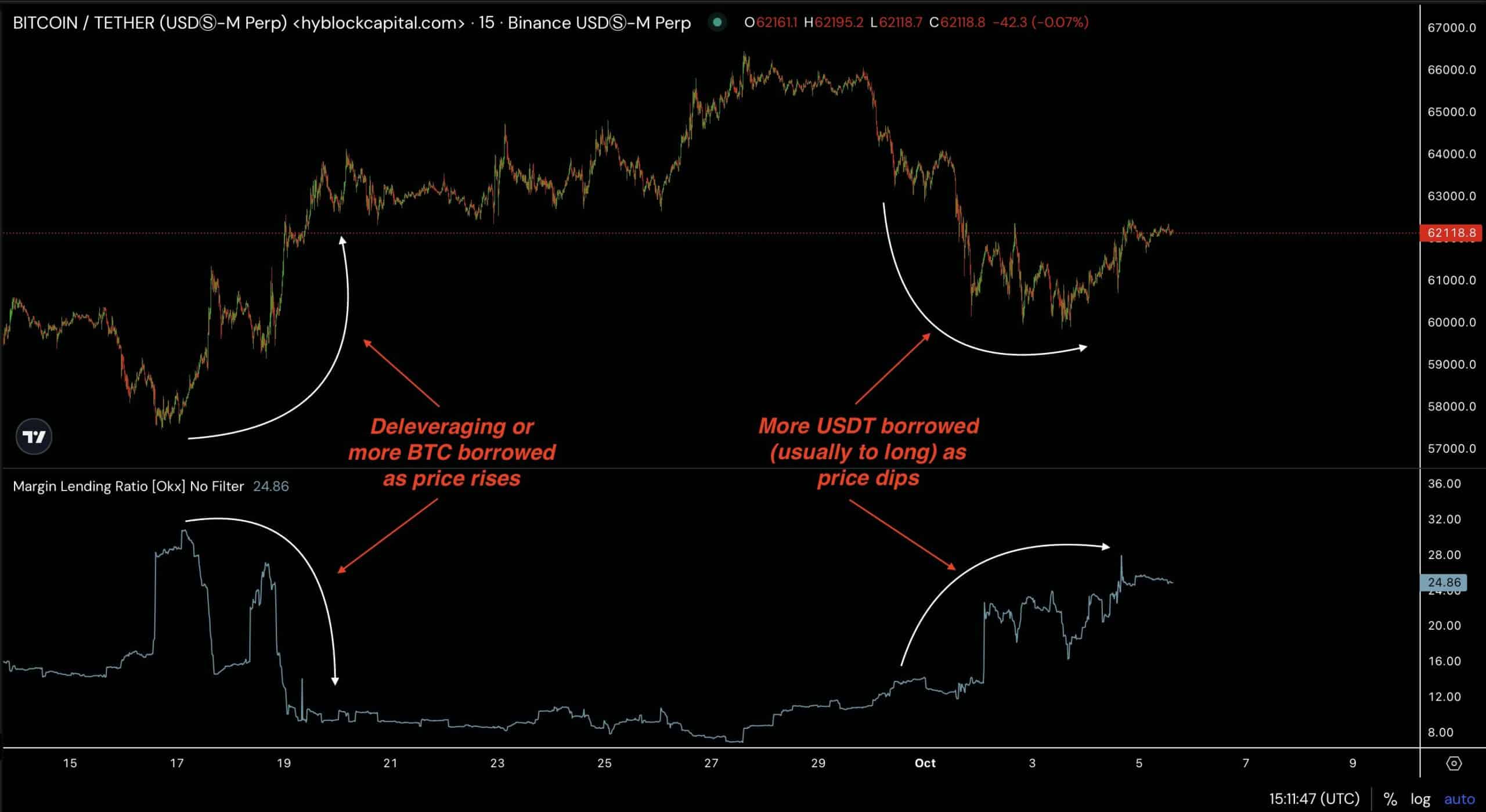

- Extra USDT borrowing than Bitcoin throughout worth dips.

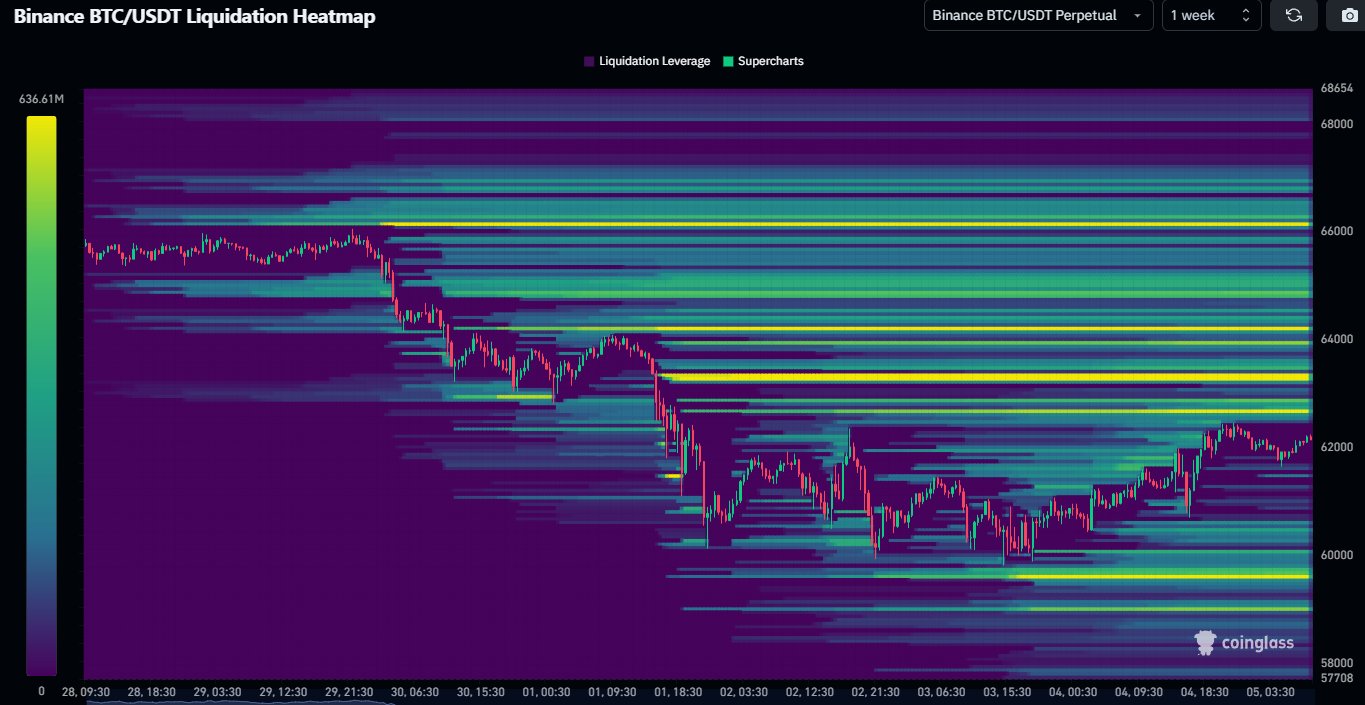

- Liquidation heatmap displaying the way in which for BTC is up.

Bitcoin [BTC] has seemingly discovered an area backside close to the midpoint of the downward pattern channel it has adopted for the previous seven months.

After briefly touching $66K, BTC started correcting, main many merchants to invest that This autumn may carry bullish momentum to the broader cryptocurrency market.

One attention-grabbing metric supporting this sentiment is the shift from borrowing BTC throughout worth pumps to borrowing USDT throughout worth dips.

Merchants are more and more borrowing USDT to “buy the dip” and improve their publicity to Bitcoin, which is a optimistic indicator for the upcoming quarter.

Bitcoin breaking market construction

The present worth motion of Bitcoin additional helps this bullish outlook. After breaking the market construction of the BTC/USD pair, the value dropped to determine a better low following important lengthy liquidations.

This native backside now units the stage for a possible transfer upward. To keep up the bullish pattern, BTC wants to interrupt above the Every day 200 Shifting Common (200MA) and surpass final week’s highs.

If Bitcoin can push by these resistance ranges, the $70K degree will turn into the subsequent essential goal, signaling stronger bullish momentum as This autumn progresses.

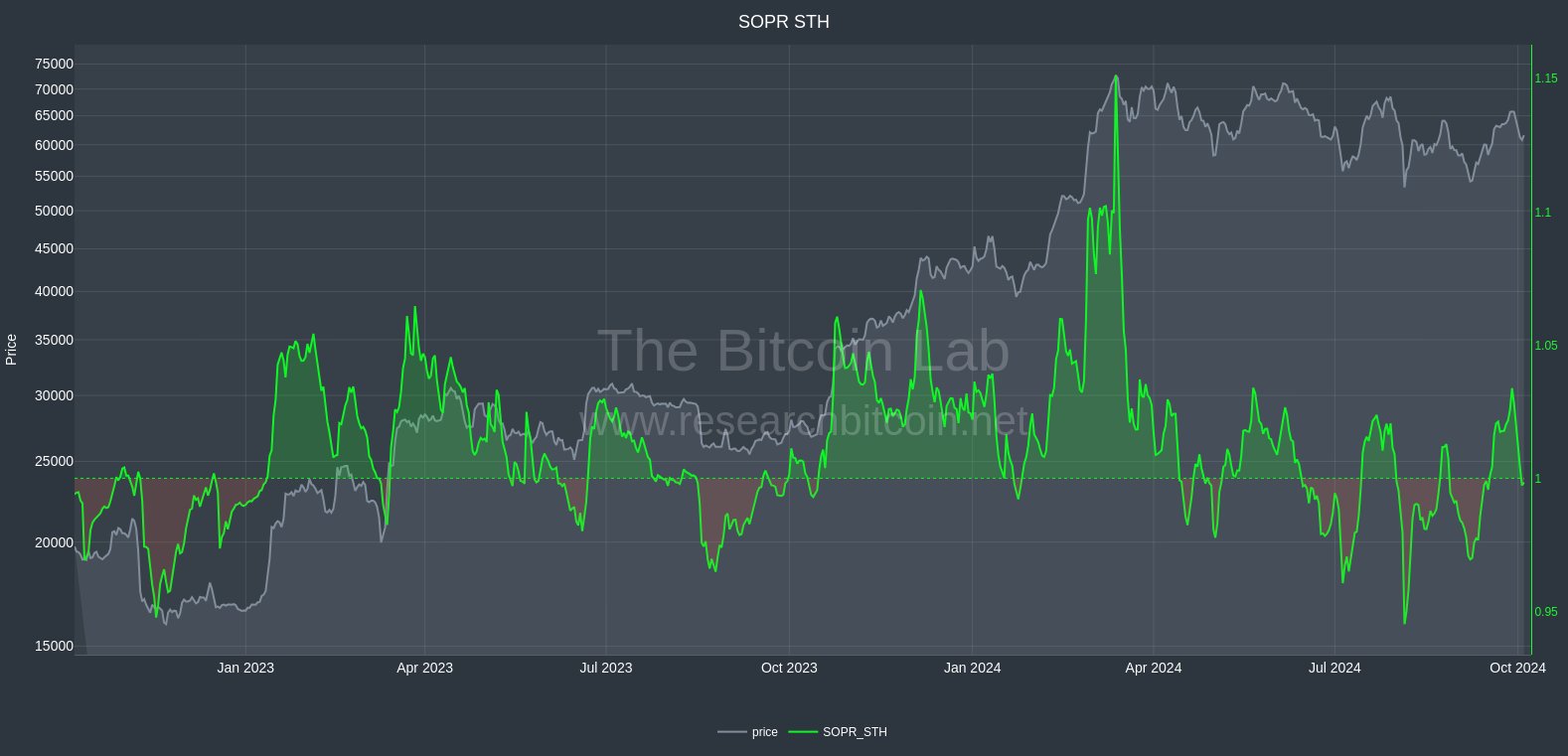

Quick-Time period Holder MVRV and SOPR retesting

Further metrics just like the Bitcoin Quick-Time period Holder MVRV and SOPR additionally level to optimistic outcomes.

Each metrics are retesting their impartial “1” line, indicating that in the event that they bounce from this place, it’ll affirm a extra bullish outlook for BTC.

This can be a essential second for short-term speculators, as a bounce right here would additional gas worth appreciation, doubtlessly rewarding each short-term merchants and long-term holders.

Such a state of affairs would improve the probability of BTC reaching new highs earlier than the tip of the 12 months.

Huge liquidity resting above

Moreover, the Bitcoin liquidation heatmap reveals {that a} important quantity of liquidity now sits above the present worth degree.

Since worth actions usually gravitate towards areas of excessive liquidity, this means that BTC is poised for upward motion.

Essentially the most substantial liquidity zone lies between $63K and $66K, that means Bitcoin may expertise a “short squeeze” if upward momentum good points traction within the coming days.

Whereas there may be some liquidity under $60K, it’s not as concentrated, indicating that the trail of least resistance is upward.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Bitcoin seems to be well-positioned for potential good points as This autumn progresses. Metrics resembling elevated USDT borrowing, the institution of an area backside, and the liquidity heatmap all level to a bullish outlook.

With the $70K degree in sight, BTC could also be gearing up for a powerful end to the 12 months, rewarding merchants who’ve positioned themselves for the subsequent leg up.