- Bitcoin’s trade reserves prompt that promoting stress was excessive

- Market indicators hinted at a bullish pattern reversal

Bitcoin [BTC], regardless of a short bout of restoration, is struggling as soon as once more after its worth slipped under $55,000 on the charts. Within the meantime, an institutional investor deposited BTC value hundreds of thousands of {dollars}, fueling sell-off considerations. Does this imply that BTC could also be poised to see yet one more worth correction within the coming days?

Are buyers promoting BTC?

Bitcoin, like most different cryptos, additionally recorded a worth drop final week because the coin’s worth plummeted by almost 8%. The bearish worth pattern continued within the final 24 hours as a result of it dipped by over 2%. On the time of writing, BTC was buying and selling at $54,284.69 with a market capitalization of over $1 trillion.

Whereas that occurred, a large-scale investor bought a considerable quantity of BTC. To be exact, Galaxy Digital deposited 1,458 BTC value $78.5 million to Coinbase Prime. This replace from Lookonchain prompt that whales at the moment are promoting BTC. Every time whales promote BTC, it implies that they’re anticipating an asset’s worth to drop additional.

Therefore, it’s value taking so much at different datasets to see whether or not promoting stress on the coin has been rising or not.

Based on AMBCrypto’s evaluation of CryptoQuant’s information, Bitcoin’s trade reserves have risen recently. By extension, this meant that promoting stress on the coin has been excessive.

Aside from that, at press time, each BTC’s Coinbase Premium and Funds Premium have been pink – An indication that promoting sentiment was dominant amongst U.S and institutional buyers.

What do the market indicators counsel?

We then assessed the crypto’s metrics to seek out out whether or not in addition they hinted at an extra worth correction.

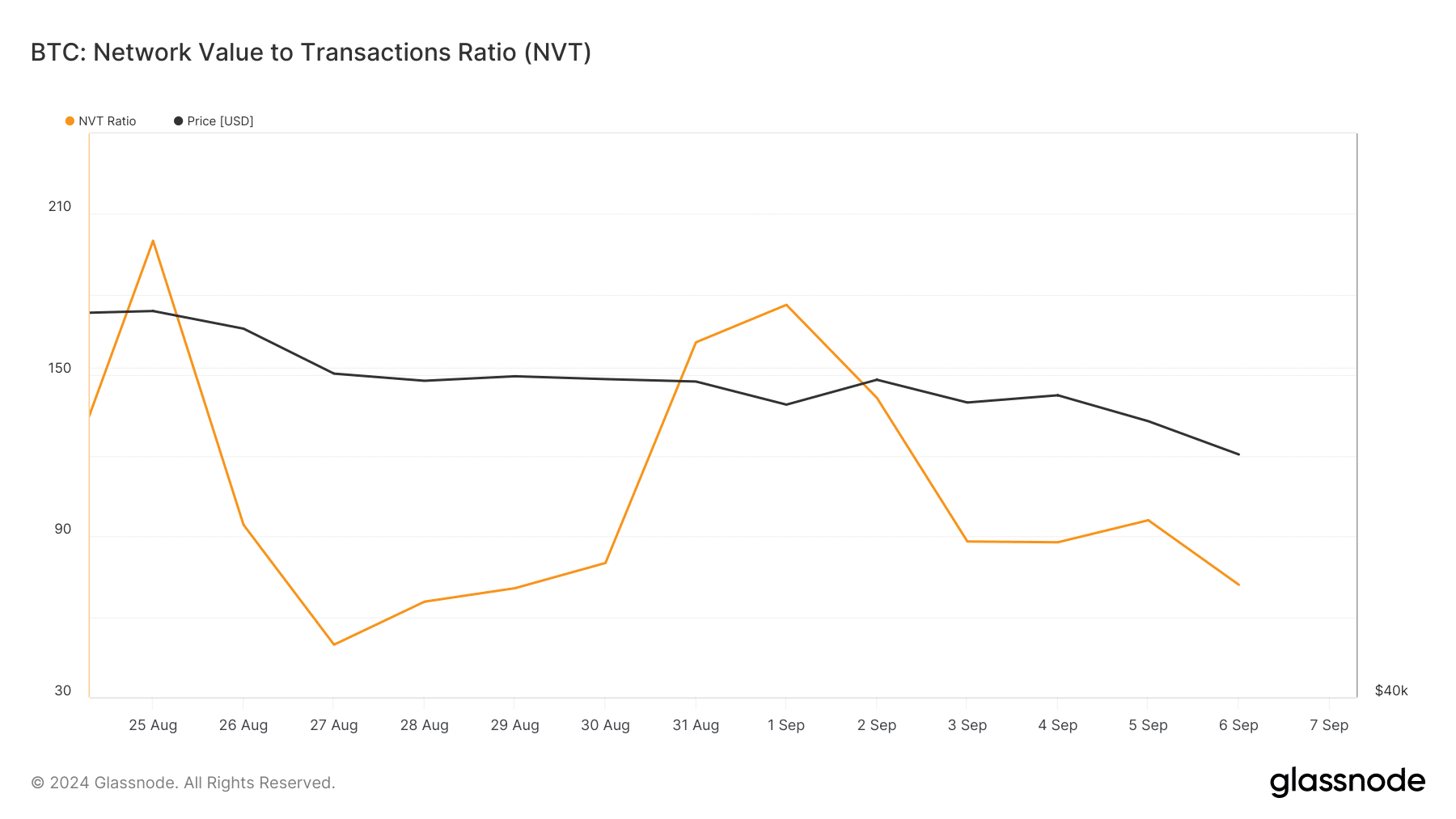

As per our evaluation of Glassnode’s information, BTC’s NVT ratio fell on the charts. Every time that occurs, it means that an asset is undervalued, hinting at a worth hike.

Moreover, BTC’s aSORP was inexperienced, which means that extra buyers have been promoting at a loss. In the midst of a bear market, it will probably point out a market backside.

Additionally, its binary CDD implied that long-term holders’ motion within the final 7 days was decrease than the common. They’ve a motive to carry their cash. This may be inferred as a bullish sign.

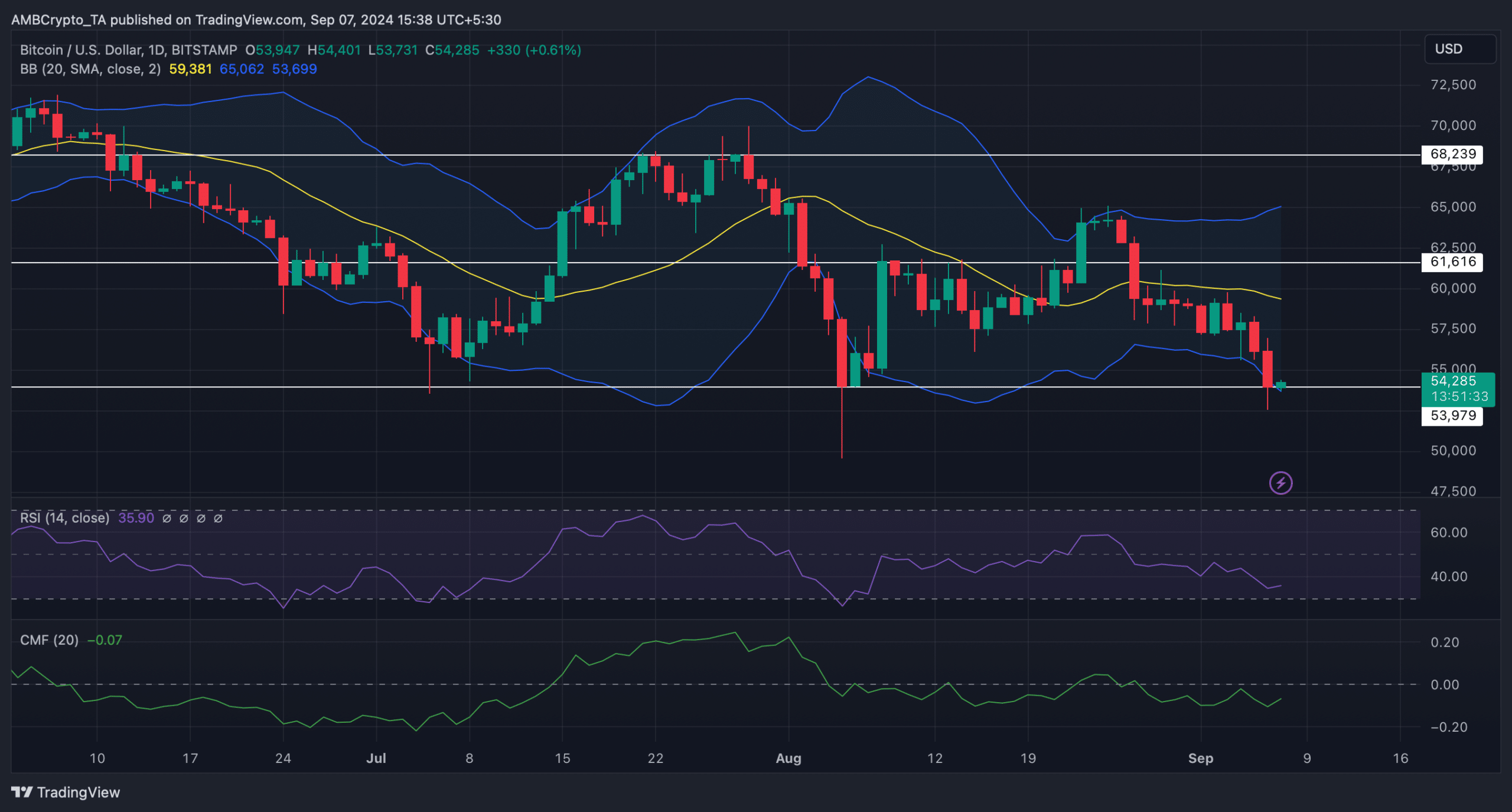

Therefore, we took a have a look at the coin’s day by day chart to raised perceive which approach it could be heading. Our evaluation revealed that BTC appeared to be testing a help stage. The coin’s worth additionally touched the decrease restrict of the Bollinger Bands, which regularly ends in worth hikes.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Lastly, each its Relative Energy Index (RSI) and Chaikin Cash Circulate (CMF) registered upticks too – Once more, indicator of an upcoming hike.