- Bitcoin value motion flips bullish.

- Bitcoin pulling establishments attributable to its yearly features.

Bitcoin [BTC] has closed above the Bull Market Assist band, a important stage on the upper timeframe, after three consecutive weeks of staying beneath it.

This restoration alerts potential for BTC’s value to maneuver larger. Regardless of temporary deviations, the worth motion now suggests a bullish development, with the present stage round $67k performing as a key liquidity zone.

Bitcoin breaking by way of the liquidity zone with sturdy quantity and staying above it, makes merchants and traders really feel assured to go lengthy, whereas others may add to their positions.

Bitcoin’s pull is unstoppable

The institutional curiosity in Bitcoin continues to develop, strengthening its upward momentum. Semler Scientific not too long ago bought 83 further Bitcoin, value $5 million, bringing their whole holdings to 1,012 BTC.

This acquisition positions them because the fourth-largest Bitcoin-holding firm within the US, excluding miners.

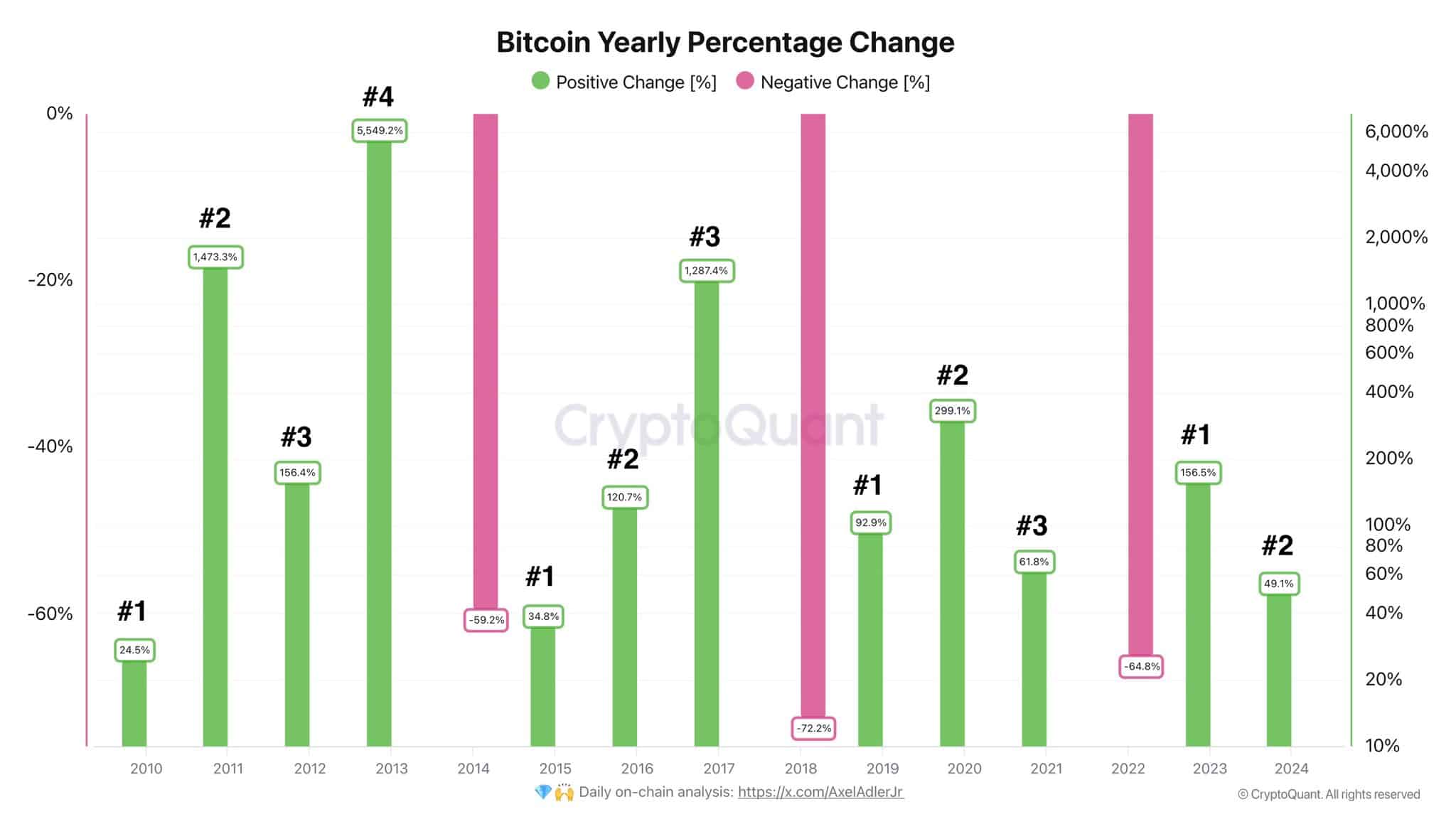

Traditionally, BTC has proven resilience, with solely three years of detrimental proportion change since its inception, whereas the opposite 12 years have been constructive.

Semler’s dedication to purchase extra BTC, backed by a $150M fundraising effort, displays the growing institutional adoption of Bitcoin, which is driving the market larger.

Regardless of challenges, Bitcoin persistently demonstrates its potential to succeed in new highs. With this yr already exhibiting constructive progress, expectations are for a powerful end, reinforcing the bullish sentiment.

BTC and S&P 500 divergence

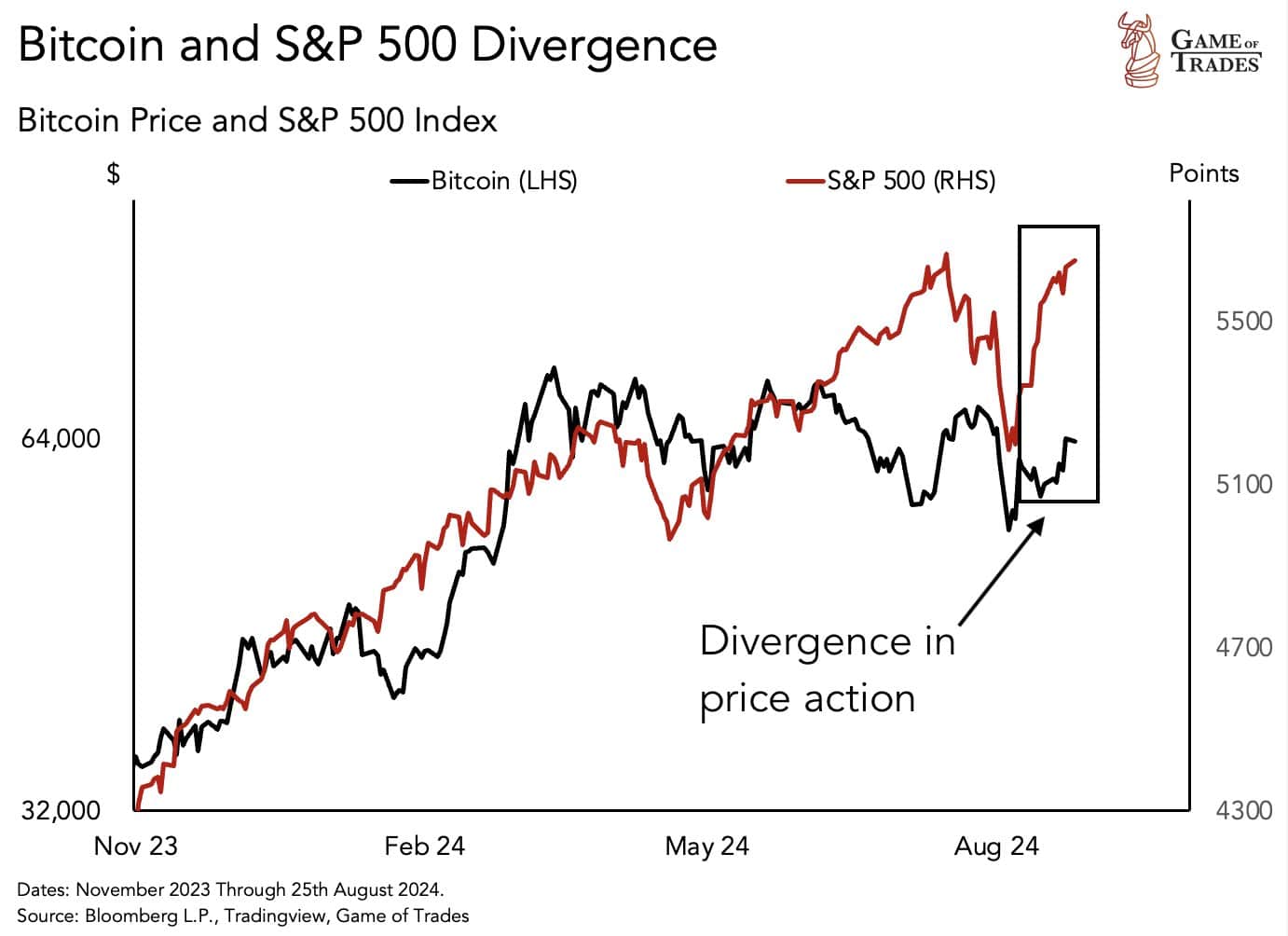

Bitcoin value actions typically mirror these of the U.S. inventory market, notably the S&P 500. When the S&P 500 rises, BTC tends to comply with, and vice versa.

In August, when the market dropped by 6% attributable to recession fears, Bitcoin value additionally noticed a pointy decline of 30%.

Nevertheless, because the market has since recovered, buying and selling close to all-time highs, BTC stays 20% beneath its July stage and 30% beneath its March 2024 stage.

This divergence presents a compelling alternative to purchase BTC, with the expectation that it’ll catch as much as the inventory market’s restoration.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Stablecoin provide will increase

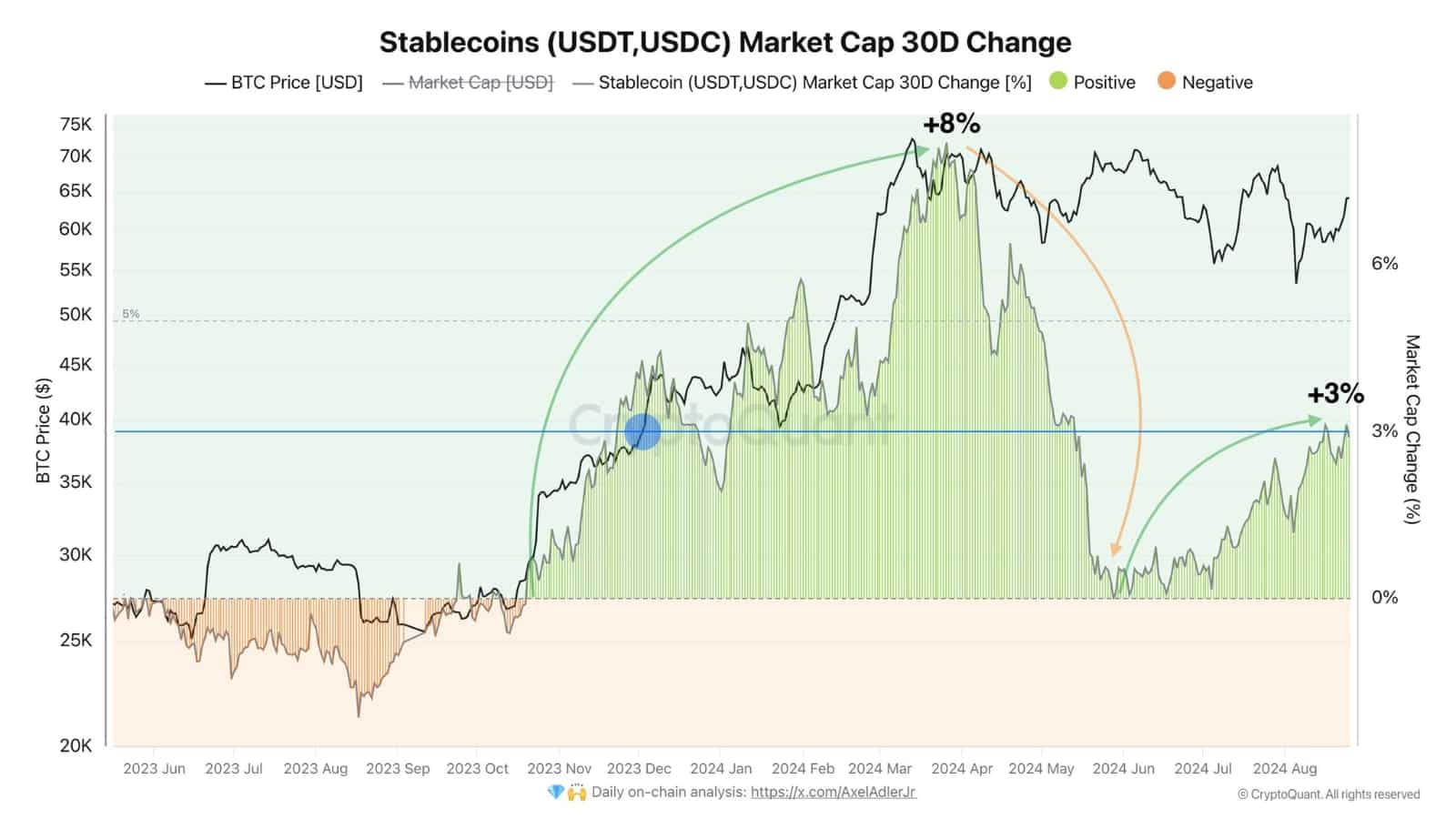

Lastly, the growing provide of stablecoins like USDT and USDC additionally helps the next BTC value. Over the previous three months, their market capitalization has grown by 3%, indicating rising demand.

With BTC provide progress slowing after the halving, this growing demand means that value is more likely to proceed climbing larger.