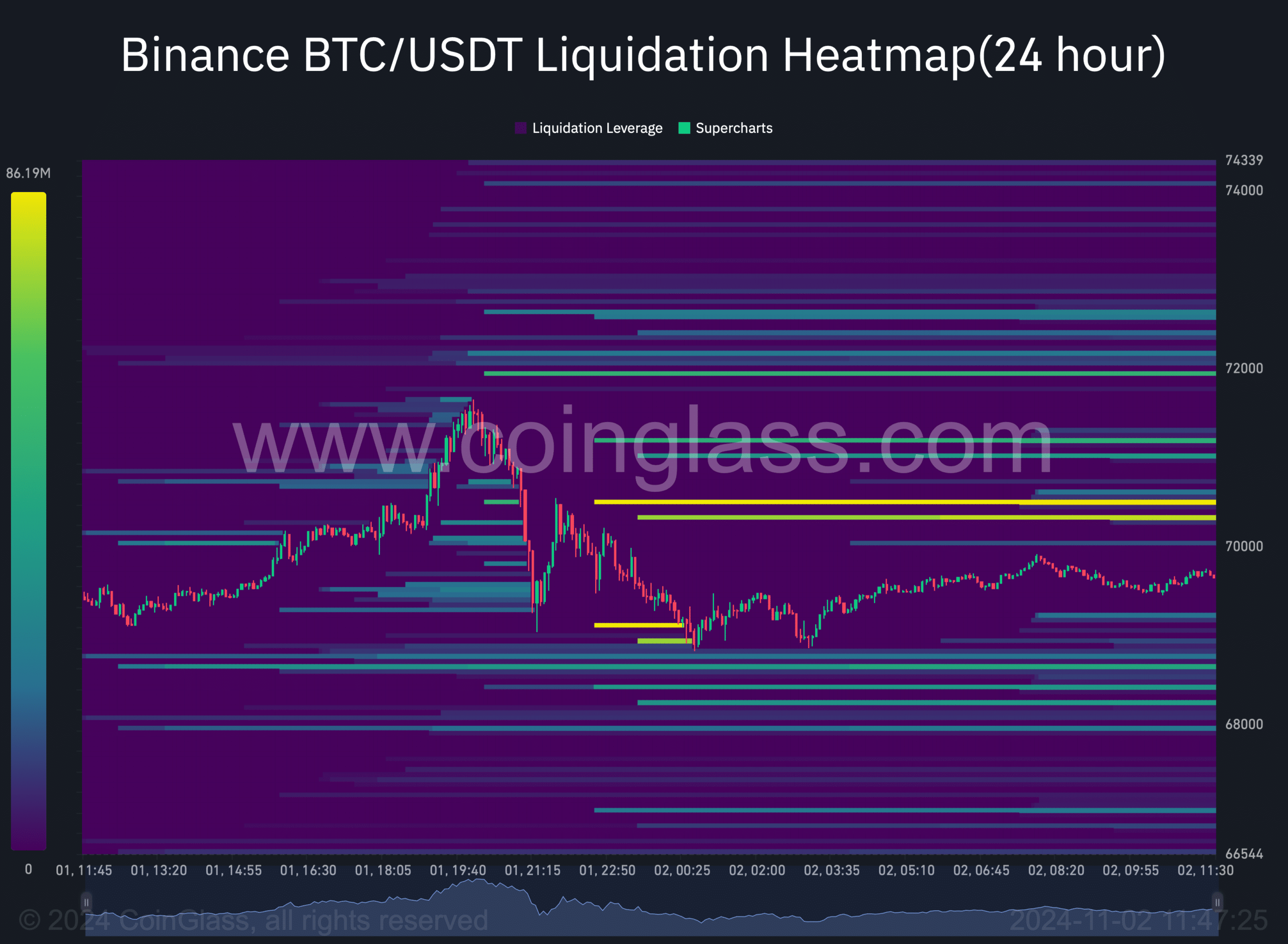

Coinglass’s liquidation heatmap additionally revealed that in case of a worth drop, BTC’s worth would possibly decline to $68.6k. This was the case as liquidations will rise sharply, which may probably act as a assist from the place bulls would have a possibility to bounce again.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Nonetheless, AMBCrypto reported that BTC’s NVT ratio dropped over the previous few days – A discovering that hinted at a worth hike.