- Bitcoin’s post-halving value struggles highlighted market volatility and challenges in surpassing $60,000.

- Mining profitability has dropped considerably, regardless of elevated hashrate and gear effectivity enhancements.

The anticipated impression of Bitcoin’s [BTC] fourth halving, anticipated to drive its value to new heights, initially appeared to materialize as BTC surged previous $70,000 in March, marking an all-time excessive.

Nevertheless, latest developments reveal a distinct story.

As of the most recent CoinMarketCap replace, BTC was struggling to take care of its momentum, buying and selling at $58,629, and has dropped by 2.41% prior to now 24 hours.

Bitcoin miners battle post-halving

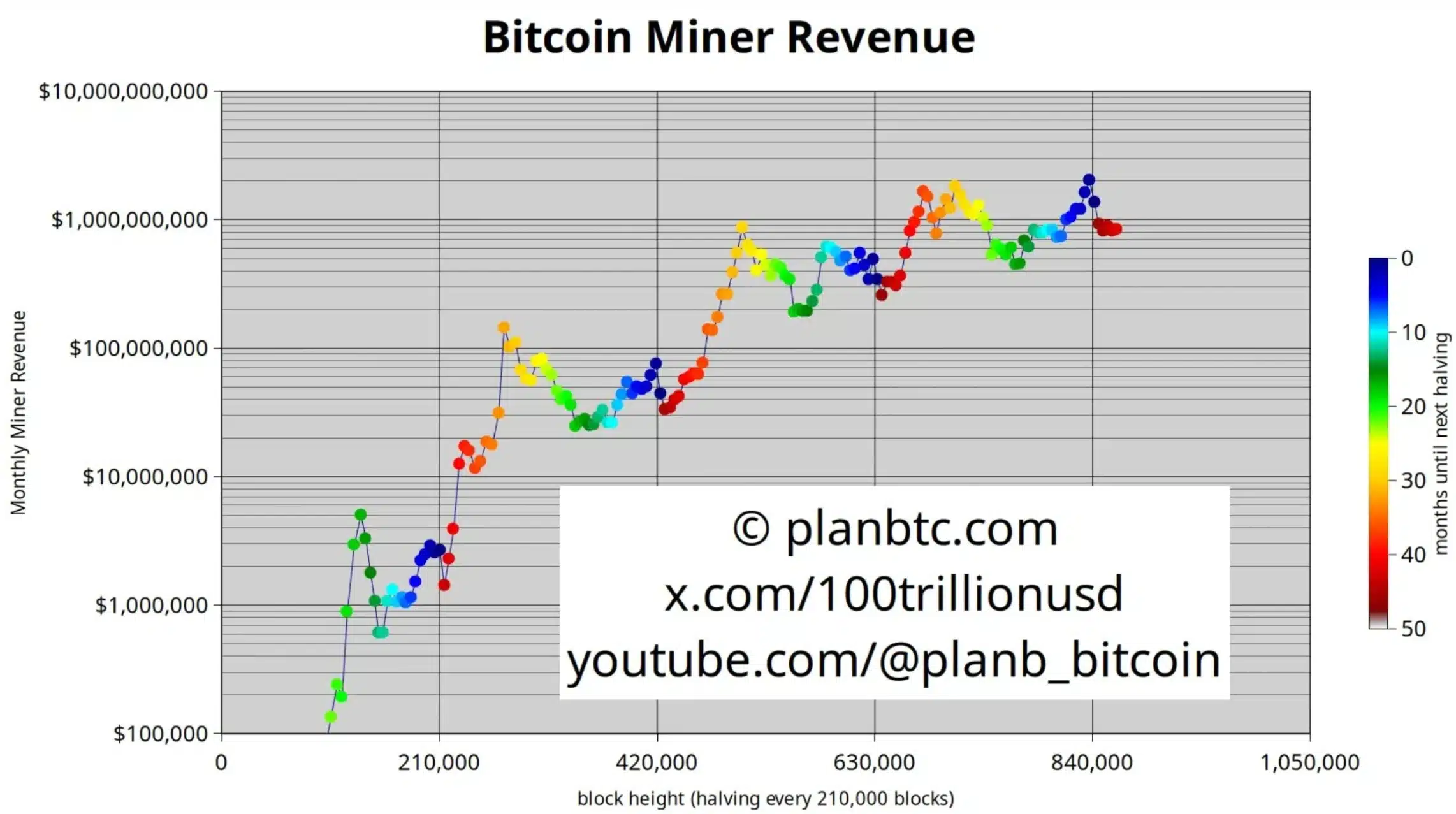

Following the latest Bitcoin halving, miners have encountered their very own challenges. PlanB, the creator of the BTC stock-to-flow (S2F) mannequin, highlighted these points on X, and stated,

“Miners are still struggling with the aftermath of the halving. We need 2x current BTC price to kick-start the bull pump.”

Compounding these challenges, funding financial institution Jefferies highlighted in a CNBC report that cryptocurrency mining profitability took a major hit in August.

In response to Jefferies, the typical every day income per exahash—basically, the earnings earned per miner—declined by 11.8% in comparison with the earlier month.

This drop underscores the rising monetary pressures confronted by miners amidst fluctuating market situations and rising operational prices.

In response to an AMBCrypto evaluation of IntoTheBlock knowledge, the rewards for BTC miners have drastically decreased.

Within the 2020 halving, miners had been awarded 7,010 BTC, valued at roughly $75.99 million.

Nevertheless, within the present 2024 halving, this reward has plummeted to simply 471.88 BTC, equal to round $28.1 million.

This stark discount underscores the monetary pressure miners are going through amid evolving market situations.

Hashrate sees an increase

Nevertheless, BitcoinMiningStockGuy added,

“And Hashrate is still rising. Bullish.”

This development is additional validated by AMBCrypto’s evaluation of IntoTheBlock knowledge, which revealed a dramatic enhance in BTC’s hashrate.

In 2020, the hashrate was 140.93 million terahashes per second (TH/s), whereas it has surged to 695.84 million TH/s in 2024.

This vital rise highlights the intensified competitors and elevated computational energy required within the mining sector.

What’s the answer?

In response to the declining profitability, North American publicly traded mining corporations are investing closely in gear upgrades to boost operational effectivity.

These developments permit newer machines to realize double the hashing energy of their predecessors whereas consuming the identical quantity of power.

Marathon CEO Fred Thiel defined to CNBC that this improve cycle is essential, because it helps offset the deteriorating financial situations within the mining sector.

“No need to add sites or power, just upgrade systems.”

Nevertheless, not all miners are going through hardship equally.

For example, Core Scientific, which emerged from chapter earlier this yr, has efficiently repurposed its intensive infrastructure to assist synthetic intelligence and high-performance computing (HPC).

Thus, because the business continues to evolve, it will likely be essential to watch how these modern approaches would possibly provide options and set new benchmarks for overcoming profitability points.