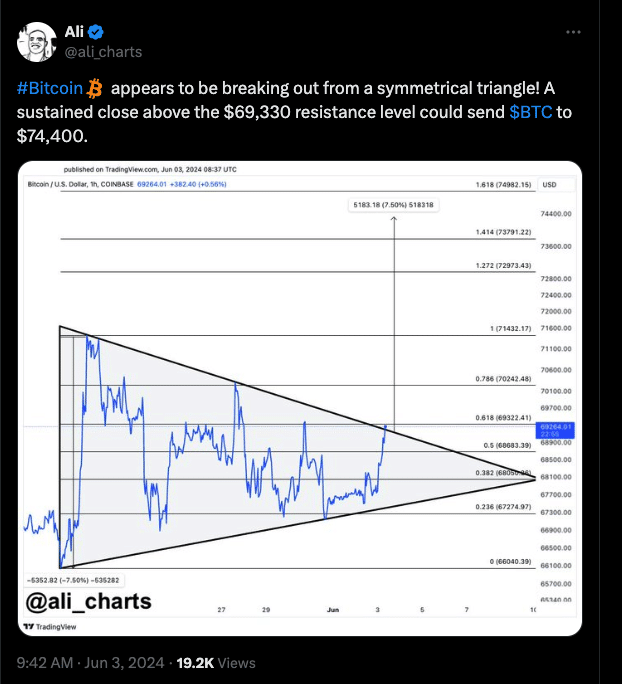

- The 1-hour chart confirmed that BTC fashioned an uneven triangle, suggesting a breakout

- If the value closes above the resistance, it may hit an all-time excessive quickly.

Bitcoin’s [BTC] value appeared to have displayed two opposing alerts. If one goes by, it may make method for the next worth. Nonetheless, if the opposite comes first, holders of the coin must cope with a value lower.

Analyst Ali Martinez made this recognized in two totally different posts on X. In his first put up, Martinez talked about that Bitcoin had fashioned an asymmetrical triangle on the 4-hour chart, indicating that the value may bounce to $74,400.

It’s a breakout or breakdown

However there was one situation connected to it. The prediction would possibly solely come to cross if Bitcoin closes above the $69,330 resistance.

An asymmetrical triangle happens when two trendlines with opposing slopes converge. A detailed above the higher resistance on this occasion brings about breakout.

Then again, if the value dumps into the assist, a notable correction may very well be subsequent. At press time, Bitcoin modified arms at $69,031, that means it was near the resistance level.

Nonetheless, the analyst’s second put up centered on the Tom DeMark (TD) Sequential. In accordance with him, this indicator had flashed a promote sign which may ship BTC all the way down to $68,050.

Once more, he talked about that the subsequent course for the coin is dependent upon the resistance as talked about earlier. Past this technical information, it’s also essential to have a look at Bitcoin’s value motion from an on-chain perspective.

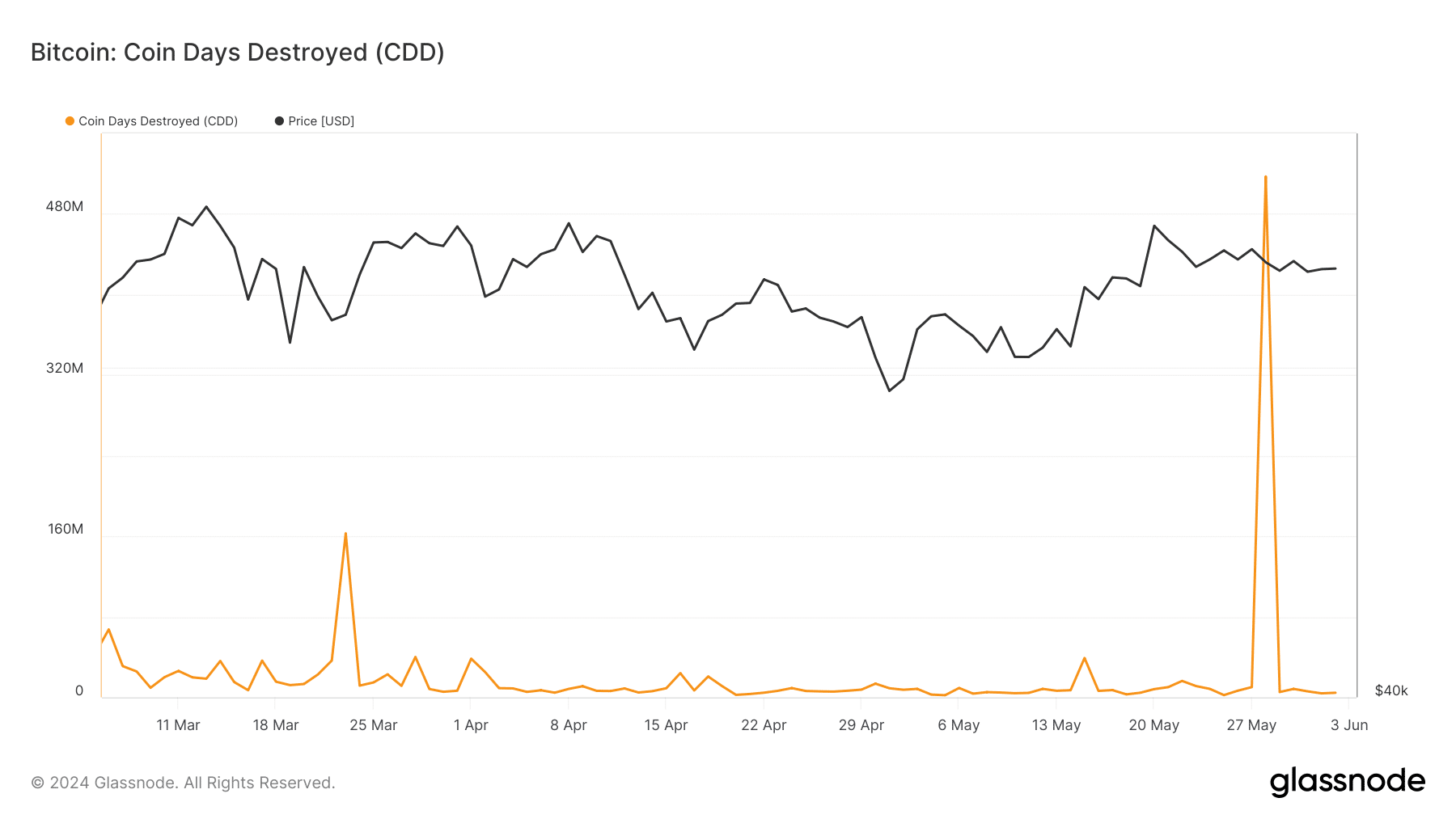

One of many metrics AMBCrypto examined was the Coin Days Destroyed (CDD). This metric how far long-term cash are transferring in giant quantities.

HODLing continues as liquidity hunt begins

If the CDD is excessive, BTC would possibly turn into extraordinarily risky, and promoting stress may trigger a value lower. This was the scenario with Bitcoin on the twenty eighth of Could.

Nonetheless, press time information confirmed that the CDD was all the way down to 4.55 million. On this occasion, long-term cash usually are not transferring round as individuals are sticking to holding.

If this continues, then the bullish prediction of $74,400 would possibly overcome the potential decline to $68,050. To buttress this level, AMBCrypto additionally seemed on the liquidation heatmap.

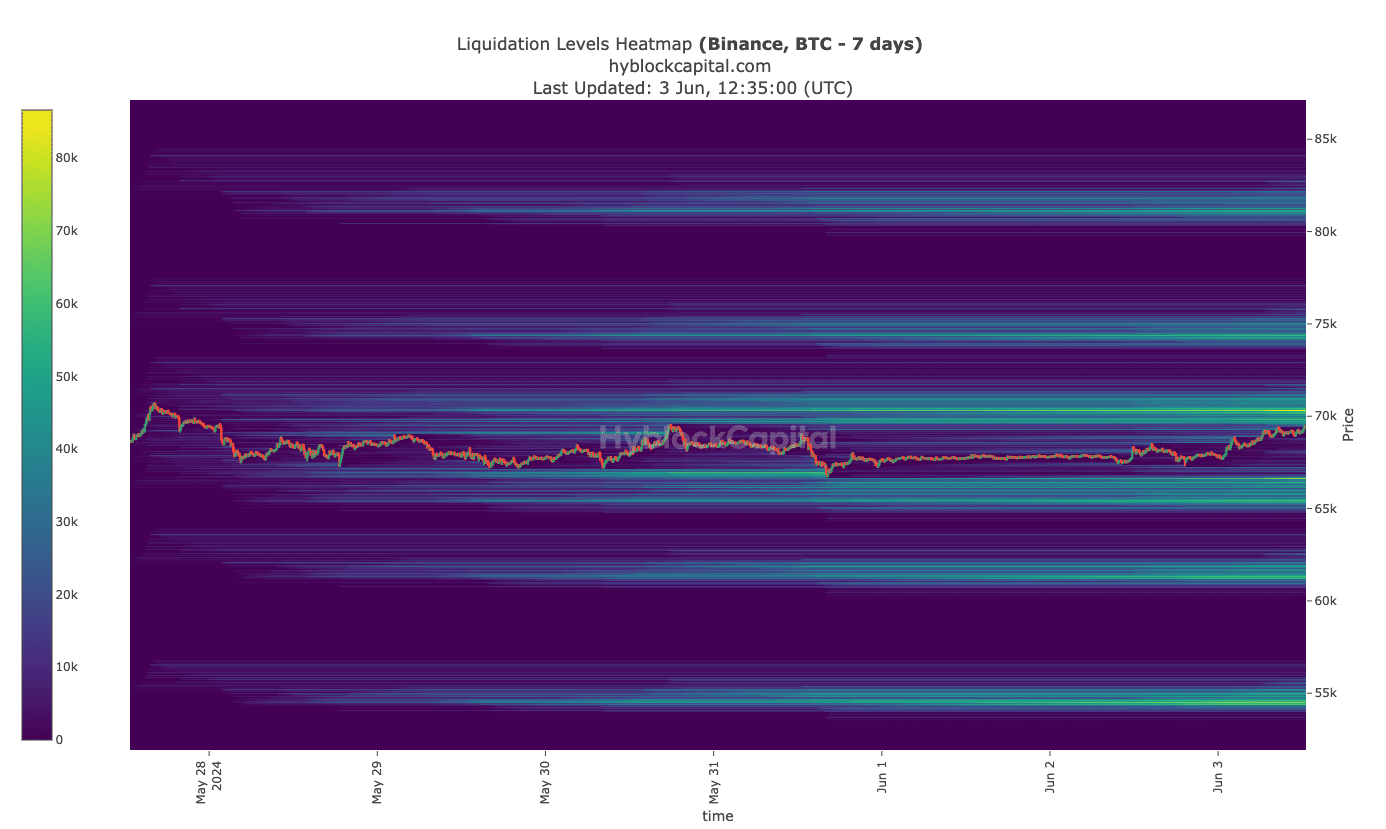

The heatmap will help merchants establish excessive areas of liquidity. And if there’s a magnetic space, the value can rise in that course. At press time, there was a excessive stage of liquidity at $70,300, suggesting that Bitcoin may hit the value.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

If attained, this might result in a breakout to $74,500 the place one other magnetic zone existed. Nonetheless, if the uptrend will get rejected, Bitcoin may hunch as little as $65,050.

However by the look of issues and metrics analyzed, BTC seems set to climb above $74,000.