- BTC may need topped on this cycle, per Peter Brandt.

- Nevertheless, different market analysts disagreed.

Bitcoin [BTC] noticed some aid bounce on the twenty first of August after July’s FOMC Minutes indicated that some policymakers advocated for price cuts.

The biggest digital asset briefly retested $61K, however the total sentiment has remained weak.

In reality, August is BTC’s fifth month of worth consolidation, elevating doubts about whether or not the asset will hit a brand new ATH (all-time excessive).

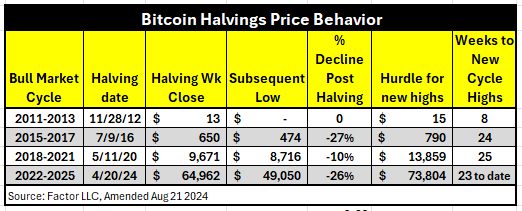

In accordance with Peter Brandt, the present cycle was taking too lengthy to hit a brand new ATH, which could sign {that a} BTC cycle high was already in.

“Current bull market cycle in $BTC will soon become the longest time post halving in history for a new ATH or, could indicate that new ATH is not in the cards.”

BTC is on monitor; Different analysts disagree

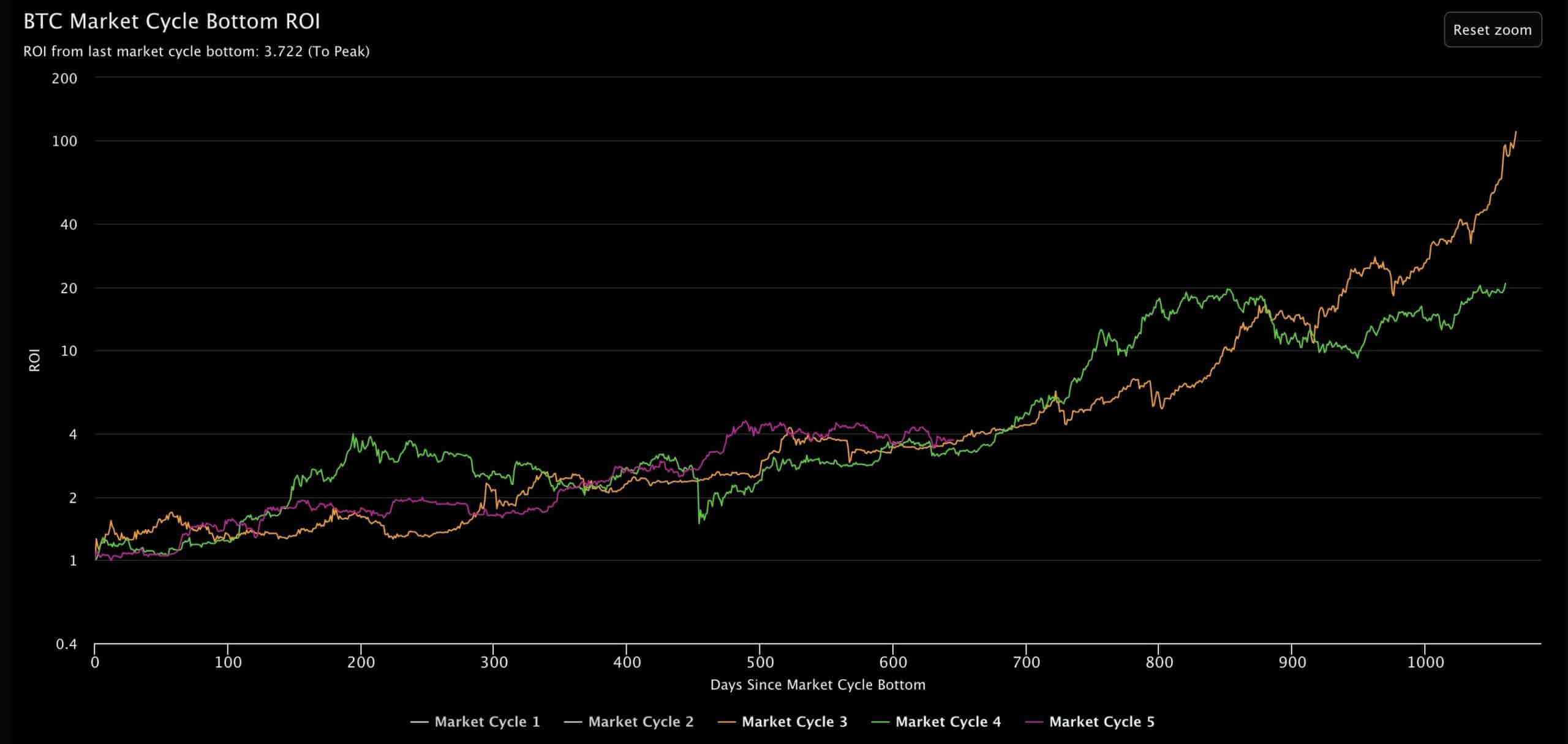

Nevertheless, different crypto analysts have disagreed with Brandt’s bearish outlook. In accordance with Benjamin Cowen, BTC was on monitor and in sync with different historic market cycle actions.

“Despite everything, #BTC is right around where it always is at this point in the market cycle.”

Primarily based on the connected chart, BTC was on the point of the subsequent leg of a rally if the historic pattern continued.

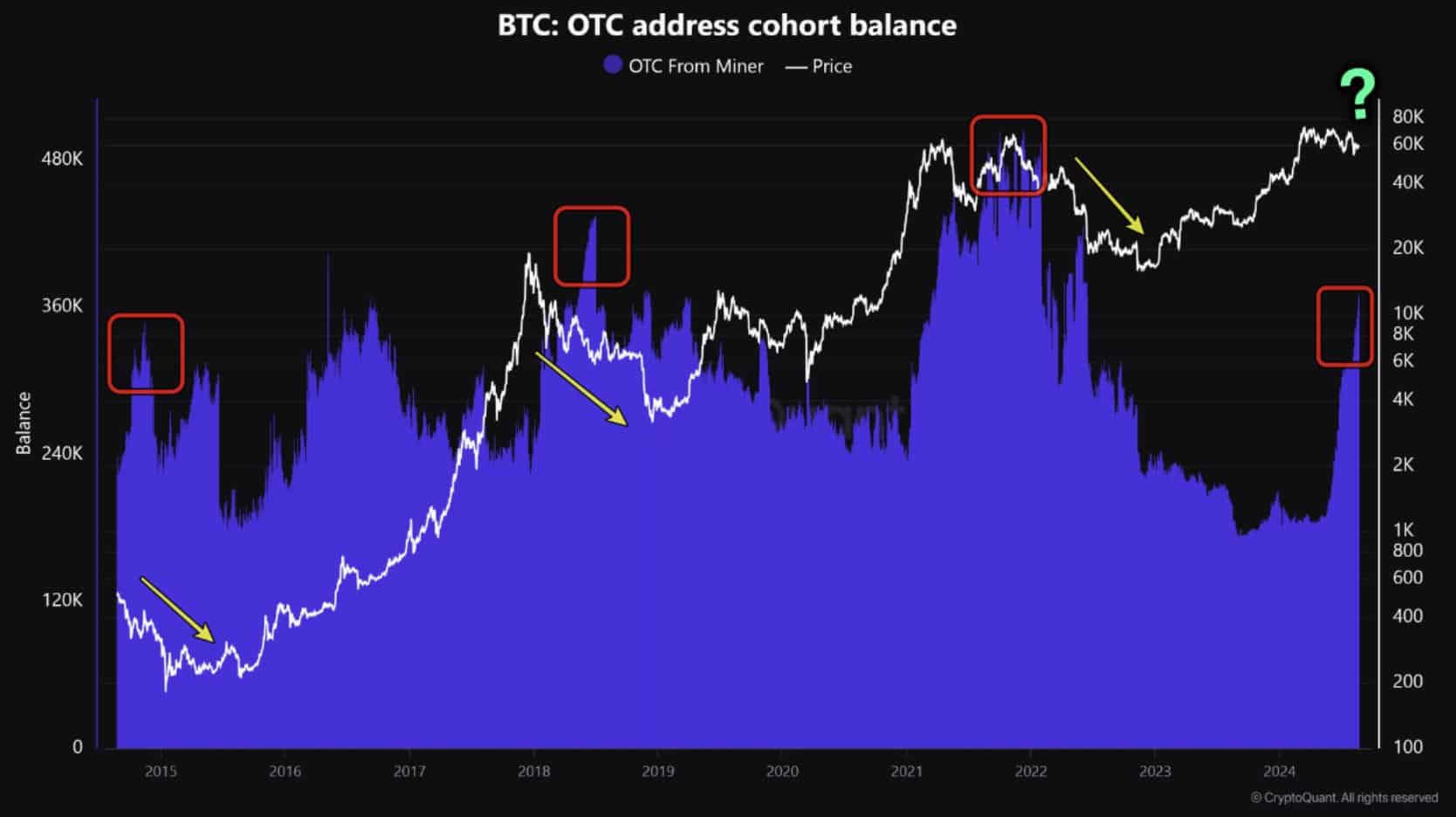

The following part of the BTC rally may start in This fall, based on CryptoQuant founder Ki Younger Ju, who cited seemingly whale actions.

“In the last #Bitcoin halving cycle, the bull rally began in Q4. Whales won’t let Q4 be boring with a flat YoY performance.”

One other knowledge level that urged a probable BTC upswing was the current drop in Funding Charges alongside an uptick in Open Rates of interest. In accordance with K33 Analysis, this market set-up was ‘ripe’ for a brief squeeze.

“Market conditions are looking ripe for a short squeeze. BTC perps notional open interest has jumped by 30k BTC since August 13, with consistent negative funding rates.”

Moreover, Glassnode revealed that BTC’s Lengthy-Time period Holders (LTH) have lowered profit-taking, which traditionally tends to usher in a brand new worth uptrend.

Nevertheless, based on CryptoQuant, BTC stock on OTC (over-the-counter) markets elevated to a file two-year excessive, which may suppress BTC restoration within the quick time period.

“Bitcoin OTC Desk Balances Soar to Two-Year Peak. Historically, increases in #Bitcoin OTC desk balances have been associated with declines in Bitcoin prices.”

In conclusion, BTC had extra upside potential if the historic pattern seen in post-halving repeats. Nevertheless, the anticipated rally may face dangers from the rising BTC stability on OTC markets.