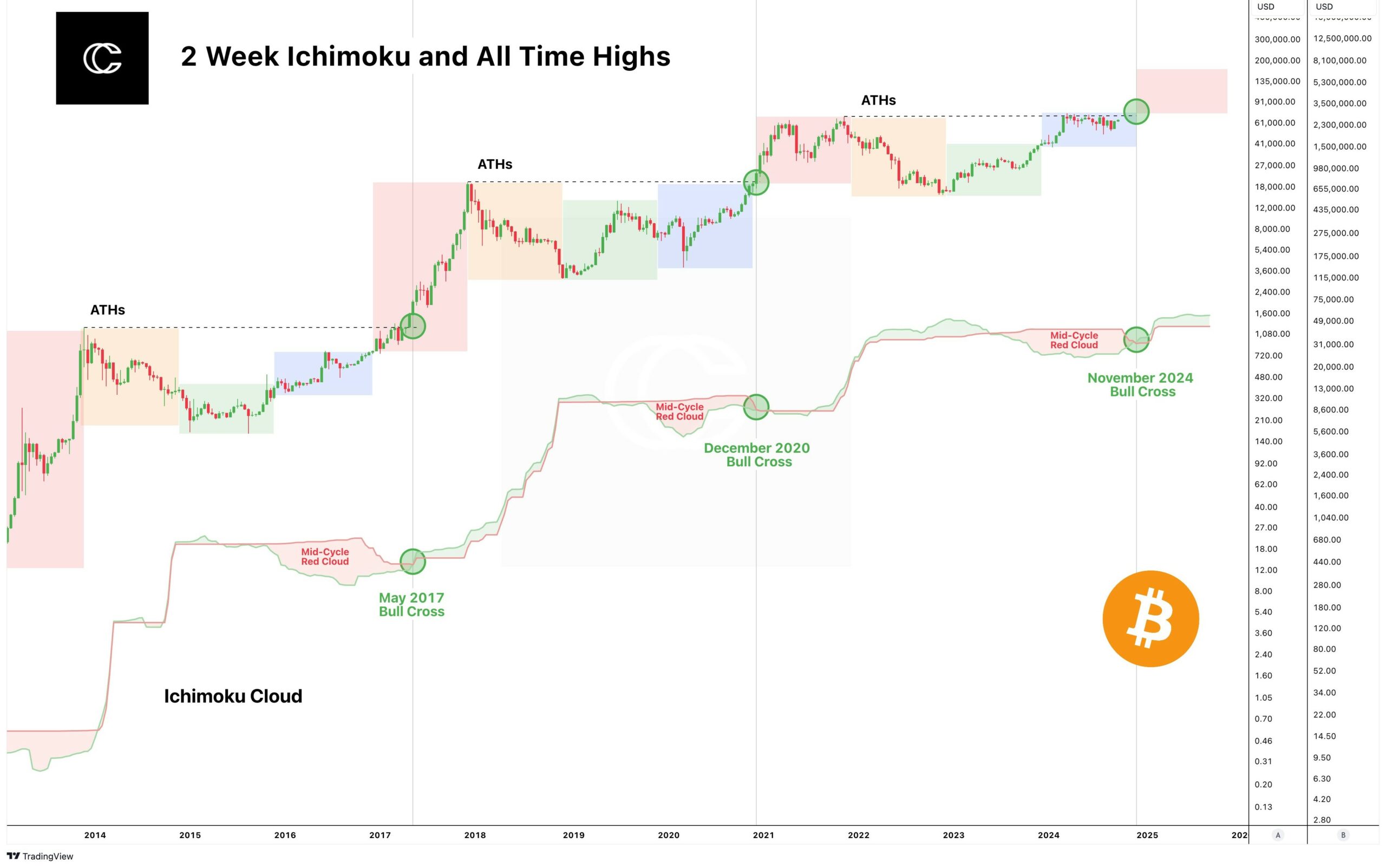

- The two-week Ichimoku Cloud indicator has predicted potential Bitcoin highs in This fall

- Establishments and retail are getting closely concerned in Bitcoin

Bitcoin (BTC) is as soon as once more on the forefront of the crypto market, driving momentum in direction of a much-anticipated bull market.

At press time, Bitcoin was buying and selling at $66k, sparking pleasure for potential new all-time highs (ATHs) within the closing quarter of the yr. Right here, it’s value historic knowledge although. Significantly the 2-week Ichimoku Cloud indicator because it has precisely predicted Bitcoin’s ATHs in previous cycles.

With the present cycle progressing forward of schedule, there’s most likely no want to attend for the transferring averages to cross. The main spans present us when it would occur, indicating {that a} new excessive could also be fashioned in November.

Many are actually questioning if November would be the month Bitcoin hits new heights. Particularly with establishments and merchants protecting an in depth eye on this timeline.

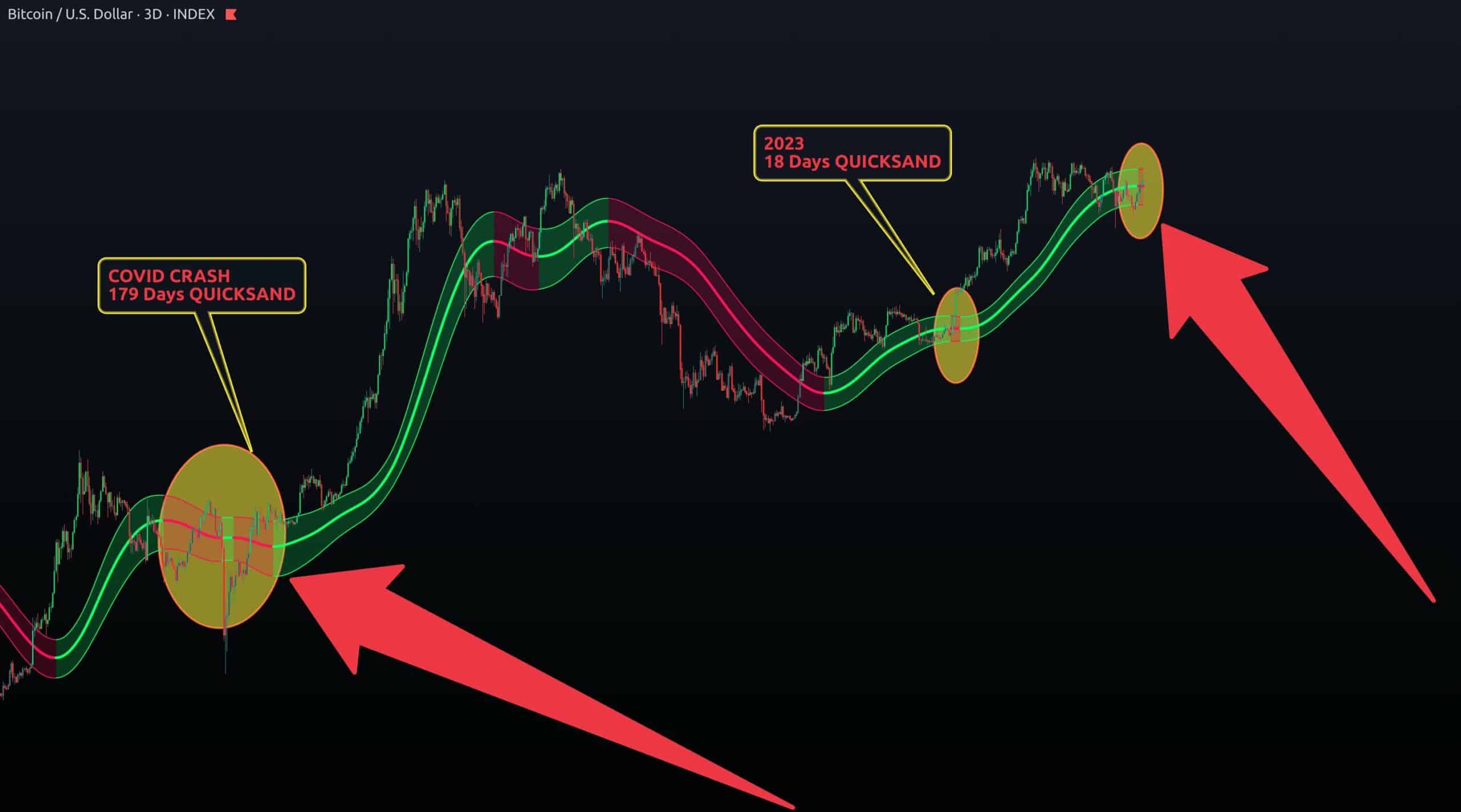

Covid19 crash sample repetition

One key issue supporting this chance is the repetition of the 2019 sample. The Gaussian Channel on the 3-day BTC chart has turned pink, which has traditionally occurred solely twice – Throughout the Covid crash and through Part 2 of Bitcoin’s earlier bull run.

When this sample final emerged throughout Covid 19, it led to a big rally, pushing Bitcoin to new ATHs. If historical past repeats itself, Bitcoin could possibly be poised for an additional main upwards transfer, and doubtlessly new highs in November.

Nevertheless, market dynamics will in the end decide the end result, and it stays to be seen if this sample will certainly result in increased costs.

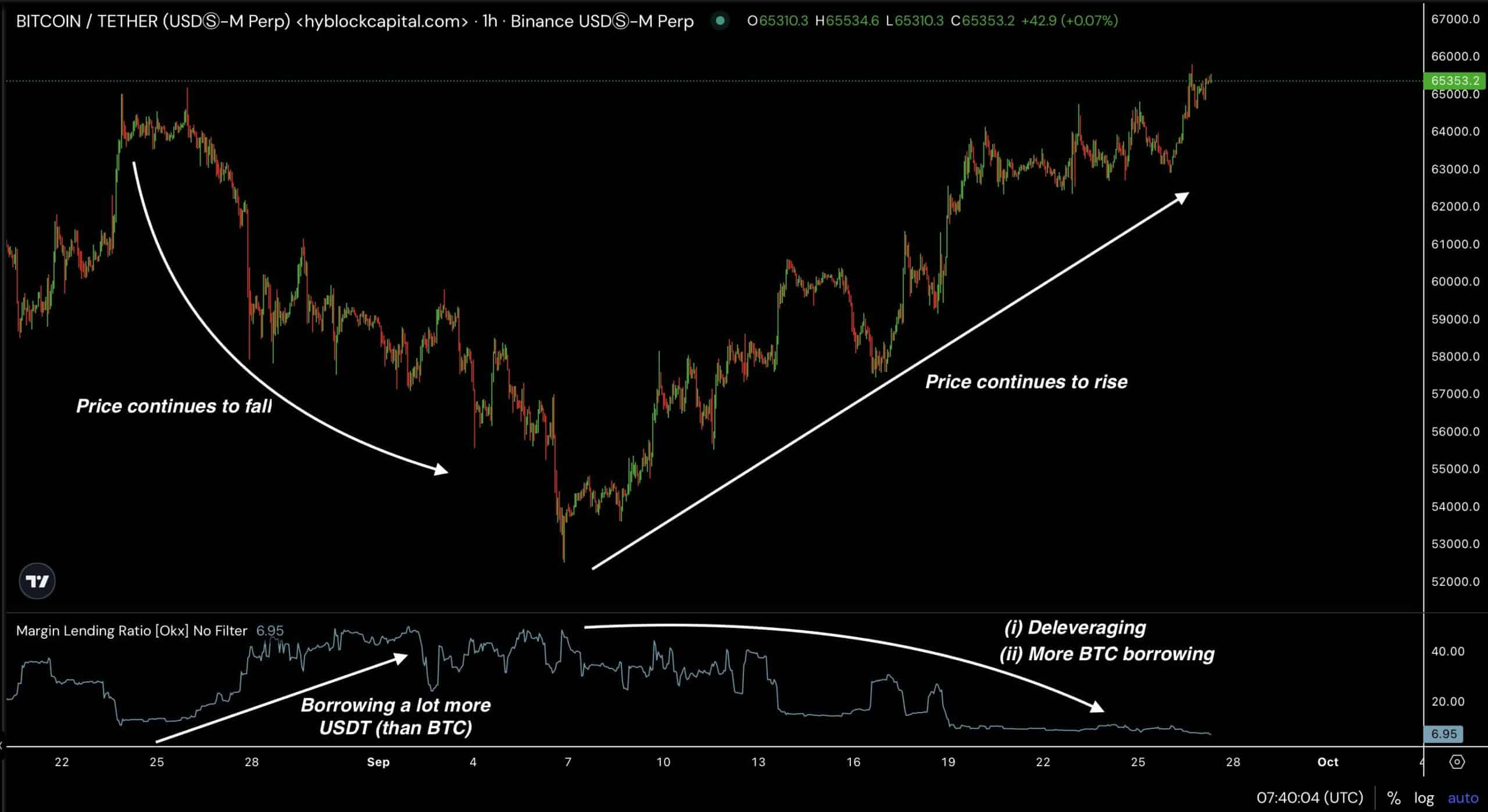

Potential impression of closely borrowed USDT

One other issue that would propel Bitcoin increased is the impression of closely borrowed USDT. Merchants have been borrowing giant quantities of USDT to purchase Bitcoin. Nevertheless, as an alternative of pushing the worth up, it initially led to a decline, inflicting over-leveraged merchants to face losses.

This kind of market habits usually precedes a big rally. Particularly as retail merchants are shaken out by means of liquidations. If the present pattern continues, this may create an ideal setup for Bitcoin to surge to new highs, doubtlessly in November.

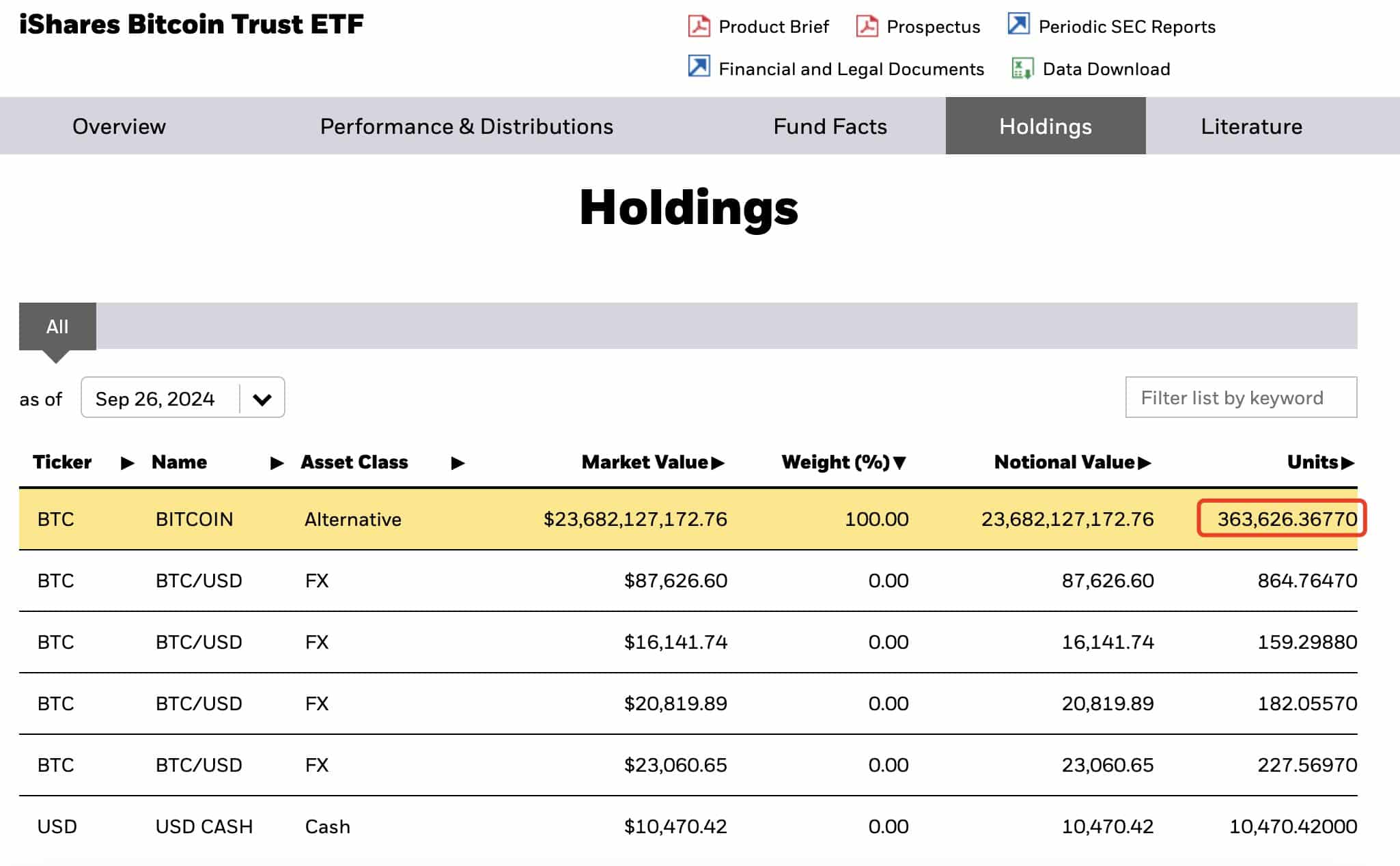

Blackrock continues to purchase BTC

Furthermore, BlackRock’s continued accumulation of Bitcoin lends additional confidence to the bullish outlook. Earlier this week, BlackRock (IBIT) bought 4,460 BTC, value $289 million, rising its complete holdings to over 362,000 BTC.

This was adopted by one other buy of 1,434 BTC value $94.3 million. Just lately, they added one other 5,894 BTC, bringing their complete holdings to 363,626 BTC, valued at $23.68 billion.

BlackRock’s vital and ongoing funding in Bitcoin signifies that they foresee substantial value appreciation, probably as quickly as November.

With historic patterns, market dynamics, and institutional assist all aligning, Bitcoin’s value might hit new highs within the close to future. The potential for a bullish run stays robust, and merchants and traders will likely be intently monitoring developments as November approaches.

If these components come collectively, Bitcoin might not solely hit new ATHs but additionally set up itself firmly in increased value ranges for the remainder of the yr.