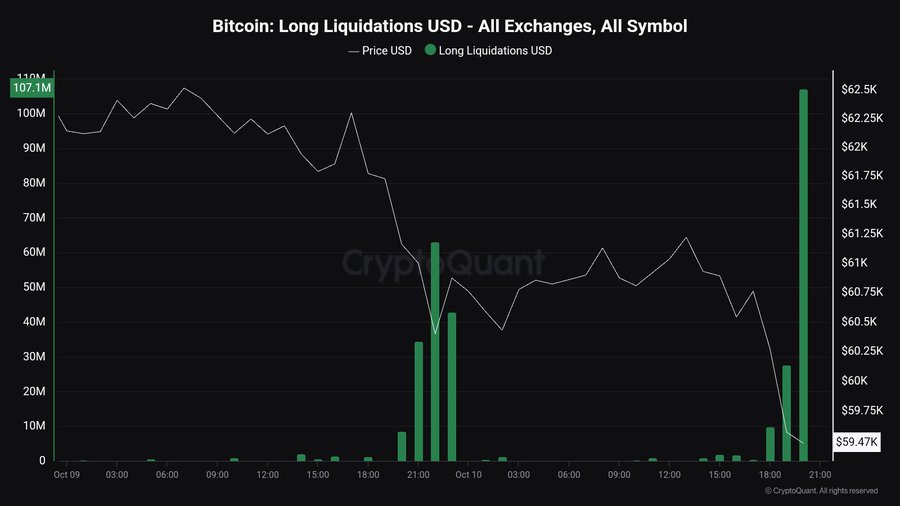

- BTC’s latest volatility resulted in whole liquidations value $107 million

- Analyst sees $60,600 because the essential stage that can decide BTC’s trajectory

For the reason that begin of October, Bitcoin has seen heightened worth fluctuations. Over this era, BTC has hit a excessive of $66,500 and a low of $58,800, with the latter being a worth stage that was hit lower than 24 hours in the past.

This drop under $60k had a large impression on BTC holders, with many getting forcefully liquidated. Actually, over $107 million have been liquidated.

This rise in volatility, accompanied by present market market circumstances, raises questions on BTC’s future trajectory. Because of this well-liked crypto analysts comparable to Rekt Capital have prompt that BTC should stay above $60,600 for a possible upside.

What does market sentiment say?

In his evaluation, RektCapital posited that Bitcoin is retesting the weekly re-accumulation- vary of $60,600 as help for the second consecutive week.

In response to this evaluation, BTC will report an uptrend if it closes above this stage on the weekly charts. Subsequently, for any potential upside within the close to future, BTC should protect this vary which is able to place the worth for additional hikes.

Nevertheless, the analyst additionally famous that if the crypto loses help right here, it should notice one other draw back deviation interval.

What do the charts say?

On the time of writing, BTC was buying and selling at $60,573. This marked a 0.58% decline on the every day charts with an extension to this bearish development by a 1.01% dip on the weekly charts.

Subsequently, primarily based on the newest worth motion, the aforementioned evaluation by RektCapital could also be regarding because it tasks potential draw back.

Therefore, it’s important to find out what different market fundamentals counsel.

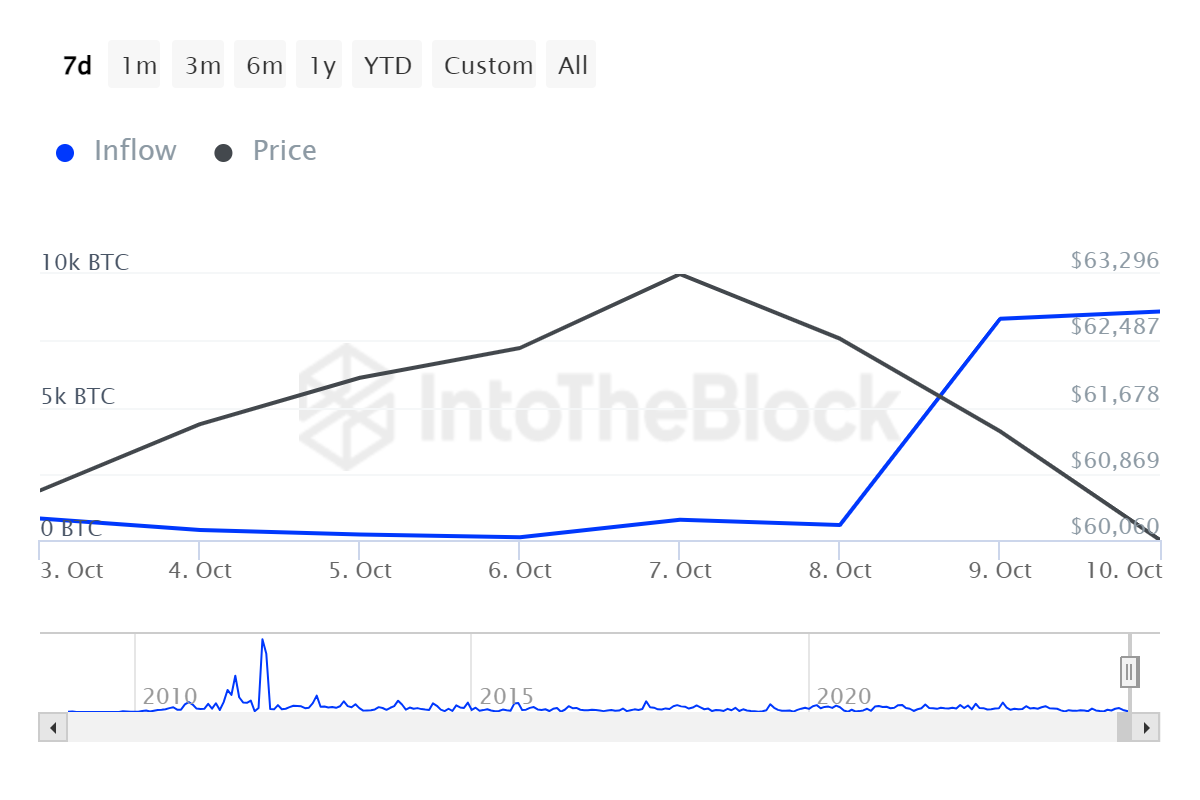

For starters, Bitcoin’s Giant holders influx spiked over the previous few days from 560.95 to eight.59k. A spike in massive holders implies that traders are shopping for the dip and taking lengthy positions.

Such market habits can also be an indication that giant holders anticipate costs to rise within the close to future.

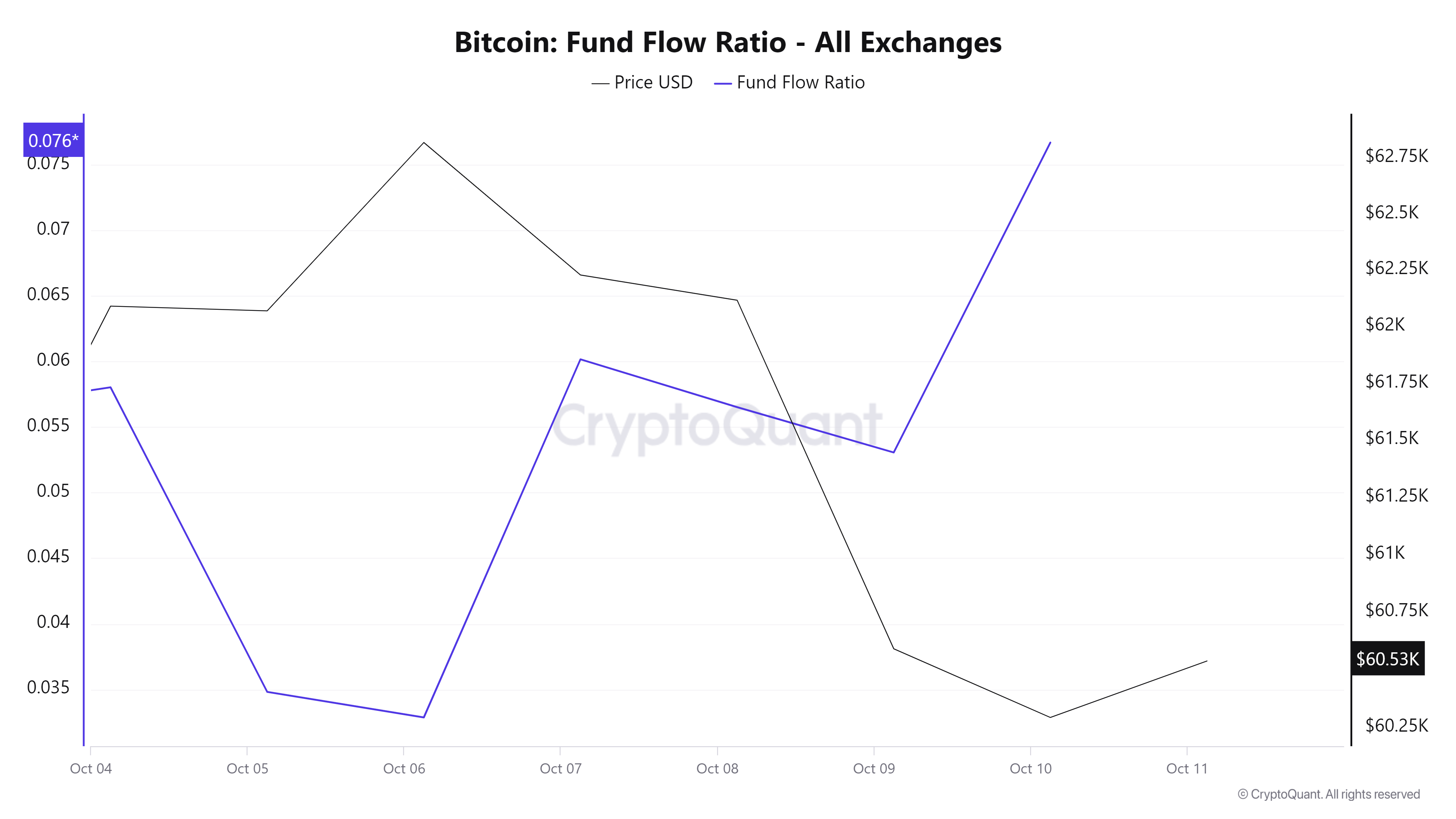

Moreover, Bitcoin’s fund circulation ratio spiked from a low of 0.032 to 0.077, indicating increased shopping for strain as traders are depositing funds to purchase BTC.

Such habits is often related to bullish market sentiment.

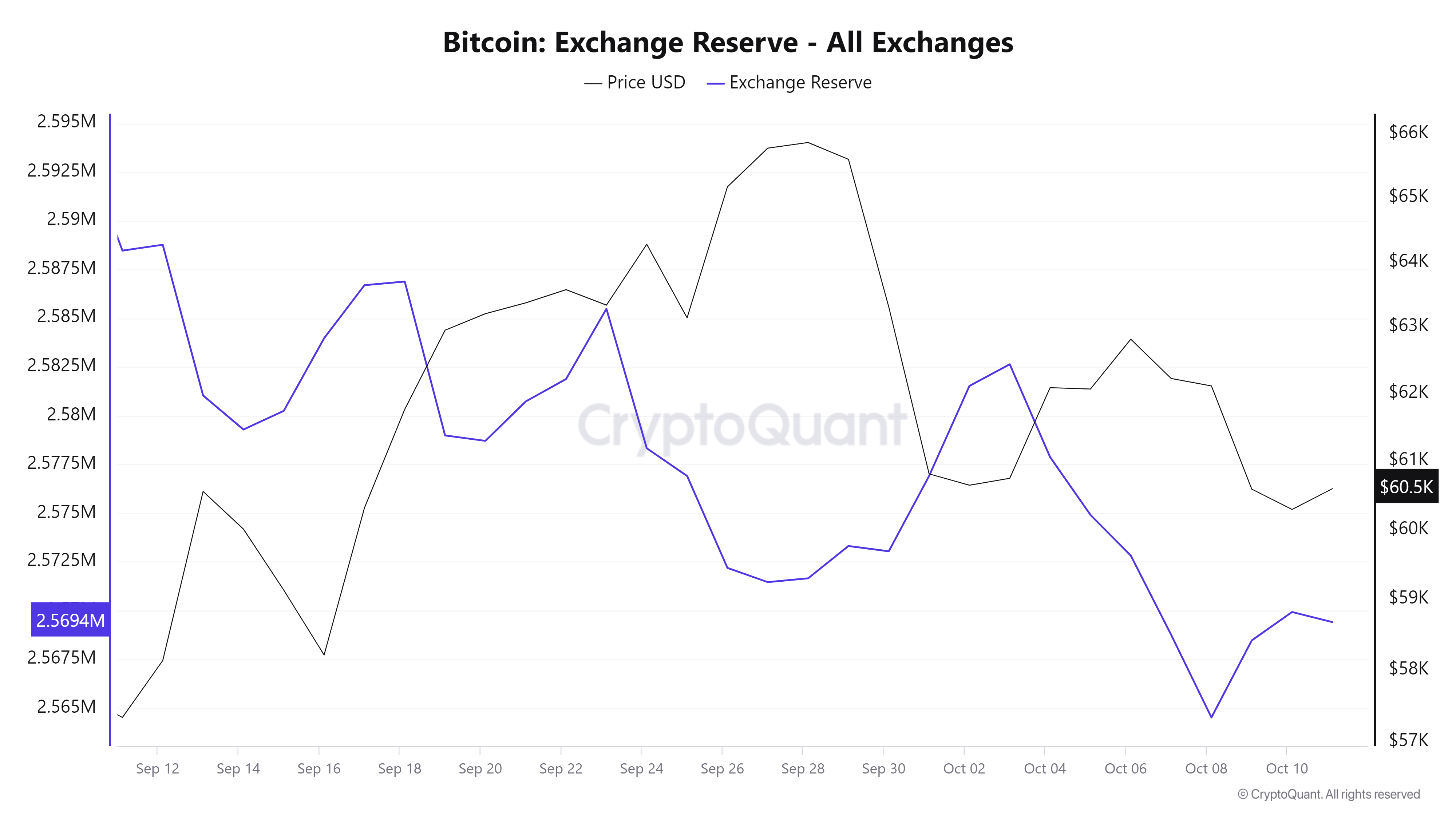

Lastly, Bitcoin’s Change reserve additionally registered a sustained decline over the previous month. This alludes to a long-term holding technique as traders are much less prone to promote their BTC within the brief time period. Largely, that is bullish sign because it reduces provide on exchanges, reducing the potential promoting strain.

Merely put, the latest downtrend has been shedding momentum and, BTC could also be well-positioned for additional positive factors. If the constructive market sentiment holds, BTC will reclaim the $61,875 resistance stage. A failure to take care of this stage will see Bitcoin drop to $58,272.