- Bitcoin profitability warrants an evaluation of the chance of promote stress.

- BTC’s latest knowledge demonstrates a resurgence of confidence in its potential to push again above $70,000.

Bitcoin [BTC] bulls have dominated for nearly three weeks now, pushing its worth above $64,000. This comes on the backdrop of renewed optimism, however must you take into account taking earnings at this stage?

Whereas Bitcoin bulls have carried out commendably, the value is now in a zone that beforehand yielded promote stress.

There was evident of some resistance build up above the $64,000 worth stage within the final three days. On high of that, an amazing majority of Bitcoin holders, 84% above $63,000, are now in revenue.

This implies that BTC might be delicate to important draw back in case of one other bearish occasion. Then again, a sequence of occasions have yielded expectations and hopes that Bitcoin might soar as excessive as $80,000 this time.

Many are actually questioning which selection can be simpler; to proceed HODLing BTC or to take earnings?

Are long run holders nonetheless optimistic?

A latest CryptoQuant evaluation means that many long run Bitcoin holders are opting to not transfer their cash. This implies that they don’t seem to be taking earnings but, and this might protect BTC from promote stress.

It might additionally enable it to increase its latest upside within the coming days or perhaps weeks if there’s demand to drive up the value.

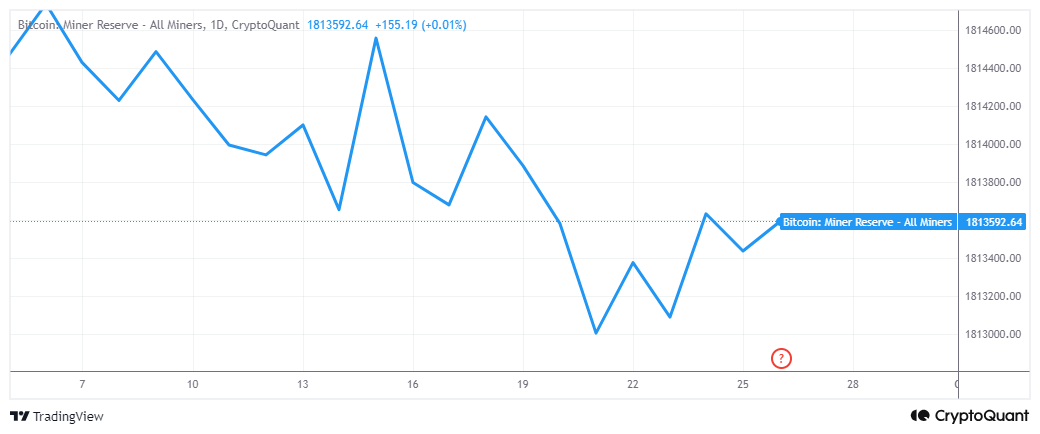

The CryptoQuant evaluation additionally means that miner capitulation can be a cause for long run Bitcoin holders to promote. Nonetheless, on-chain knowledge revealed that miner reserves have been on an general uptrend within the final 5 days.

The miner reserves uptick means that miners are additionally opting HODL their cash in anticipation of upper costs.

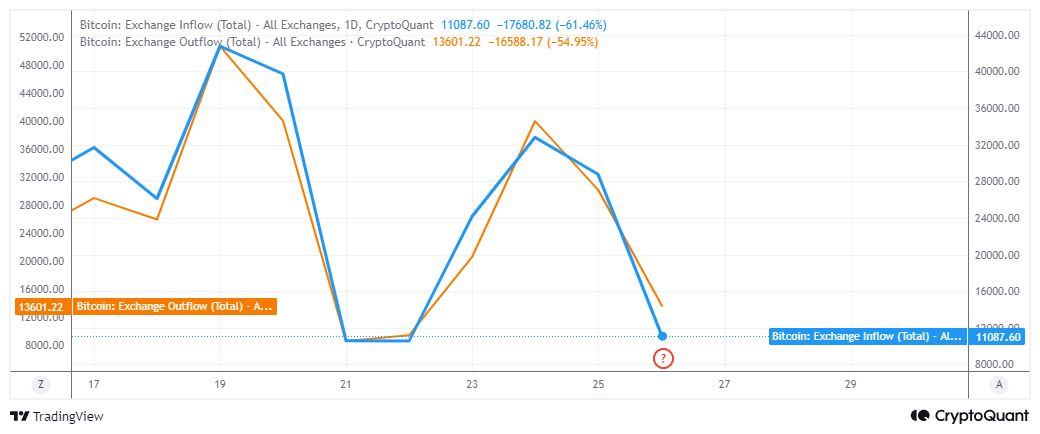

However what in regards to the prospects of promote stress within the brief time period? Nicely, regardless of the present worth stage yielding some resistance, change circulate knowledge revealed that demand nonetheless outweighed promote stress.

Bitcoin change outflows have been greater within the final 24 hours at 13,601 BTC in comparison with 11,087 BTC flowing out of exchanges.

Nonetheless, it’s value noting that change flows have been slowing down within the final 3 days. Additionally, they’d slowed right down to ranges the place they beforehand pivoted, suggesting that there might be a shift within the coming days.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

In conclusion, Bitcoin worth motion beforehand demonstrated strong promote stress above $60,000. That doesn’t seem to the case with its newest push above the identical stage.

This implies rising ranges of confidence, boosted by latest prospects of liquidity flowing into the market.