- Bitcoin bear market has consolidated its worth inside a particular vary, jeopardizing the bulls’ possibilities for a rebound.

- If this dominance continues, BTC would possibly drop to $40K. What are the percentages?

Bitcoin [BTC] was buying and selling above $57K at press time, a vital degree for a possible rebound. If bulls handle to defend this place, BTC might rally in direction of the $68K resistance.

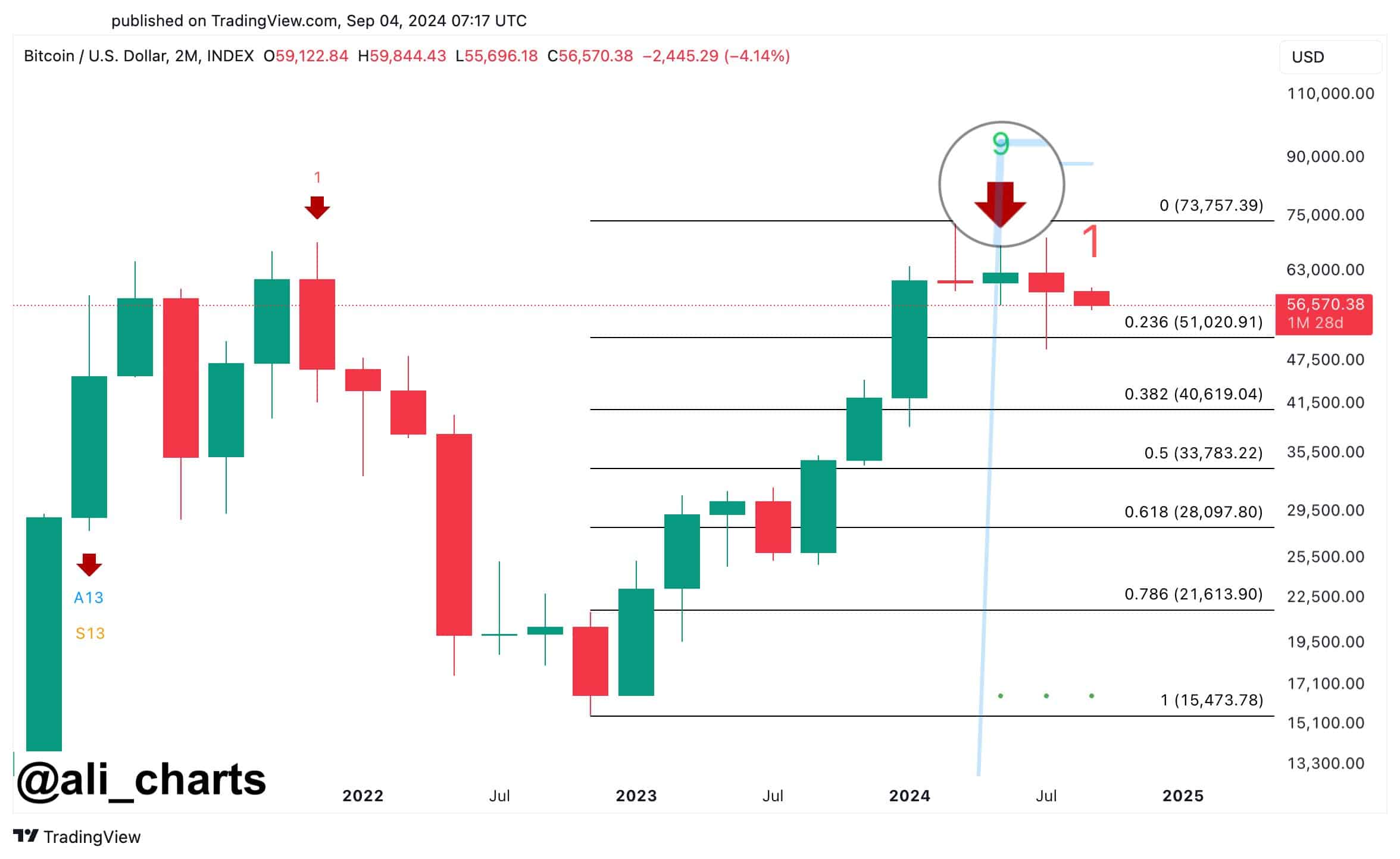

Nonetheless, if the Bitcoin bear market takes management and BTC loses the $55K assist, a decline to $50K-$51K is possible. If this assist fails, BTC might expertise a deeper drop towards $40K.

Traditionally, September has been Bitcoin’s most bearish month, with solely 4 constructive years out of the previous 13. Will this month comply with the pattern, or can bulls flip it round?

BTC faces unsure bearish outlook

Including to the uncertainty, analysts are warning that the Bitcoin bear market might regain management.

The TD sequential indicator on the Bitcoin 2-month chart is displaying a promote sign, suggesting a possible drop. If BTC falls beneath $51,000, it’d slide to $40,600 – a state of affairs bulls would wish to keep away from.

To stop this, it’s essential to take care of the $57K assist degree. AMBCrypto believes that assuaging overcrowding in leveraged positions is vital.

In easy phrases, a ten% discount in open curiosity might assist stop sudden, sharp worth actions.

Furthermore, with much less open curiosity, the market would possibly stabilize, probably leading to a bear pullback or a bullish swing. So, is a drop coming?

Bitcoin bear market reigns supreme

Moreover, the Bitcoin bear market has outperformed the bulls firstly of September, conserving the worth throughout the $59K – $57K vary.

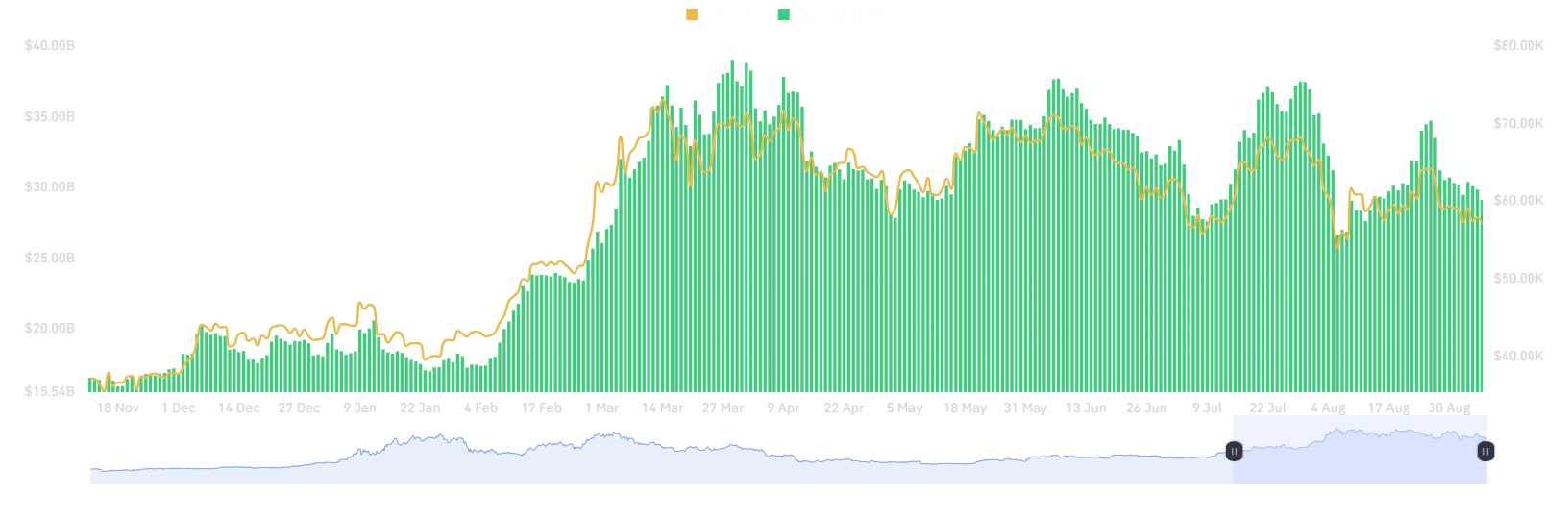

In response to AMBCrypto’s evaluation, on the twenty sixth of August, when BTC examined the $64K ceiling, OI stood at round $34.72 billion. Since then, each BTC and OI have dropped considerably, suggesting that future merchants have aggressively locked in earnings.

Nonetheless, approaching a zone with vital OI once more might improve volatility. As individuals close to breakeven, if many exit, it might gradual momentum and push BTC costs decrease.

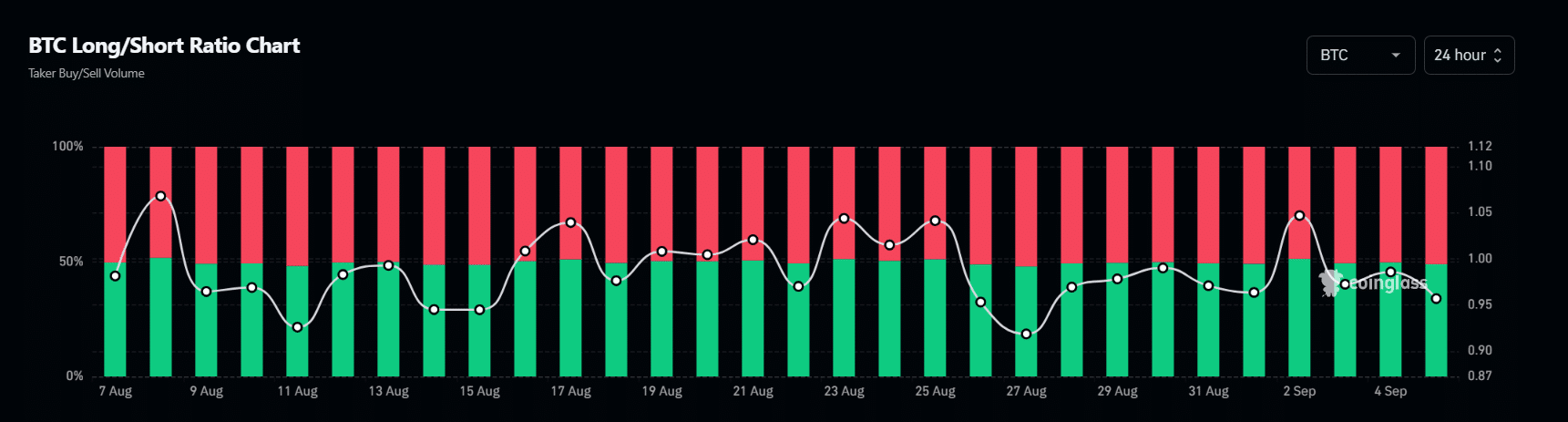

Furthermore, shorts have been dominating longs for the previous three days. As of now, shorts are nonetheless outperforming longs, making up 52% of the market.

If the Bitcoin bear market takes management and BTC checks the $56,572 worth vary, about $45 million in 100x leverage positions may very well be liquidated, doubtlessly pushing the worth nearer to $51K.

Conversely, if BTC strikes nearer to $57,400, round $67 million in brief positions may very well be liquidated.

General, excessive OI with shorts dominating the derivatives panorama might favor the Bitcoin bear market. Due to this fact, sustaining the $56K – $57K assist degree is essential for a possible breakout – What are the percentages?

Bitcoin establishments face bear risk

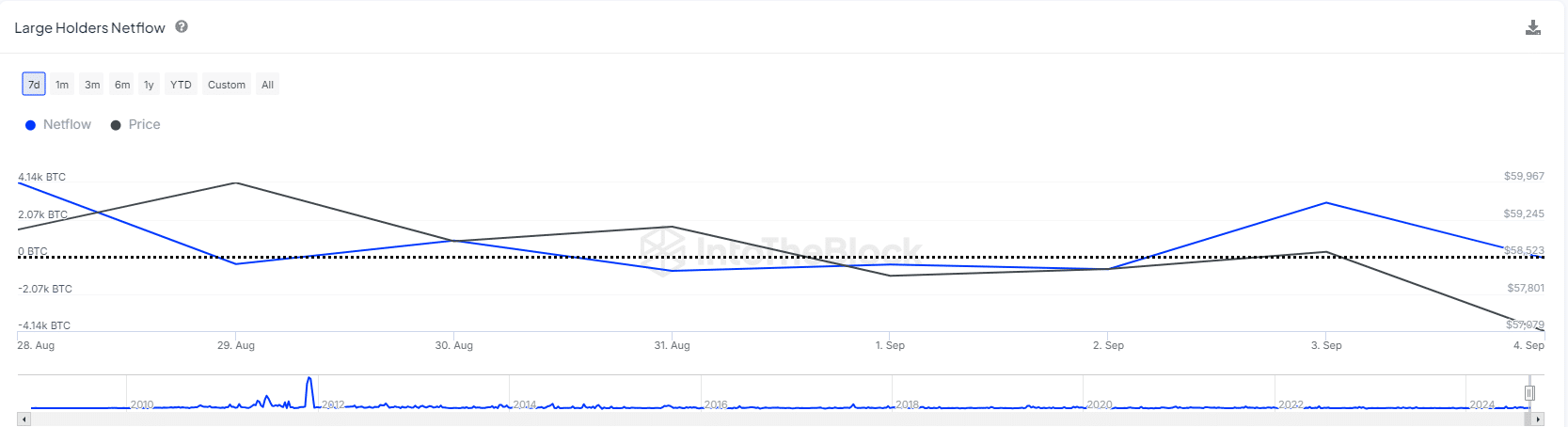

It seems establishments are promoting BTC. Because the twenty sixth of August, crypto asset administration firm Ceffu has deposited 3,063 BTC, price $182 million into Binance. The truth is, on the third September, a big constructive internet movement brought on BTC to drop by 3%.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

This chart suggests an absence of optimism amongst massive holders. In response to AMBCrypto, if this pattern continues, it might set off market panic.

To defend the $57K assist and goal $68K, long-term holders should keep away from a promoting spree. In any other case, with the shorts dominating, BTC would possibly fall to $51K and doubtlessly beneath $40K.