- Traders and long-term holders anticipated higher returns from Bitcoin, based mostly on historic tendencies

- Giant wave of promoting earlier this month confirmed disbelief within the bullish situation

Bitcoin [BTC] confronted rejection at $66.5k after a robust rally towards the top of September. October is a month that usually sees constructive returns for the coin, however not this time, a minimum of thus far. The truth is, on the time of writing, BTC was down 4% from the month’s open.

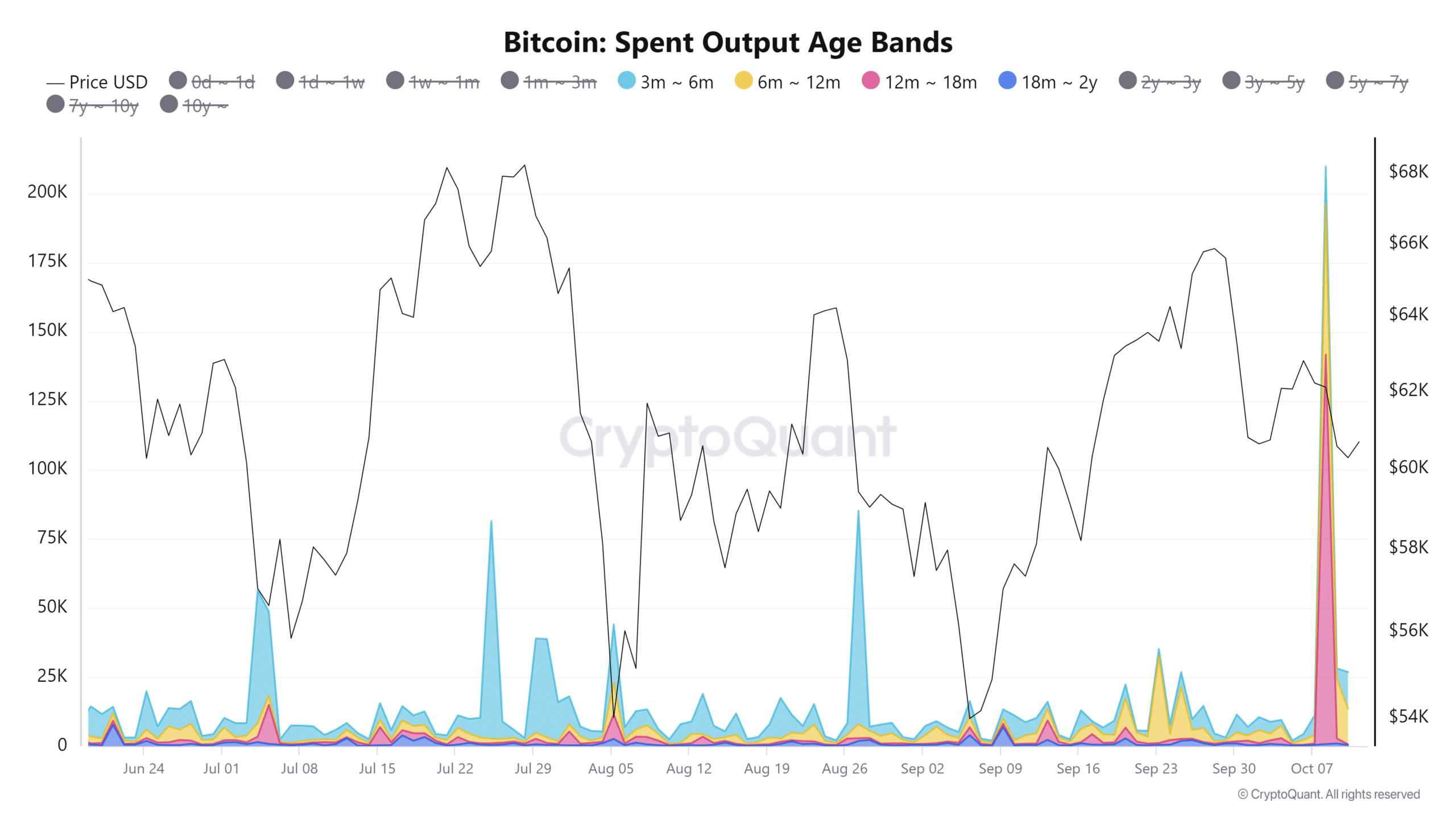

Supply: CryptoQuant

The spent output age bands metric confirmed that many longer-term holders equivalent to 12 month-18 month band opted to promote Bitcoin on 8 October.

The short-term holders additionally participated, resulting in a wave of promoting not seen since January 2021.

Bitcoin halving returns don’t match expectations

Supply: Ki Younger Ju on X

In a submit on X, CryptoQuant Founder and CEO Ki Younger Ju famous that we’re on target to have the longest sideways value motion in a halving yr. The 2020 cycle noticed Bitcoin start its rally mid-way via October.

The efficiency of BTC within the first quarter far surpassed the one seen in 2020, however the two years had wildly completely different begins. In 2024, the spot exchange-traded funds (ETFs) have been permitted within the U.S., main to an enormous wave of demand.

In 2020, the onset of the Coronavirus pandemic was looming and each analyst and investor was on the verge of panic as a result of menace of financial harm.

A counterargument is that the longer the consolidation part, the stronger the breakout. Might this occur to Bitcoin, or is the king coin extra mature and fewer amenable to the loopy features it noticed in earlier cycles? Solely time will inform.

Purchase the dip situation

Supply: nestay on X

Crypto analyst nestay identified on X that the primary two weeks of October have traditionally seen volatility and a seeming downturn, earlier than restoration.

The 2021, 2023, and 2024 value actions have been in contrast. In every of those case, the market construction turned bearish earlier than a bullish pattern was established within the second half of the month.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

This may encourage the concept of shopping for the dip. Now, whether or not Bitcoin can pattern as strongly because it did within the earlier cycle is unknown, however long-term holders would doubtless desire to HODL than to promote within the face of disappointing Bitcoin performances.