- BTC LTHs are torn between promoting and holding amidst worth volatility.

- Bitcoin remained beneath $60,000 at press time.

The current enhance in Bitcoin’s [BTC] volatility is obvious, as its worth struggles to keep up the essential $60,000 vary.

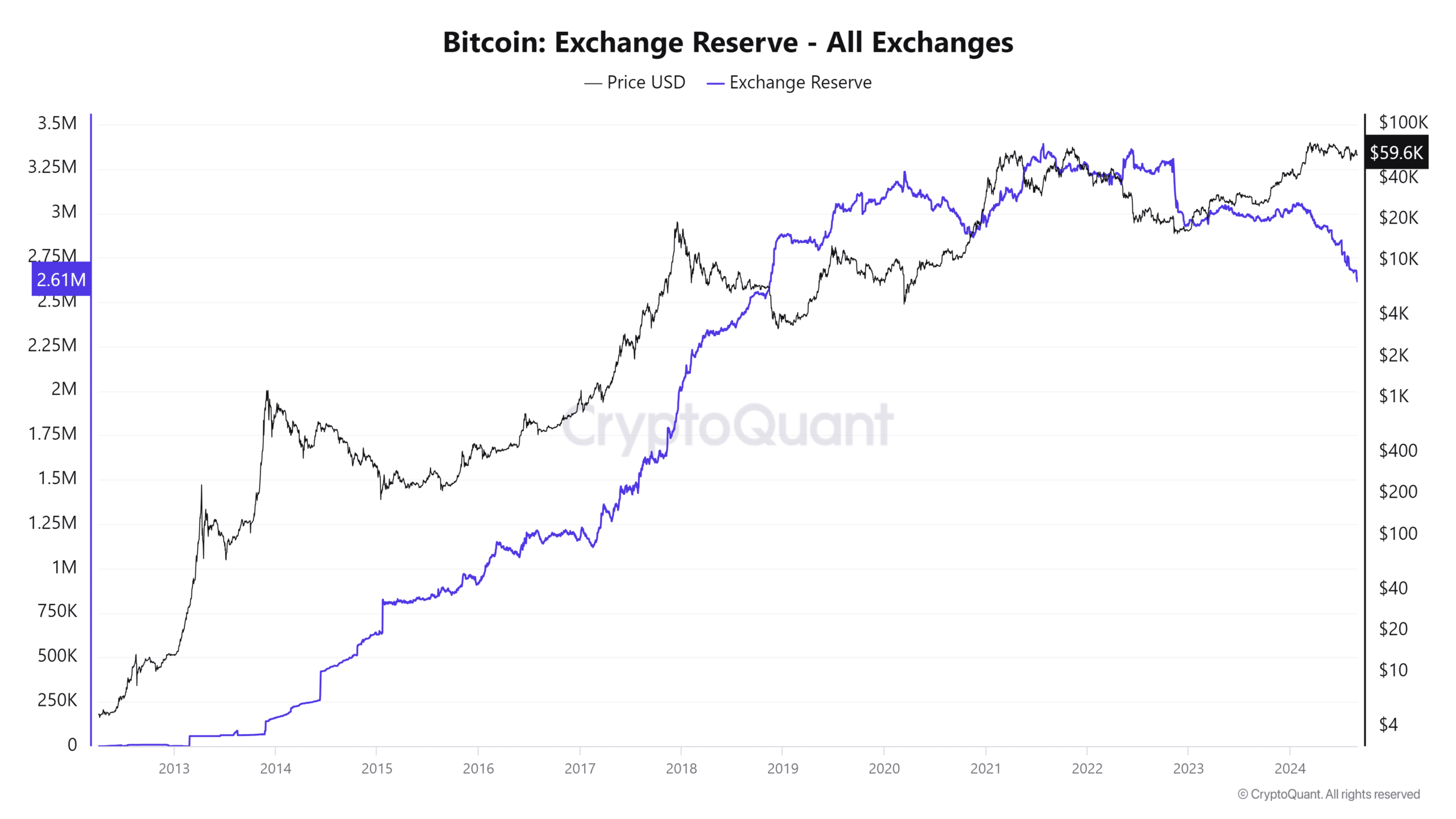

Regardless of these worth fluctuations, a notable development has emerged: Bitcoin trade reserves have declined. This lower in trade reserves signifies that main holders, usually known as “whales,” are more and more unwilling to promote their Bitcoin.

Bitcoin trade reserves hit one other low

AMBCrypto’s evaluation of Bitcoin’s trade reserves revealed that they’ve hit one other low, persevering with a big downward development that started at the beginning of the yr.

In keeping with the chart on CryptoQuant, the reserves have fallen to roughly 2.6 million BTC. This was down from over 3 million BTC reserves recorded in January.

Additionally, this decline in trade reserves suggests a discount within the liquidity obtainable on exchanges.

This discount in liquidity is usually a constructive signal for Bitcoin’s worth, because it signifies that fewer holders wish to promote their BTC. The transfer reduces the promoting strain in the marketplace.

Moreover, the continued decline in trade reserves is probably going pushed by long-term holders (HODLers). This conduct displays a powerful perception in Bitcoin’s future worth and a reluctance to interact in short-term buying and selling.

As long-term holders’ dominance will increase, the market might grow to be extra secure and fewer inclined to giant panic gross sales.

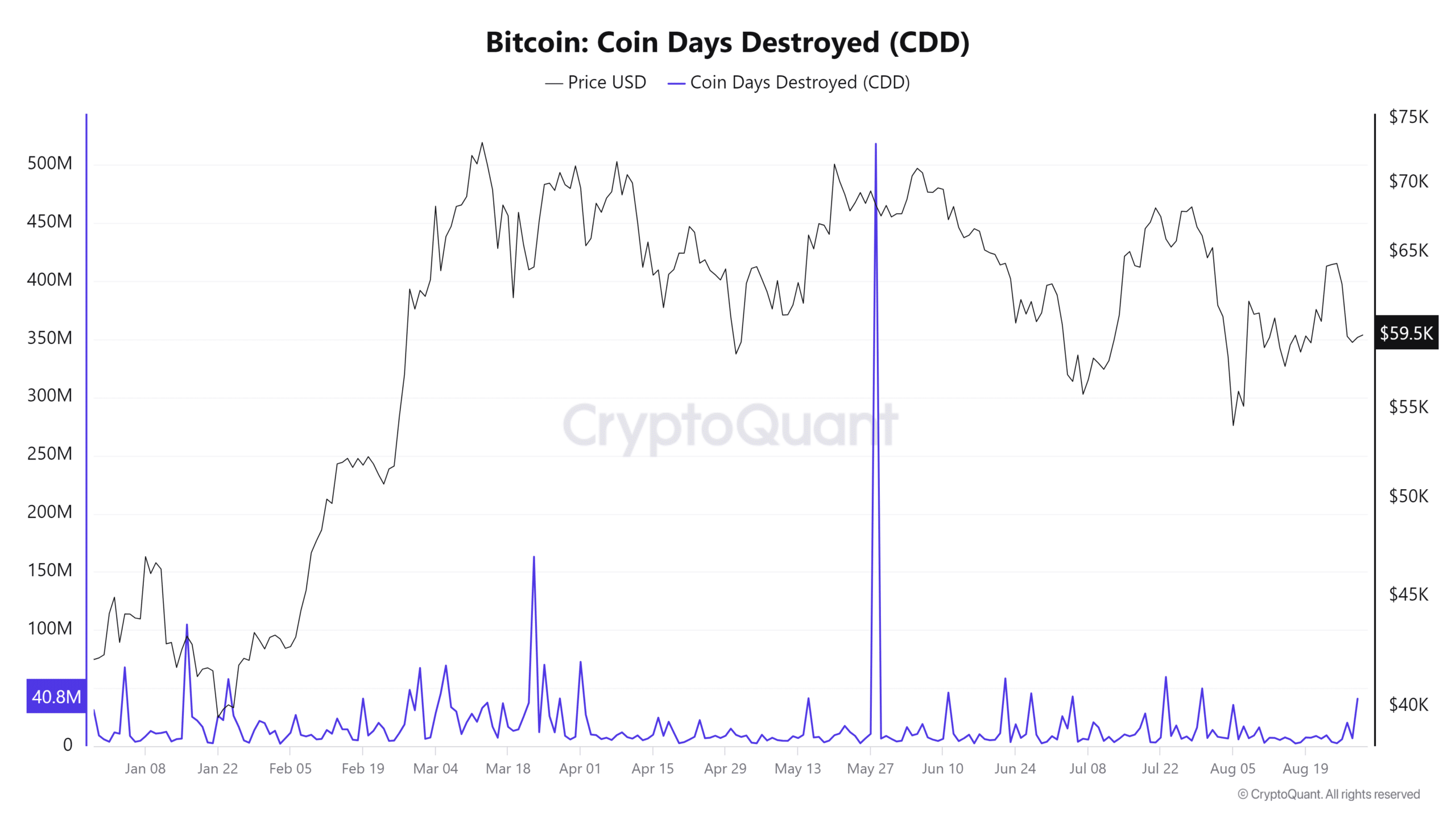

Evaluating CDD with Bitcoin trade reserves

The current evaluation of Bitcoin’s Coin Day Destroyed (CDD) metric alongside Bitcoin trade reserves suggests an attention-grabbing divergence. The CDD metric has skilled a slight spike not too long ago.

This contrasted with the beforehand secure development that indicated long-term holders (LTHs) weren’t actively spending their cash.

The CDD metric tracks the motion of older Bitcoins which have amassed “coin days” whereas remaining unspent. Every Bitcoin earns a “coin day” for on a regular basis it’s held in a pockets with out being moved.

When these Bitcoins are ultimately spent, the amassed coin days are “destroyed,” therefore the time period “Coin Day Destroyed.”

The current enhance in CDD means that the current volatility in Bitcoin’s worth might have triggered some long-term holders to maneuver or promote their cash, breaking the earlier development of holding.

This shift could possibly be a response to market uncertainty or a strategic resolution by some holders to capitalize on worth actions.

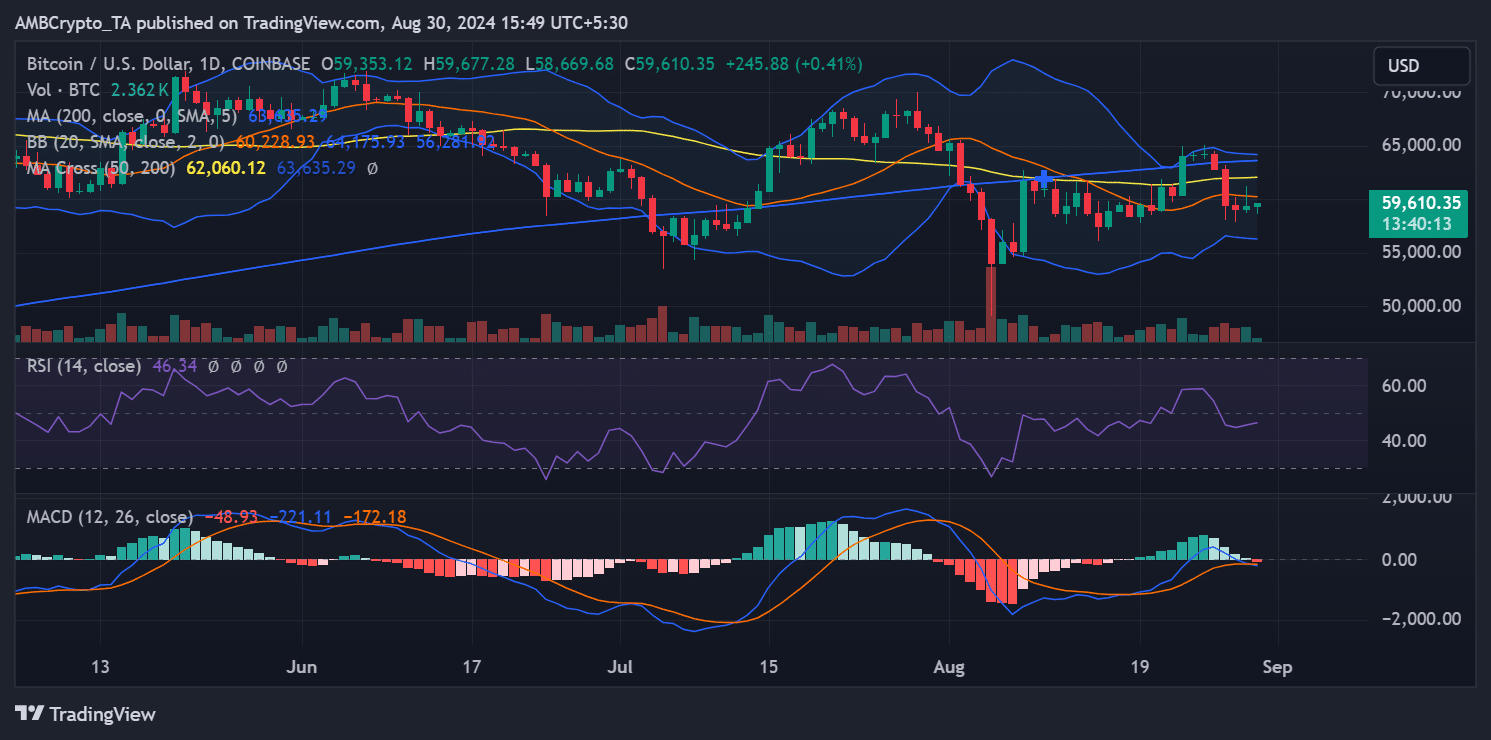

BTC stays risky

The current evaluation of Bitcoin’s each day worth development signifies that Bitcoin rose to roughly $61,000 within the earlier buying and selling session. Nevertheless, it couldn’t maintain this stage and ultimately closed the session at round $59,264.

This sample of briefly reaching larger costs earlier than retreating has been a constant development for Bitcoin over the previous few days, contributing to elevated market volatility.

The extent of this volatility is additional illustrated by the conduct of Bitcoin’s Bollinger Bands, a technical indicator that measures worth volatility.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The “elasticity” of the Bollinger Bands refers to their widening in response to elevated worth fluctuations. When the bands stretch wider, it signifies larger volatility as the value strikes extra dramatically in both course.

As of this writing, Bitcoin is buying and selling at round $59,597, with a slight enhance of lower than 1%. The continuing volatility, as proven by the Bollinger Bands, means that Bitcoin is experiencing vital short-term worth swings.