- Bitcoin dominance approaches 60% amid rising volatility, suggesting a near-term bullish outlook.

- What does this imply for altcoins?

In simply over two weeks, Bitcoin [BTC] dominance has surged from 57% to almost 60%, extending management over the crypto market regardless of fierce competitors from rival property.

Nevertheless, regardless of this milestone, BTC’s value has remained consolidated under $68K for a complete week. If this pattern persists, the excessive dominance might sign a market prime, with the present value serving as a key psychological resistance stage.

On the flip facet, the prevailing market sentiment is considerably formed by key macroeconomic elements. The upcoming election outcomes are anticipated to deliver shifts in financial coverage, probably setting BTC up for a risky week forward. Nevertheless, this example underscores a extra vital subject.

Traders are more and more turning into risk-averse

The cryptocurrency market is witnessing a notable transition. Whereas Bitcoin continues to interrupt out to new highs, altcoins are lagging behind.

Presently, solely 14 out of the highest 50 altcoins have outperformed BTC within the final 90 days, accounting for a mere 29% of their dominance. In the meantime, Ethereum has seen its market share tumble over 7% in simply 30 days, now standing at 13% on the time of writing.

Put merely, there’s a notion that Bitcoin serves as a secure haven throughout heightened volatility. As regulatory uncertainties loom, capital is predicted to stream extra into BTC, probably delivering one other blow to high-cap altcoins.

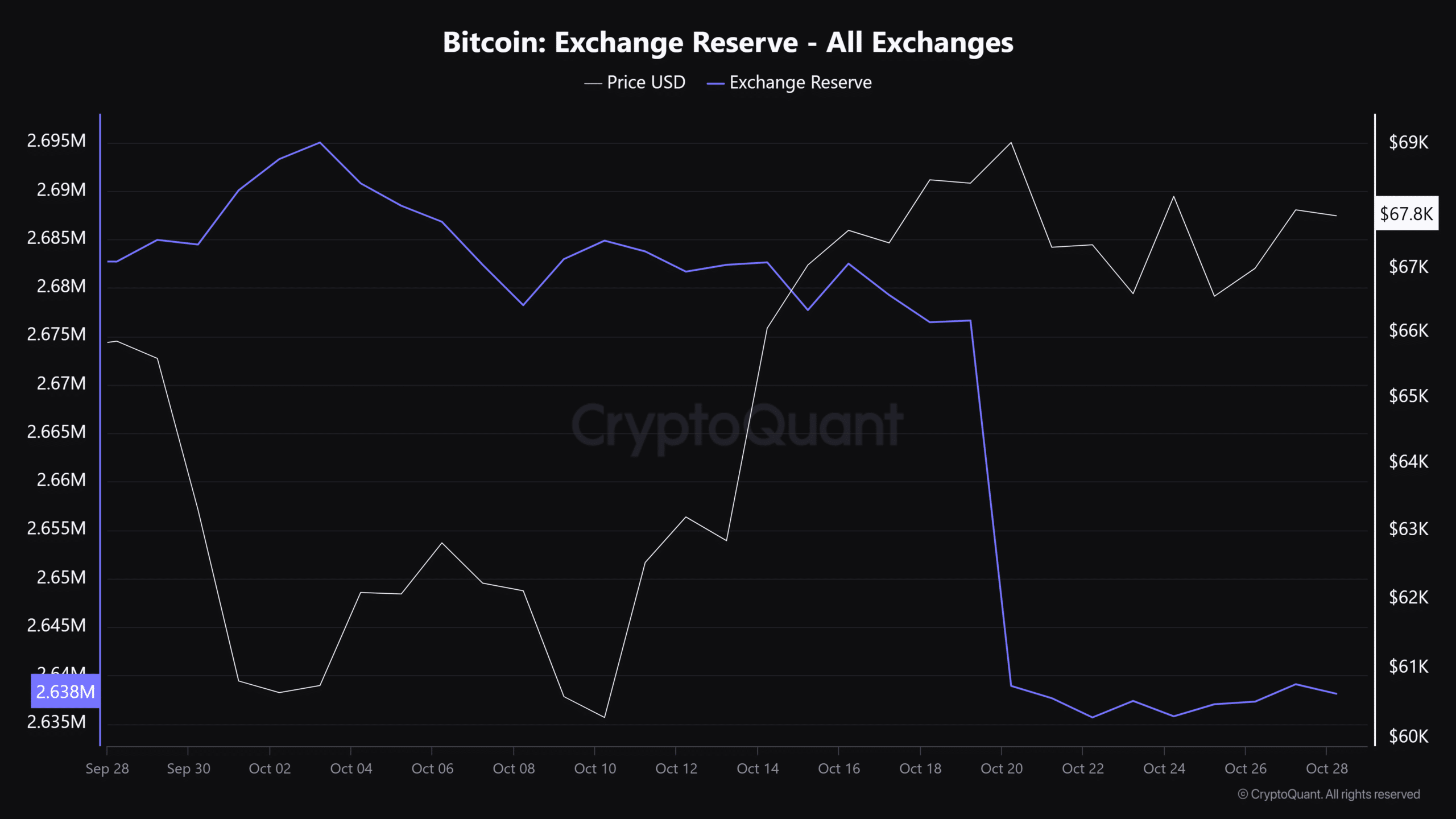

The full Bitcoin held on exchanges has hit a decrease low, a sample that ceaselessly alerts market bottoms throughout bullish tendencies. This improvement, alongside numerous different indicators, hints at a possible sentiment shift amongst traders.

AMBCrypto means that because the election buzz begins to settle, extra traders could flock to Bitcoin – no less than till a clearer regulatory panorama emerges.

This example factors to a impartial short-term outlook for BTC, as market members search for stability within the face of uncertainty.

Altcoins poised for short-term positive factors

As Bitcoin stands to profit from the present volatility, altcoins may see some motion. Nevertheless, an altcoin season stays out of attain.

Whereas altcoins might obtain the required push for a slight reversal, their momentum remains to be closely reliant on Bitcoin’s efficiency.

Consequently, AMBCrypto dismisses the opportunity of a sturdy altcoin season except the post-election panorama ushers in a extra pro-altcoin sentiment or Bitcoin dominance nears 70%, signaling an overheated market and a possible prime.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Presently, on-chain information signifies that $67K is a big native low for BTC. With expectations of elevated volatility subsequent week, Bitcoin seems poised to problem its earlier resistance at $69K and will even attain a brand new ATH.

Consequently, altcoins are additionally displaying a bullish short-term outlook, hoping to profit from Bitcoin’s optimistic trajectory. Nevertheless, the long-awaited altcoin season nonetheless stays elusive.