Nevertheless, it’s nonetheless value understanding what rho means, because it does present one other dimension of understanding as to how the worth of an choice might fluctuate.

What Is Rho?

Rho measures how the worth of an choice is delicate to a change in risk-free rates of interest. The rationale this makes it the least necessary Greek metric is as a result of risk-free rates of interest not often see important or surprising adjustments.

Plus, even when rates of interest do fluctuate, they solely have a minor influence on the worth of choices. This implies rho has a extra long-term impact (very similar to vega) and has solely a minimal influence on short-term choices.

Keep in mind, you might also see rho used for a guide of a number of choices positions. On this case, rho is in reference to the aggregated threat of publicity to adjustments in rates of interest.

Irrespective of if rho is getting used for a single choice or a guide of a number of choice positions, it’s a greenback quantity that represents how a lot the choice worth will change if risk-free rates of interest change by a single proportion level.

Choices Rho Math

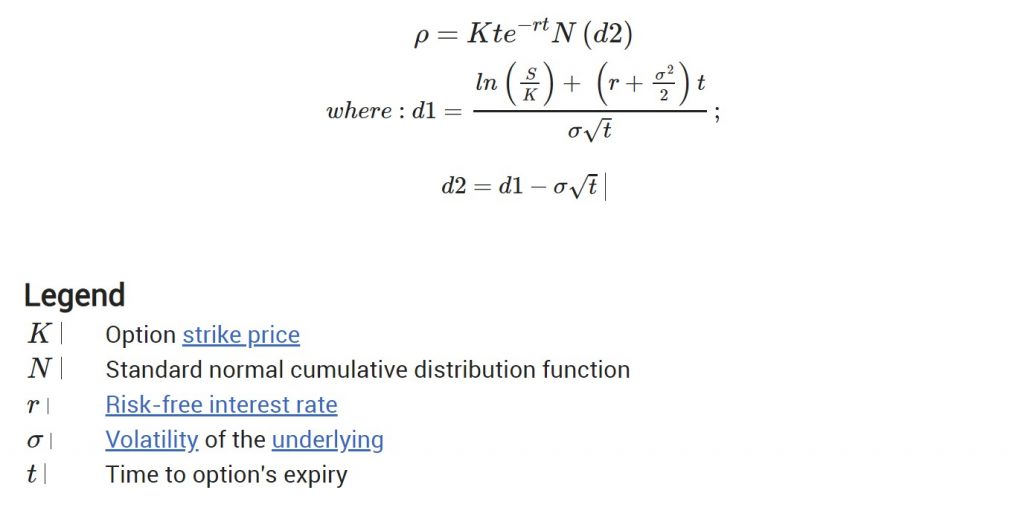

It isn’t mandatory to know the mathematics behind Rho (please be happy to go to the subsequent part in order for you), however for these rho is outlined extra formally because the partial spinoff of choices worth with respect to (threat free) rates of interest.

The method for the rho of a name choice is under (some information of the conventional distribution is required to know it). The same method for a put choice additionally exists.

Supply: iotafinance

Calculating the Influence of Rho

To place the above into context, let’s say that an choice has a price of $3.25, Rho is 0.5, and the risk-free rate of interest is 1.5 %. This implies the worth of an choice will theoretically improve by $0.50 for each 1 % improve in rate of interest. Due to this fact, if rates of interest improve by 1.5 % to three.5 %, the theoretical improve shall be:

$3.25 + 0.5 x 2 = $4.25

If rates of interest dropped by 2 %, we’d see a lower as an alternative:

$3.25 – 0.5 x 2 = $2.25

If the choice has a unfavorable rho of -0.5, the other will occur — the worth will drop because the curiosity will increase:

$3.25 + -0.5 x 2 = $2.25

However the worth will rise when curiosity decreases:

$3.25 – -0.5 x 2 = $4.25

Why Do Curiosity Charges Have an effect on Choices?

It’s simple to know why the components resulting in sensitivity within the different Greeks influence the worth of an choice. For rho, it’s much less apparent. In spite of everything, rates of interest are for debt securities, whereas inventory choices are equities with no mounted curiosity.

To grasp why rates of interest have an effect on choices in any respect, it’s necessary first to be clear about what we imply by risk-free rates of interest.

What Are Threat-Free Curiosity Charges?

In asset administration, some forms of investments are thought-about threat free. As an illustration, US authorities bonds are threat free as a result of they’re backed by the establishment of the federal government. As the federal government is unlikely to undergo extreme monetary troubles, there may be virtually no threat of savers seeing a default on their bonds.

In different phrases, if you are going to buy authorities bonds, you’ve got a minimal threat of dropping your funding. The danger-free rate of interest is the minimal return you possibly can obtain on the cash you borrow when the chance is zero.

Value of Carry in Choices

The principle cause why rho issues in any respect is value of carry. There’s a carrying value of holding choices as a result of merchants usually borrow cash to buy monetary devices. As well as, even when a dealer has cash accessible while not having to borrow, there’s a carrying value. Merchants may very well be investing this identical quantity in an account that yields curiosity as an alternative. It’s for these causes that increased rates of interest result in the next value of carry.

As a consequence, the price of carry is included within the worth of calls — regardless that shopping for calls is cheaper than shopping for the underlying asset. Due to this fact, the price of calls will increase and reduces with the risk-free rate of interest.

Rho for Calls and Places

When rho is optimistic, its worth will increase with the next rate of interest and reduces with a decrease rate of interest (not less than in idea). This, identical to when utilizing any of the opposite Greeks, assumes that each one different components stay the identical.

Rho is optimistic for lengthy choices (lengthy calls and brief places) however unfavorable for brief choices (brief calls and lengthy places). In different phrases, a rise in rate of interest is mostly excellent news for lengthy choices, whereas brief choices have a tendency to learn if rate of interest decreases.

To grasp why that is, let’s use an instance. Think about that ABC inventory is buying and selling at $35. To purchase 100 shares would value $3,500, however you may as an alternative purchase an at-the-money name for subsequent month at $3.50. This implies you may spend simply $350 and the reward could be the identical as should you purchased the inventory however the threat decrease. Plus, should you make investments the remaining $3,150 in authorities bonds, you’d be capable to hedge your funding. If it seems that rates of interest do improve, the worth of the decision will even improve and grow to be an excellent funding.

Moreover, merchants usually tend to purchase calls when rates of interest are excessive due to the higher financial savings from shopping for choices in comparison with shopping for the underlying inventory. This increased demand can also push up the worth of choices.

On the flip aspect, if rates of interest are at the moment low, it’s possible you’ll resolve to forgo shopping for choices and purchase the underlying inventory as an alternative. It is because you’ll obtain little curiosity maintaining your cash in your brokerage. Hundreds of different traders shall be pondering precisely the identical method, that means extra folks shall be shopping for inventory than name choices. Because of this, the worth will drop for the decision choice.

Now let’s take into consideration how curiosity impacts lengthy places as an alternative. To play the underlying asset to the draw back you possibly can both brief the shares or go lengthy a put choice. The primary selection means you generate money with curiosity. The second selection prices much less, however it gained’t add any additional cash to your brokerage with curiosity. As a consequence, the primary selection is extra interesting when rates of interest are excessive and it exhibits why excessive rates of interest decrease the worth for lengthy put choices.

Does Volatility Influence Rho?

Volatility is a significant factor for many of the Greeks, however it solely has an oblique influence on the rho through the delta. How volatility impacts rho will depend upon whether or not the choice is out of the cash, on the cash, or within the cash.

Out of the Cash

When choices are out of the cash, they’ve a strike worth that’s above (for calls) or decrease than (for places) the market worth for the underlying asset. Rho has a very low worth for choices which can be deep out of the cash. You acquire worth if volatility will increase, as this results in the next delta and subsequently the next rho.

On the Cash

Choices on the cash have a strike worth that’s near the identical (if not precisely the identical) as the present market worth for the underlying inventory. They’re little impacted by volatility. Any improve retains the delta flat, that means there isn’t a change to the rho. Nevertheless, trying on the rho can nonetheless be helpful for at-the-money choices, as it will possibly present a sign as to the longer term worth pattern of the underlying asset. If the choice is receiving consideration from traders, it’s extra prone to see earnings.

Within the Cash

In-the-money name choices have a strike worth under market worth and put choices have a strike worth above market worth. A rise in volatility means a lower within the delta, which interprets to a lower within the rho.

The way to Use Rho

You possibly can anticipate to see the next rho for choices within the cash and a lower in rho as the choice strikes out of the cash. Rho can be increased for choices which have an extended time till expiration. That is fairly completely different from the opposite Greeks.

Rho could have a higher influence when rates of interest change unexpectedly. It is because the sudden price change will result in elevated market volatility usually, which causes increased choice costs.

All the identical, it’s only actually value trying on the rho if the choice has a very long time till expiry — this goes for each calls and places. It is because rates of interest have a minimal influence on premium as choices close to expiration, as a result of decrease extrinsic worth. As an illustration, rho can impact long-term fairness anticipation securities (LEAPs), because the expiration dates are normally not less than two years.

Though rho is the least used of all the foremost Greek metrics, it’s nonetheless worthwhile understanding what it means and the way it works. Then you possibly can resolve if you wish to take note of this metric or should you’d moderately deal with the opposite 4. When you’ve got LEAPs, you’ll in all probability discover that rho does have some influence. For those who commerce in shorter-term choices, nonetheless, you’re unlikely to note rho making a lot distinction.

In regards to the Writer: Chris Younger has a arithmetic diploma and 18 years finance expertise. Chris is British by background however has labored within the US and these days in Australia. His curiosity in choices was first aroused by the ‘Trading Options’ part of the Monetary Instances (of London). He determined to convey this data to a wider viewers and based Epsilon Choices in 2012.

Associated articles: