- Bitcoin’s BTC small retail holders dominated the market at press time.

- Analysts counsel three situations for Bitcoin to rally to new highs.

Bitcoin [BTC], the biggest cryptocurrency by market capitalization, has been on a downward trajectory over the previous month. On its worth charts, BTC has declined by 1.01% on every day charts to commerce at $56657.

Equally, over the previous 30 days, it has dropped by 2.80% suggesting elevated volatility.

Since hitting an ATH of $73737 in March 2024, the crypto has struggled to keep up an upward momentum thus even hitting a neighborhood low of $49k.

The elevated market volatility has spiked questions over the longer term prospects based mostly on holders’ behaviors. Inasmuch, Santiment’s analysts have prompt three situations for BTC to hit new highs.

What prevailing market sentiments counsel

In response to Santiment, though market sentiment amongst retail merchants has turned optimistic, it’s not enough to spice up BTC for a rally.

Within the evaluation, wallets holding <1 BTC have now elevated their holding to the very best ranges in seven months. Which means small retail merchants are holding the bigger share of the BTC provide.

Nevertheless, based on this analogy, elevated holding by small merchants shouldn’t be ok for a rally. Primarily based on this evaluation, the primary situation for BTC to rally is small holders decreasing their holdings.

Ideally, when small holders dominate the market, it signifies elevated hypothesis or a fragile market since small holders are emotional sellers.

Thus, for a sustained rally, fewer small holders are much less preferable as a result of they’re liable to panic promoting.

Secondly, mid-sized traders with 1-100 BTC must develop their holdings steadily. A sustained progress by mid-sized traders means that extra skilled traders and establishments are getting into the market.

The doorway of such traders is general bullish, because it reveals confidence in long-term prospects.

The third and last situation for a rally is aggressive accumulation by 100+ holders. Aggressive accumulation by giant holders means that establishments and whales are bullish on the longer term prospects.

Due to this fact, whales accumulating BTC suggesting they’re assured in a longer-term worth improve via decreasing liquidity on exchanges, which often helps worth appreciation.

Bitcoin holder evaluation

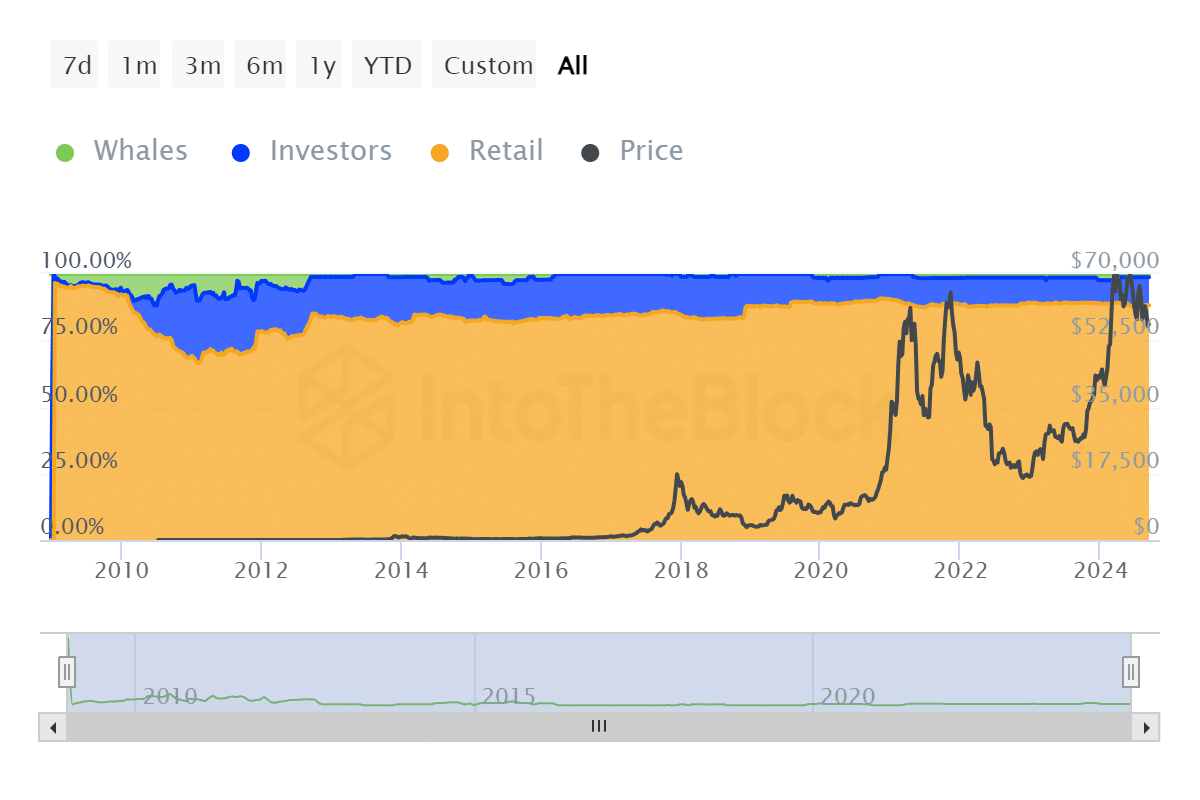

As famous by Santiment, small retail holders have continued to dominate the market within the latest previous.

For starter’s, Bitcoin’s possession by historic focus indicated that retail merchants holders held 88.24%, that are 17.44 million Bitcoins, whereas traders maintain 10.5% and whales 1.26%.

This reveals retailers have a significant say out there, which ends up in speculative promoting, ensuing within the not too long ago witnessed volatility and fluctuations.

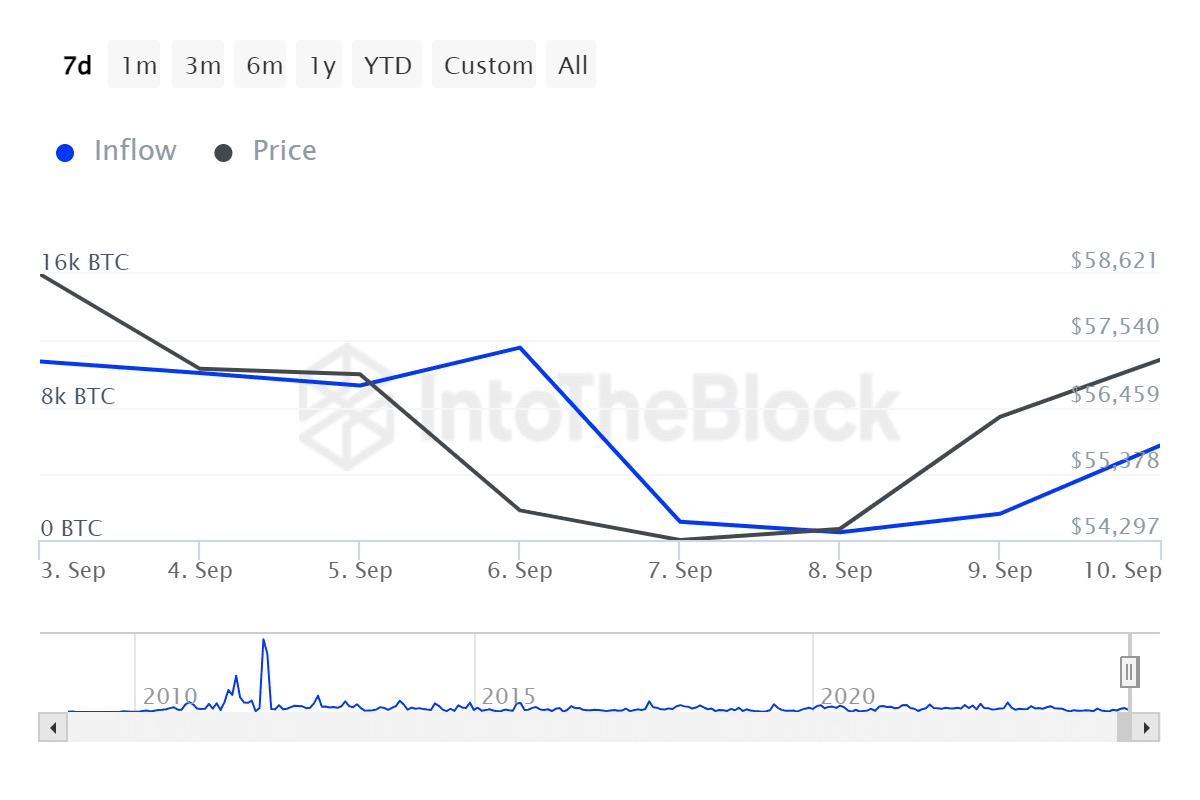

Moreover, giant holders’ influx has declined from 11.57k to a low of 1.58k over the previous seven days.

This implies diminished demand by whales as they’ve turned to closing their positions in the course of the market downturn. A discount in whale holding reveals confidence sooner or later prospects.

Due to this fact, the rise in small retail merchants holding displays the present market fluctuations.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Throughout downturns, retail merchants have a tendency to shut their positions as they’re speculative sellers, which additional drives costs down.

Thus, a rise in giant and mid-sized holders would stabilize the market and push costs up. Thus, if the retail merchants proceed to dominate the markets, BTC will decline to $54587.