- Bitcoin whales resumed shorting as value approached $65K.

- The bot tracker indicator says there’s elevated buy-side bot exercise.

Bitcoin’s [BTC] value motion is carefully watched by the market as it’s the largest cryptocurrency and thus, influences the general market efficiency.

Just lately, whales resumed shorting BTC because it neared $65K, sparking considerations a few potential drop earlier than any important upward transfer.

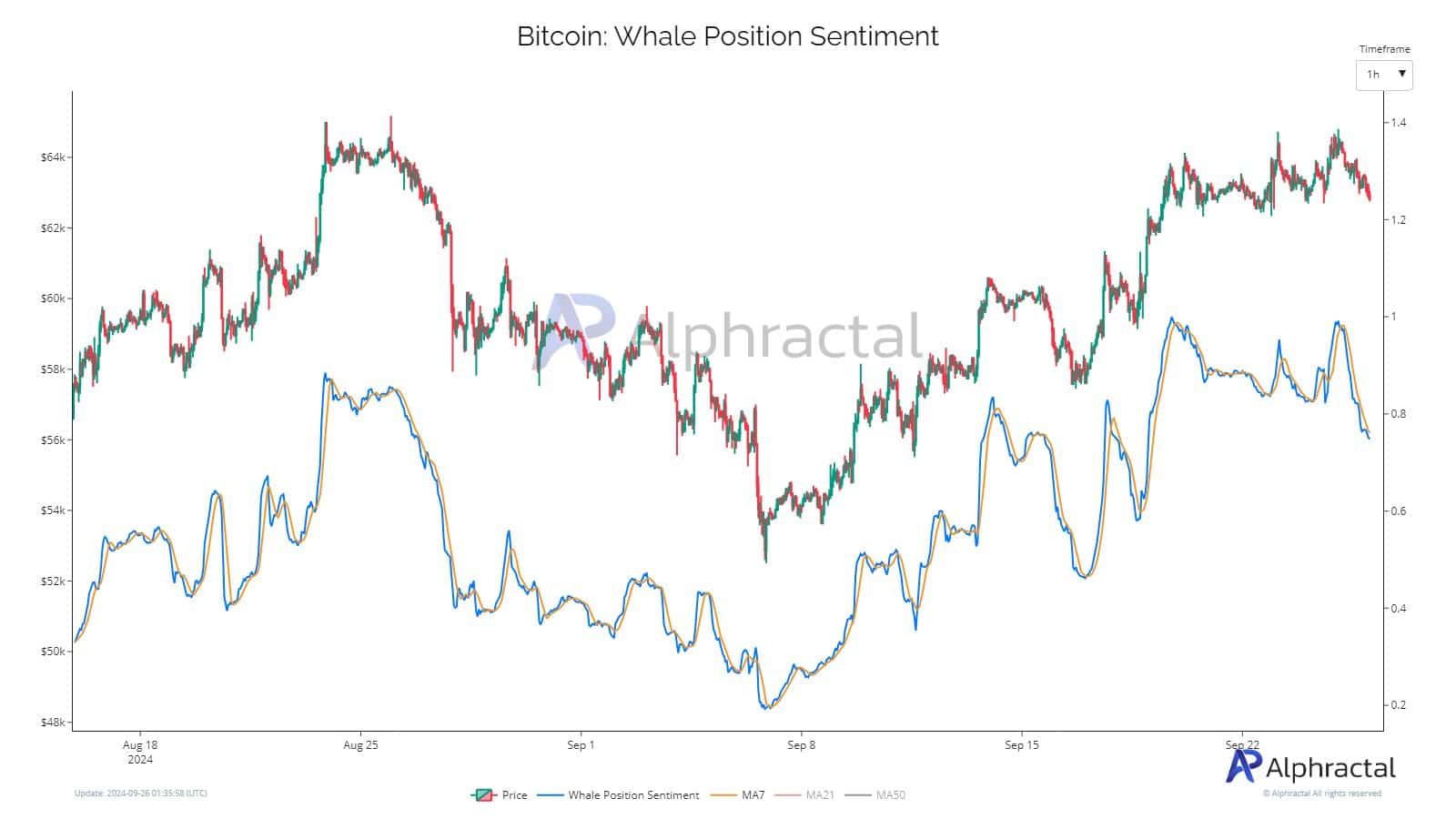

Whale Place Sentiment, an indicator monitoring whale exercise throughout exchanges, has confirmed a lower in sentiment, signaling extra quick positions being taken. This sentiment shift typically has a powerful correlation with Bitcoin’s value motion.

For BTC to keep away from slipping into bearish territory, it should maintain above $62K, the Brief-Time period Holder Realized Worth, a key degree signaling the continuation of the present development.

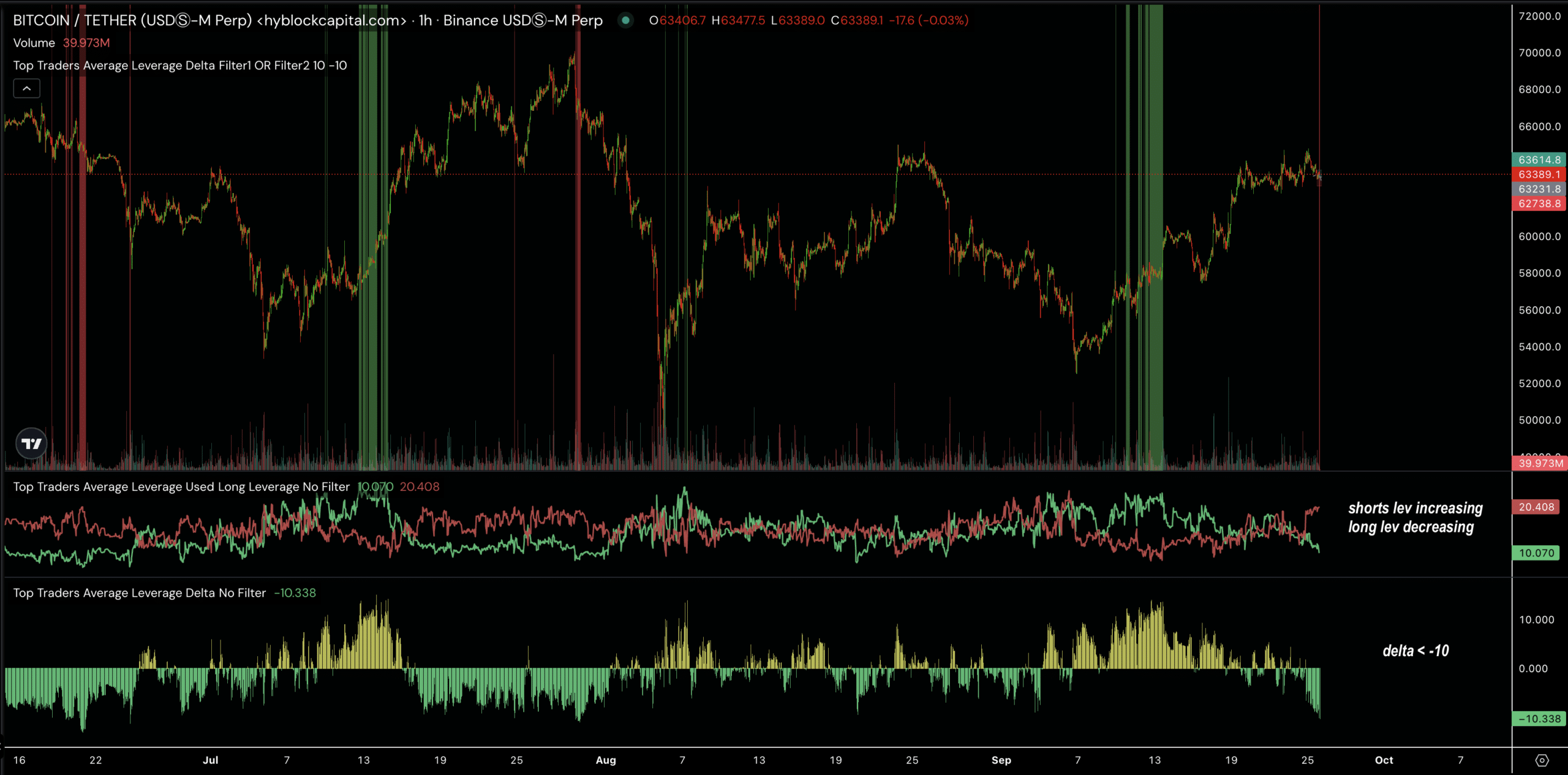

Common leverage delta

The autumn in whale sentiment has brought on Bitcoin’s common leverage delta between longs and shorts to drop under -10. Because of this quick leverage is presently dominating the market, which was beforehand pushed by lengthy leverage.

Though whales have shifted their positions, the typical leverage delta doesn’t affirm a bearish outlook simply but. Bitcoin remains to be holding above the $63K degree, sustaining help on the 200 exponential shifting common.

Regardless of the whales’ exercise, this implies that BTC should push increased if sure situations are met…

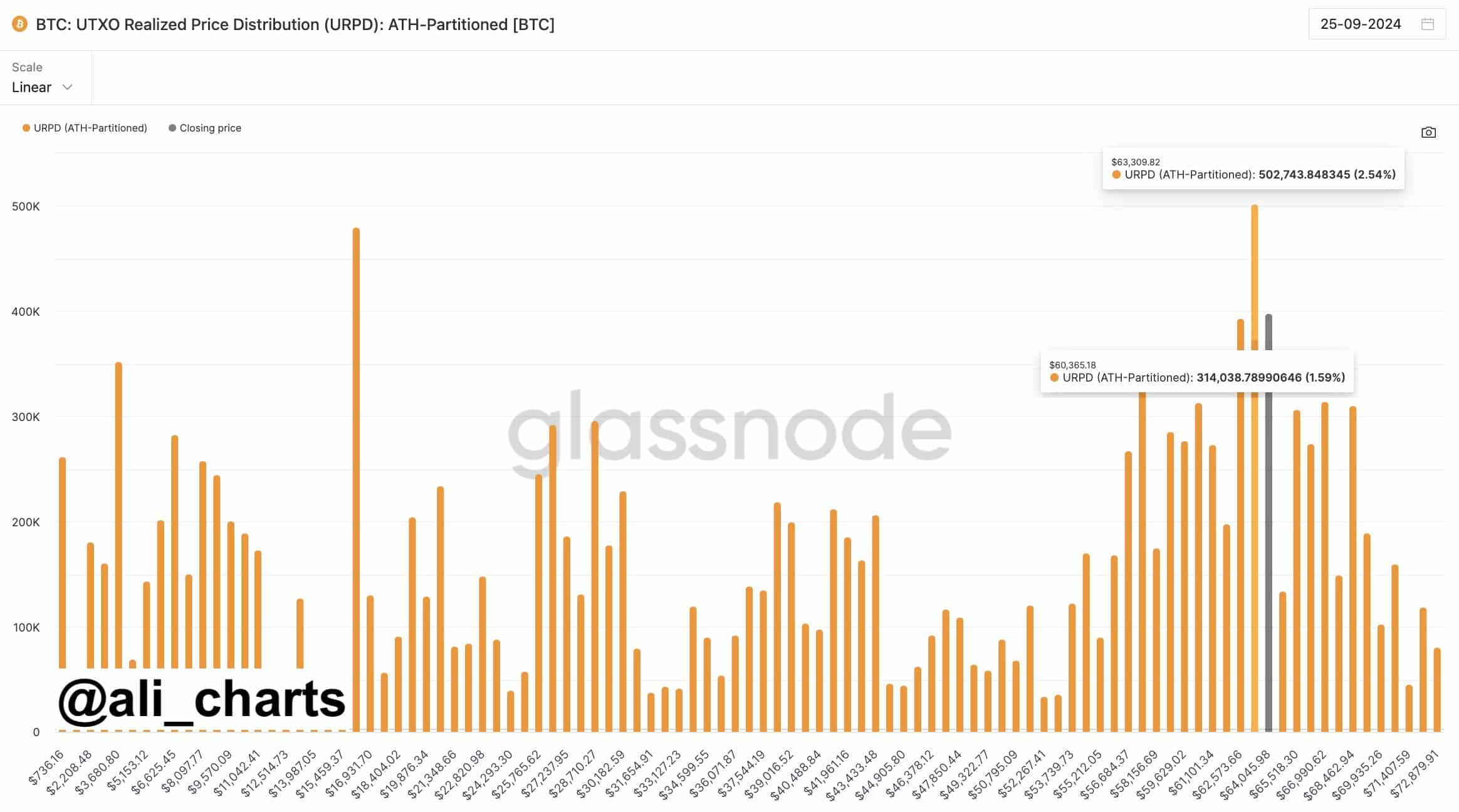

UTXO realized value distribution

The primary essential indicator supporting Bitcoin’s outlook is the UTXO Realized Worth Distribution (URPD), which reveals that the $63K degree serves as probably the most necessary help zone. This space additionally consists of the $65K resistance degree.

If Bitcoin manages to remain above $63K, it has the potential to interrupt via $65K. Nonetheless, a drop under this help might result in a dip to $60K earlier than any upward transfer resumes. The market is rigorously watching this zone to find out Bitcoin’s subsequent route.

Bitcoin bot tracker indicator

Additional supporting a bullish outlook for Bitcoin is the Bot Tracker Indicator. This device tracks high-frequency bot-like exercise available in the market, exhibiting that bots are accumulating lengthy positions.

Elevated buy-side bot exercise typically correlates with an increase in value. If Bitcoin experiences a slight pullback to $60K, it might appeal to extra whale shopping for at discounted costs, which can push BTC again up towards $65K, leading to important features for bigger holders.

Supply: Hyblock Capital

Whereas whales have resumed shorting Bitcoin because it nears $65K, the general market construction stays intact. So long as BTC holds above key ranges corresponding to $62K and $63K, there’s potential for increased features.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Bot exercise and different on-chain indicators help a bullish outlook, suggesting that any dip could also be short-lived earlier than BTC makes one other upward transfer.

Merchants and traders ought to preserve an in depth eye on these key help and resistance ranges to gauge the market’s subsequent transfer.