- Bitcoin has been closely uncovered to leverage this month.

- A take a look at how heavy shorts liquidations this week have influenced BTC’s efficiency.

Bitcoin[BTC] comfortably pushed previous $65,000 in the course of the day’s buying and selling session. Nonetheless, this was at the price of heavy losses, particularly for merchants that anticipated it to pivot within the $64,000 worth vary.

Some merchants anticipated Bitcoin to undergo one other retracement at or close to the $65,000 stage.

In any case, BTC has been rallying because the second week of September and profit-taking would seemingly manifest.

Such expectations led to the explosion of quick positions, which in flip obtained them short-handed as costs continued to rally.

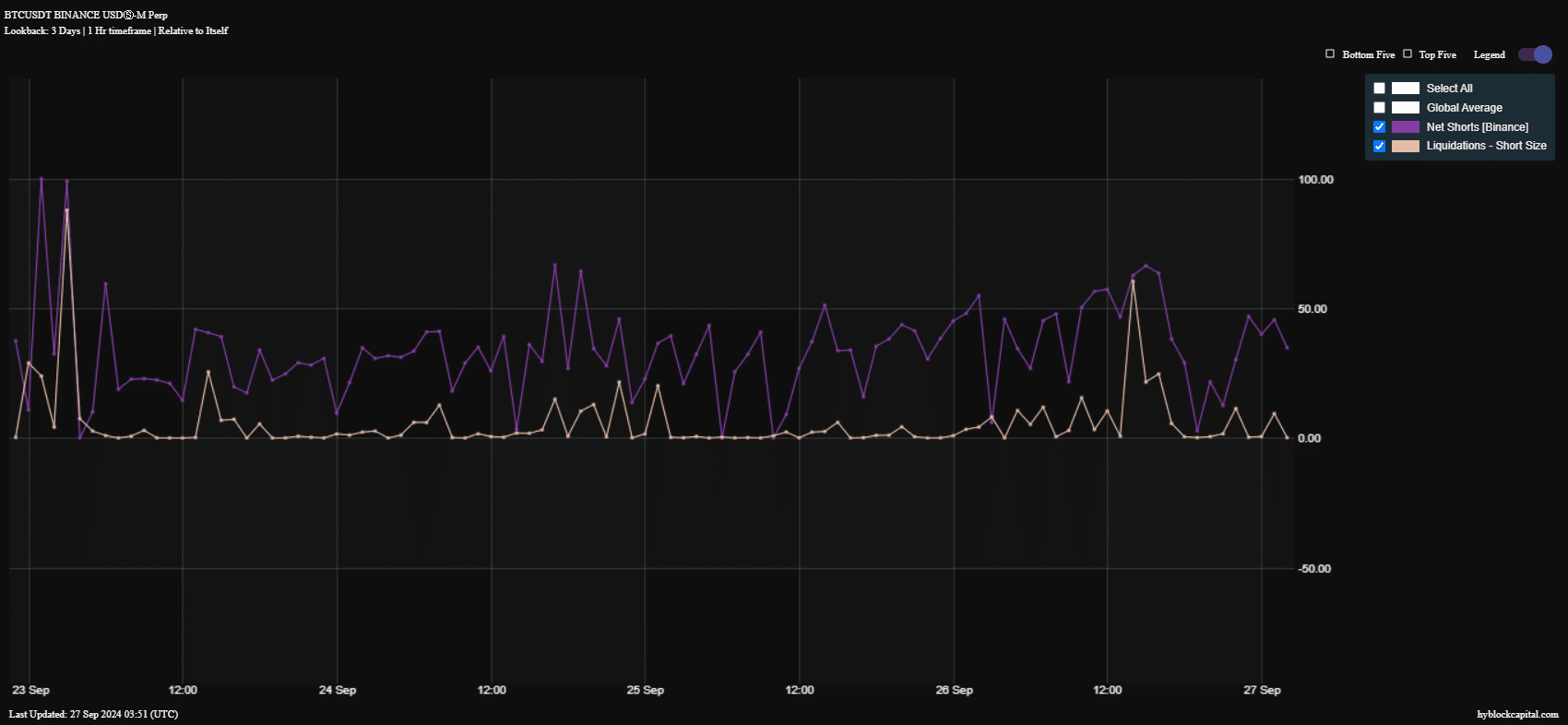

Hyblock Capital knowledge demonstrates spikes briefly positions prior to now three days. This was no coincidence, since Bitcoin bulls confirmed indicators of declining momentum between the twentieth of September and the twenty third of September.

Some could have seen this as an indication that the bears would seemingly take over.

There was a big spike in internet shorts on Binance on the twenty third of September, adopted by a spike in shorts liquidations.

One other spike occurred the next day, however there have been fewer liquidations.

Lastly, AMBCrypto noticed one other quick spike on the twenty sixth of September, adopted by a big uptick in liquidations.

The Bitcoin liquidations throughout yesterday’s buying and selling session occurred after the worth unexpectedly went in the wrong way. This left shorts uncovered, thus the liquidations.

This was in keeping with a earlier remark which revealed that long-term holders weren’t taking income and miner reserves have been rising.

Assessing Bitcoin publicity to leverage

The shorts could have been closely leveraged, thus liquidations triggered a short-squeeze state of affairs.

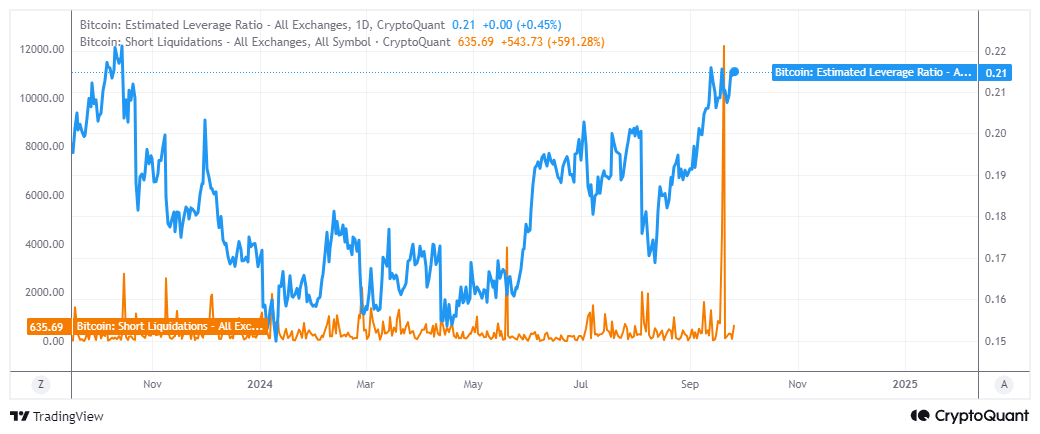

CryptoQuant knowledge revealed that the estimated leverage ratio bounced again sharply after its dip in August.

The final time that Bitcoin’s estimated leverage ratio was that top was in October 2023.

CryptoQuant’s quick liquidations metric revealed that the variety of shorts liquidated within the final 24 hours was up by 591%.

Liquidations amounted to roughly 635 shorts throughout this era. This pales compared to the variety of shorts liquidated on the twentieth of September, which peaked at 12,118.

The short-squeeze and subsequent liquidations underscore Bitcoin’s present stage of publicity and sensitivity to leverage. So far as BTC worth is worried, the cryptocurrency might nonetheless be topic to potential draw back.

Nonetheless, it can seemingly be restricted if most long-term holders proceed to HODL.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The present sentiment stays bullish, however merchants ought to transfer cautiously because the markets might change at any time.

Bitcoin continues to be topic to heavy volatility, particularly because the election interval approaches quick. That is the following main occasion that can have an effect on the crypto market.