- BTC has surged by 5.91% over the previous month.

- Analyst finds 350k new addresses are crucial for Bitcoin to see a sustained uptrend.

Since hitting a neighborhood low of $58k, Bitcoin [BTC] has skilled a powerful upswing on month-to-month charts to hit a neighborhood excessive of $69k.

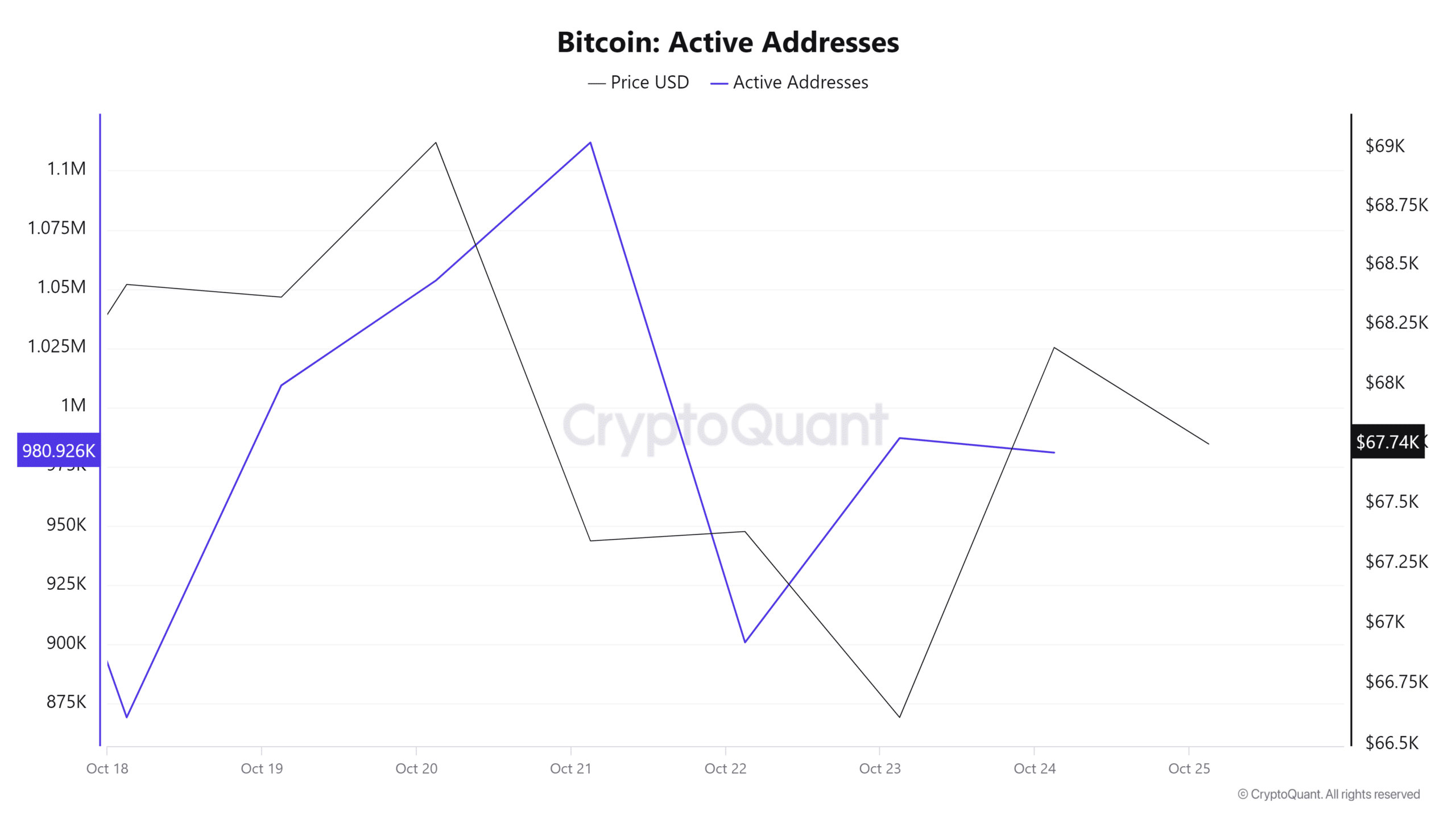

Nevertheless, regardless of this upward momentum, Bitcoin’s each day lively addresses have expressed a pointy decline. As such, lively addresses have declined from a excessive of 1.1 million to 980k. This drop in lively addresses has left analysts speaking.

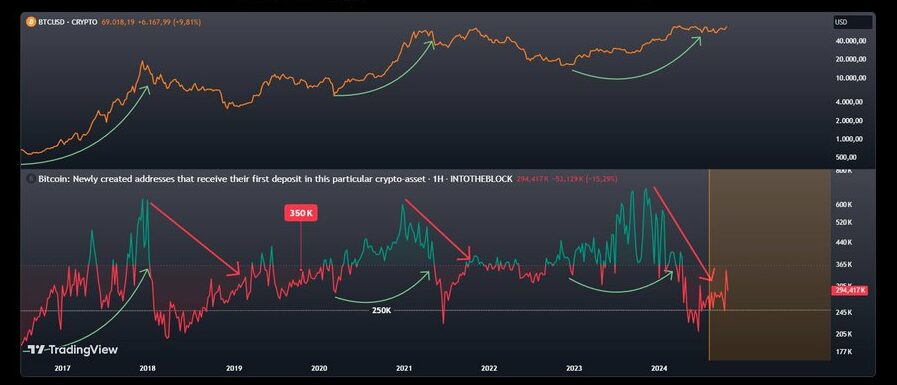

Inasmuch, Cryptoquant analyst Burak Kesmeci has urged that 350k new addresses are probably the most crucial for BTC to maintain an uptrend.

Why 350k addresses are crucial

The analyst posited that new addresses are important for Bitcoin bulls to realize market energy.

Based on him, the market is wholesome provided that the variety of new Bitcoin addresses will increase.

Subsequently, the 350k stage is a pivot separating the bulls and bears. When the variety of new addresses falls beneath 350k, the market faces a powerful downward motion as bears take over thus beginning a bear season.

Subsequently, when addresses stay above this stage, it means bulls are gaining energy and the uptrend holds.

Traditionally, Bitcoin addresses have performed a crucial position in seeing each bull and bear seasons. For instance, over the previous 6 years, Bitcoin addresses have fallen beneath 250k 3 times the place BTC declined.

In 2018, it dropped from $19k to $6k, in 2021, it dropped from $64k to $30k, and in 2024 from $73k to $49k.

Subsequently, when new addresses flip 350k, the market will probably be wholesome sufficient for traders. Though 2024 has seen a surge in new addresses, it has not surpassed 350k. As such, they fell to 210K in June 2024 and rose to 349K on October 14, 2024. Nevertheless, they’ve declined once more to 249k.

Based on this analogy, the BTC market shouldn’t be sturdy sufficient for a sustained rally.

What it means for BTC charts

Though Bitcoin is but to flip 350k new addresses, the crypto is presently experiencing a powerful uptrend. As such, prevailing market sentiment favors BTC for extra beneficial properties on value charts.

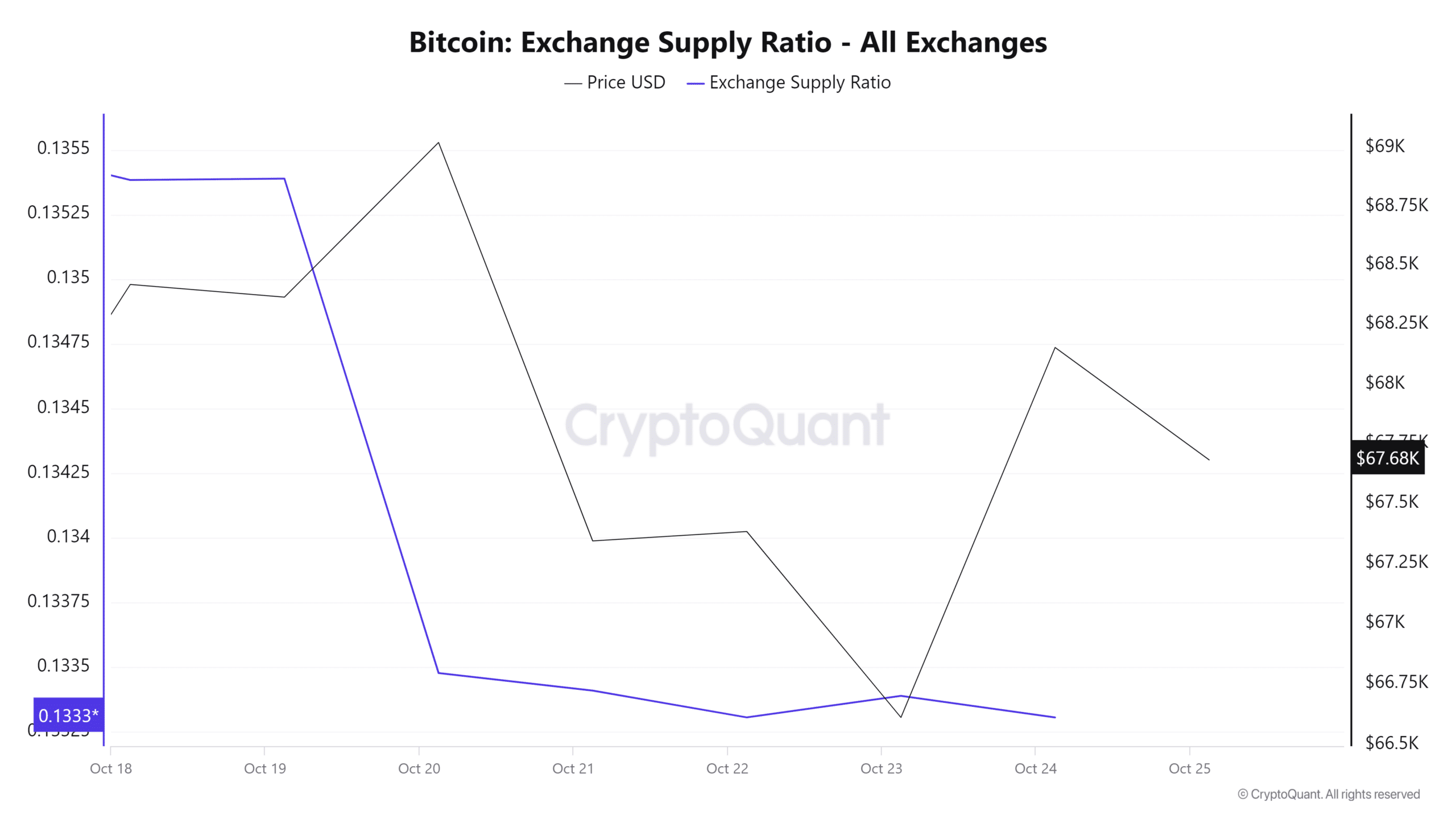

For instance, the trade provide ratio has skilled a pointy decline over the previous week. This means that holders are accumulating and storing their Bitcoin off exchanges signaling they don’t have any quick intentions to promote.

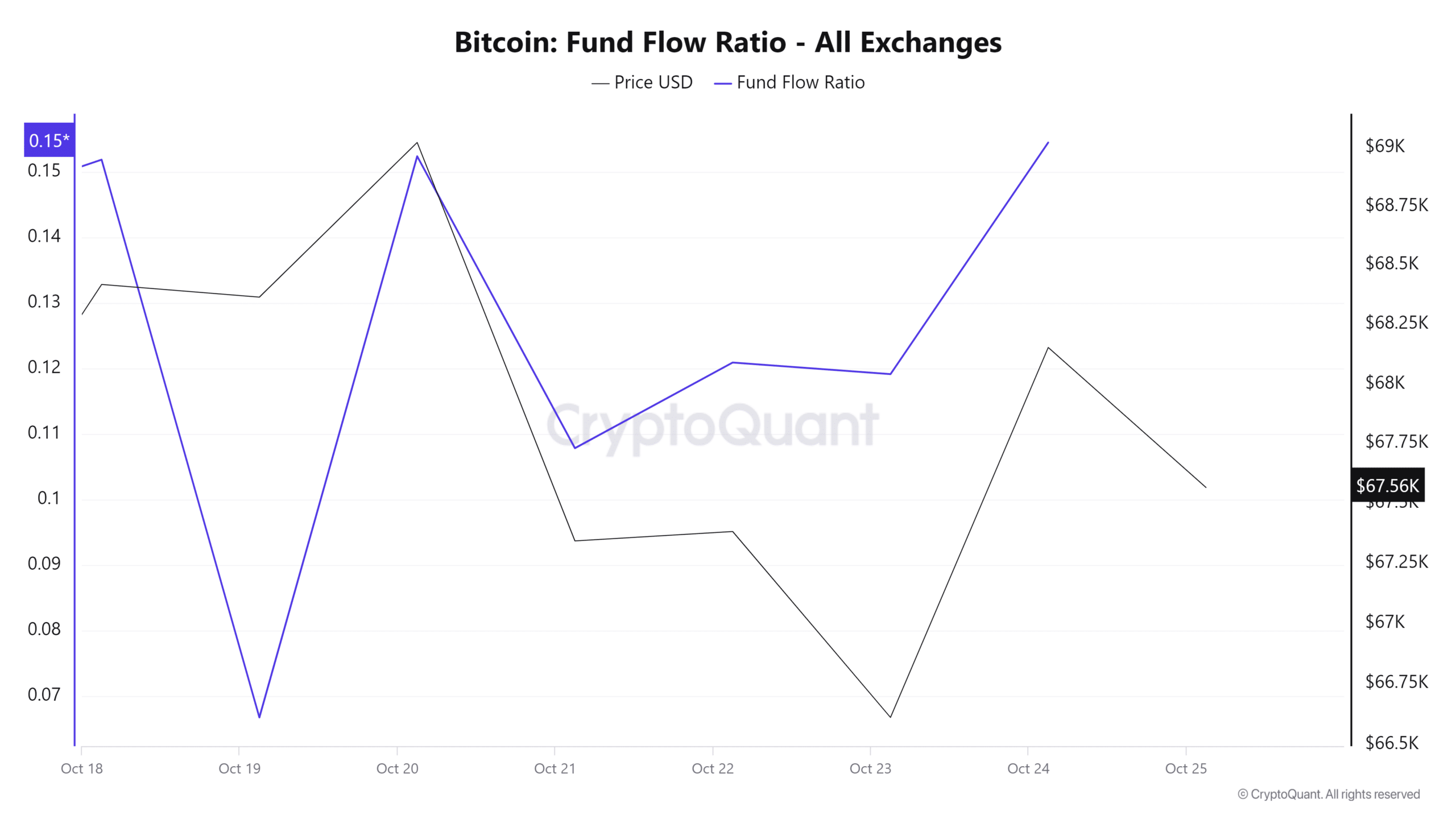

Moreover, Bitcoin’s fund movement ratio has elevated over the previous week from a low of 0.06 to 0.15. This means that extra traders are shopping for BTC signaling elevated demand and a bullish market sentiment.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

The truth is, on the time of this writing, BTC was buying and selling at $67714. This marked a 5.91% enhance on month-to-month charts.

Subsequently, if the prevailing market sentiment holds, BBC will try $69400 resistance the place it has confronted a number of rejections.