- Bitcoin is displaying indicators of weakening demand as September, a month usually related to declining costs, approaches

- Potential rate of interest cuts within the U.S and different bullish catalysts may stir volatility

August was a unstable month for Bitcoin’s (BTC) worth. BTC began buying and selling at round $63k on 1 August and barely one week into the month, the crypto’s worth tanked to round $49,000. Whereas the value later rebounded to the touch $65,000 in late August, it has since dropped to commerce at $59,190 at press time.

Regardless of Bitcoin being down by practically 8% over the previous month, merchants anticipate additional declines in September if the coin follows previous worth actions. In truth, in accordance with fashionable analyst Ali Martinez,

“If you think August was tough for Bitcoin, keep in mind that September often brings negative returns as well.”

As an illustration, again in September 2023, the crypto’s worth oscillated between $24,000-$27,000, with out making any vital positive aspects. A pointy 17% drop in worth was additionally seen in September 2021.

So, will historical past repeat itself or will Bitcoin break this sample?

A have a look at key metrics

A number of key metrics are already displaying that bears are taking on and positioning themselves for a possible drop in September.

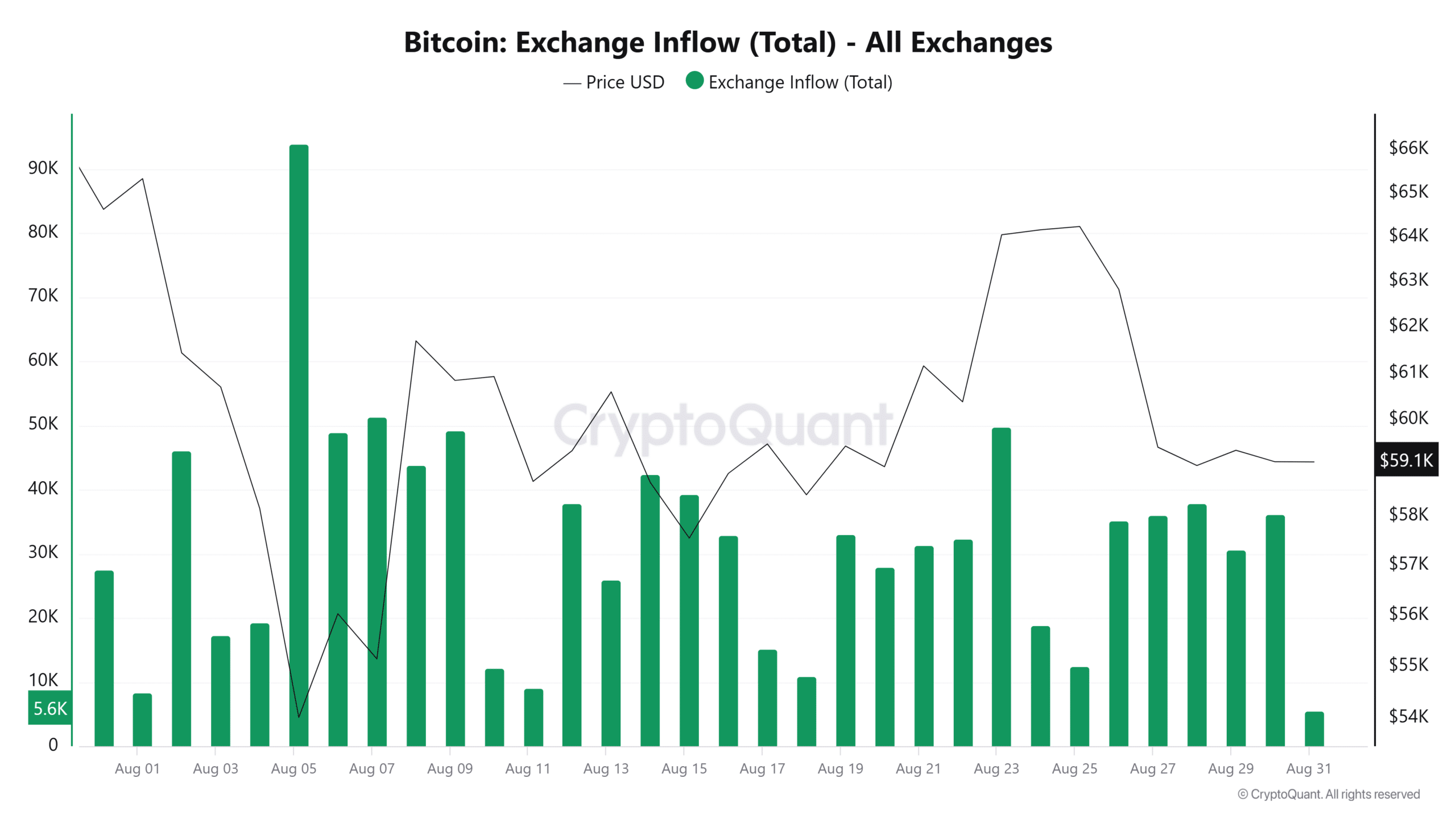

As an illustration – Information from CryptoQuant revealed a major enhance in trade inflows since late August. The inflows got here shortly after BTC’s worth rebounded above $64k.

This indicator may imply that after the current rebound in costs, a major variety of merchants selected to promote and reduce dangers in case of additional dips forward.

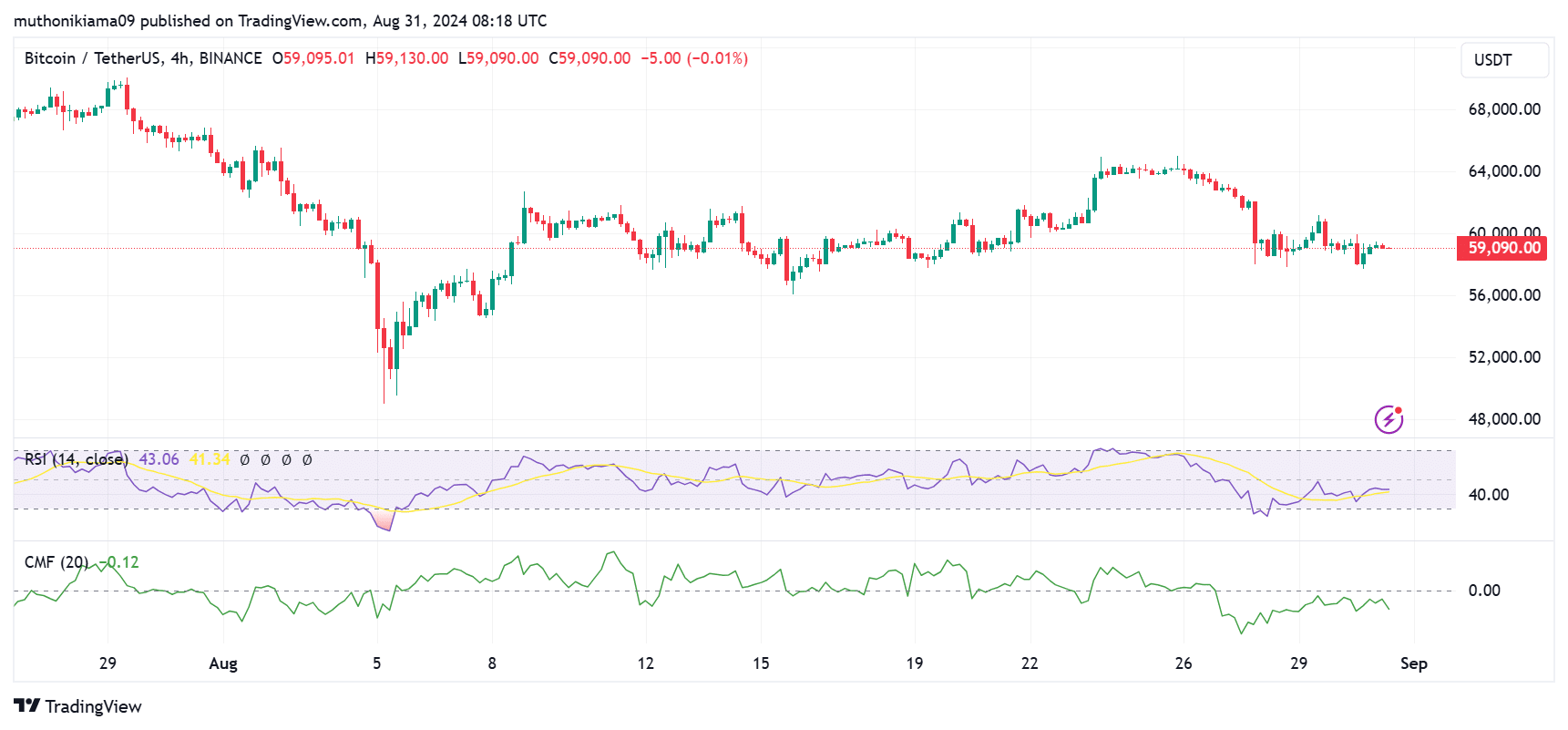

Patrons are additionally displaying hesitance to get again into the market. A number of key indicators, the Relative Energy Index (RSI) and the Chaikin Cash Circulation (CMF), confirmed waning purchaser curiosity at press time.

The RSI at 43 instructed sellers are nonetheless in management, and consumers are unwilling to enter at its prevailing costs. The CMF has additionally oscillated within the damaging area since 26 August – An indication of bearish dominance.

On 30 August, the U.S introduced that the core PCE worth index for July got here in at 2.6% year-on-year. This was decrease than the anticipated 2.70%.

Such constructive macro elements often result in a bounce in Bitcoin’s worth. Nonetheless, that didn’t occur yesterday.

In keeping with QCP, with the current macro information having barely any impact on crypto costs, BTC will proceed to commerce rangebound inside $58k-$65k within the quick time period.

Moreover, inflows to identify Bitcoin exchange-traded funds (ETFs) have weakened. Within the final 4 consecutive days, as an example, BTC has seen constant outflows, as per SoSoValue information.

Will September 2024 be totally different?

Weakening demand for Bitcoin seems to be merchants hesitating to enter the market in case September seems to be one other gloomy month.

Nonetheless, a number of bullish elements may stir a rally in September. The constructive information across the U.S financial system has fuelled hypothesis that the U.S will trim rates of interest within the subsequent Federal Open Market Committee (FOMC) assembly.

Information from the CME FedWatch Device confirmed {that a} majority of buyers anticipate the Fed to desert financial coverage tightening for the primary time since March 2020. If that occurs, it should gas a rally in threat belongings corresponding to Bitcoin.

One other bullish catalyst is the discharge of former Binance CEO Changpeng Zhao from jail. His launch date is about for 29 September, and a few already anticipate it would ignite a bull run.

Lastly, former U.S President Donald Trump will debate U.S Vice President Kamala Harris in September. If there may be any point out of crypto, it may spike volatility.

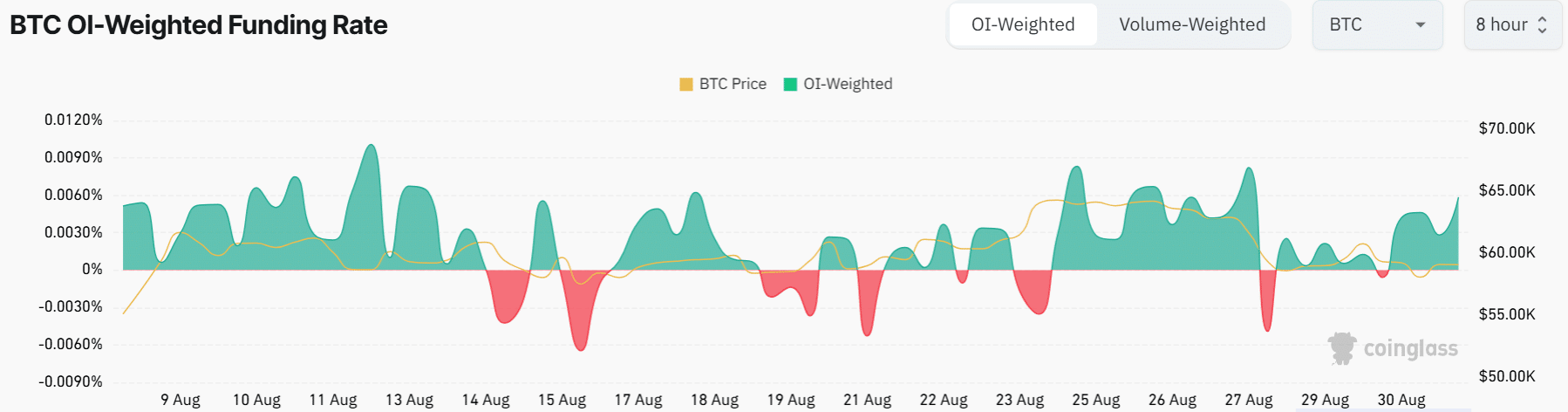

Bitcoin’s funding charges have additionally flipped constructive and risen considerably over the previous couple of days. This suggests a surge in lengthy positions – A bullish sign as merchants anticipate future positive aspects.