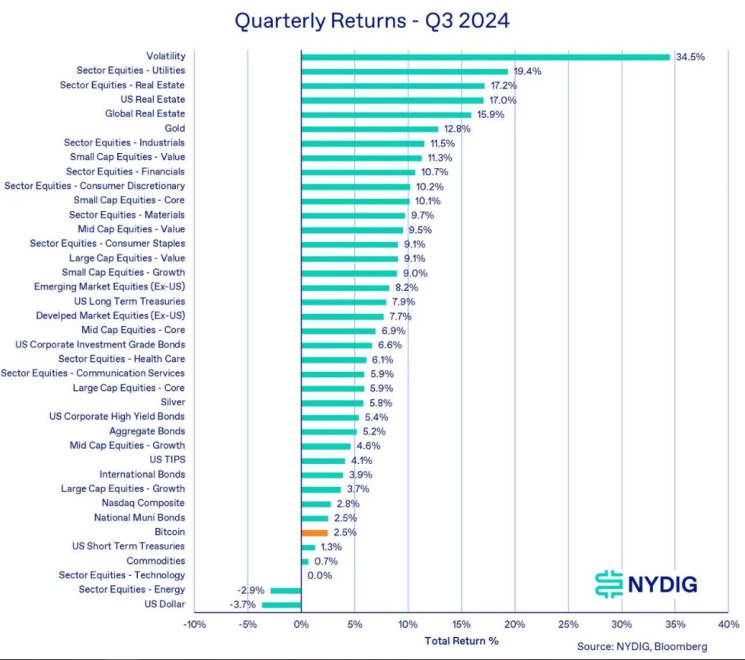

Regardless that the third quarter was robust, Bitcoin has been very sturdy in 2024, persevering with to be the best-performing forex. A brand new report from the New York Digital Funding Group (NYDIG) says that Bitcoin made a small 2.5% achieve in Q3, after happening within the earlier three months. This makes the expansion to date this 12 months a tremendous 49.2%. Bitcoin remains to be doing very nicely, although the market is underneath a whole lot of strain.

Market Dynamics And Challenges In Q3

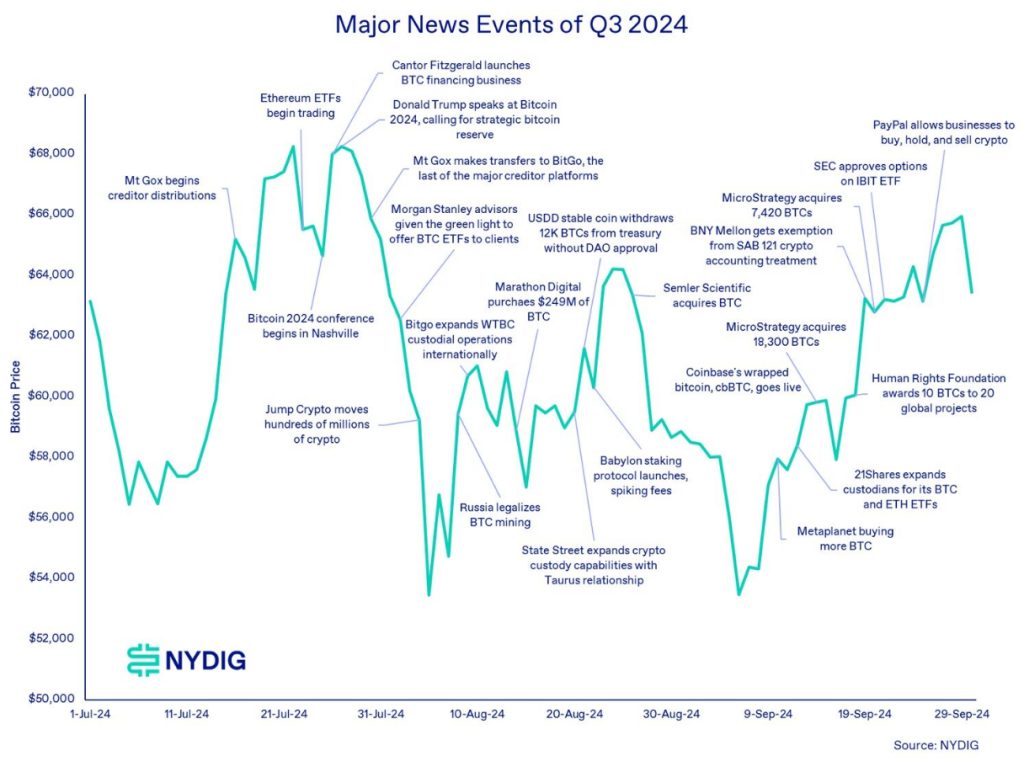

This 12 months was no exception to the frequent notion that the third quarter of the 12 months is a difficult time for Bitcoin. The cryptocurrency encountered quite a few obstacles, reminiscent of substantial sell-offs by vital holders.

You will need to word that the US and German governments bought off vital portions of Bitcoin, which dramatically affected market sentiment. Moreover, the decision of long-standing bankruptcies, reminiscent of Mt. Gox, resulted within the return of billions of {dollars} in Bitcoin to collectors, which additional influenced costs.

Regardless of all of the difficulties Bitcoin confronted—a month normally marked with decreases for the digital asset—it exceeded expectations in September with a ten% improve. Although different asset lessons, such gold and equities, had been performing nicely, Greg Cipolaro, the analysis director of NYDIG, identified that Bitcoin’s skill to take care of its place as the highest asset is outstanding. The evaluation underlined that throughout the previous six months, Bitcoin’s value has moved between $65,000 and $54,000 with no clear sample.

ETF Inflows Fostering Progress

The demand for US spot exchange-traded funds (ETFs) has been a considerable issue within the assist of Bitcoin’s value throughout this era. In Q3, these ETFs acquired a complete of $4.3 billion in inflows, with BlackRock’s iShares Bitcoin Belief taking the lead.

This injection of capital has allowed Bitcoin to search out new technique of supporting the value in intervals of bigger market volatility. Conversely, exchange-traded funds based mostly on Ethereum have struggled to generate wherever near the identical degree of curiosity.

BTC market cap at the moment at $1.22 trillion. Chart: TradingView.com

The expansion of ETF funding continues to be on an upward curve, displaying confidence from buyers within the rising potential of cryptocurrencies as an honest asset in gentle of considerably fluid and risky circumstances throughout the financial setup. Mainstream markets are nonetheless sound though indices such because the S&P 500 have lately proven enhancements. It is for that reason that Bitcoin’s place diverges uniquely and actually helps multi-asset portfolios to offer diversification advantages.

Picture: StormGain

Future Prospects: Potential Catalysts

As we head into This fall, analysts see nice promise for Bitcoin. Traditionally, the highest crypto has had a great run over this era. One in every of quite a few attainable triggers that may elevate costs, Cipolaro famous is the approaching US presidential election on November 5. If former President Donald Trump, who has proven assist for cryptocurrencies, wins, Bitcoin stands to achieve tremendously.

Furthermore, international financial easing and stimulus measures from nations like China may additional affect Bitcoin’s trajectory within the coming months. Whereas some buyers could really feel annoyed with Bitcoin’s range-bound buying and selling over current months, Cipolaro reassured them that this isn’t uncommon for this time of 12 months.

Featured picture from StormGain, chart from TradingView