- Ethereum staking noticed constant progress this 12 months, with over 54 million ETH at stake

- Technical indicators revealed the potential for a value hike quickly

Ethereum [ETH] staking has been constantly up in 2024, reflecting traders’ belief within the king of altcoins. A hike in Ethereum staking signifies that extra Ether tokens are being dedicated to the Ethereum community to validate transactions and preserve safety.

Nevertheless, will this have a optimistic affect on the token’s value within the remaining days of 2024?

Will staking assist Ethereum?

IntoTheBlock, a preferred knowledge analytics platform, just lately shared a tweet, revealing that Ethereum staking noticed constant progress this 12 months, with over 54 million ETH staked. The market additionally noticed the explosive progress of ETH restaking, which presently accounts for practically 10% of staked ETH.

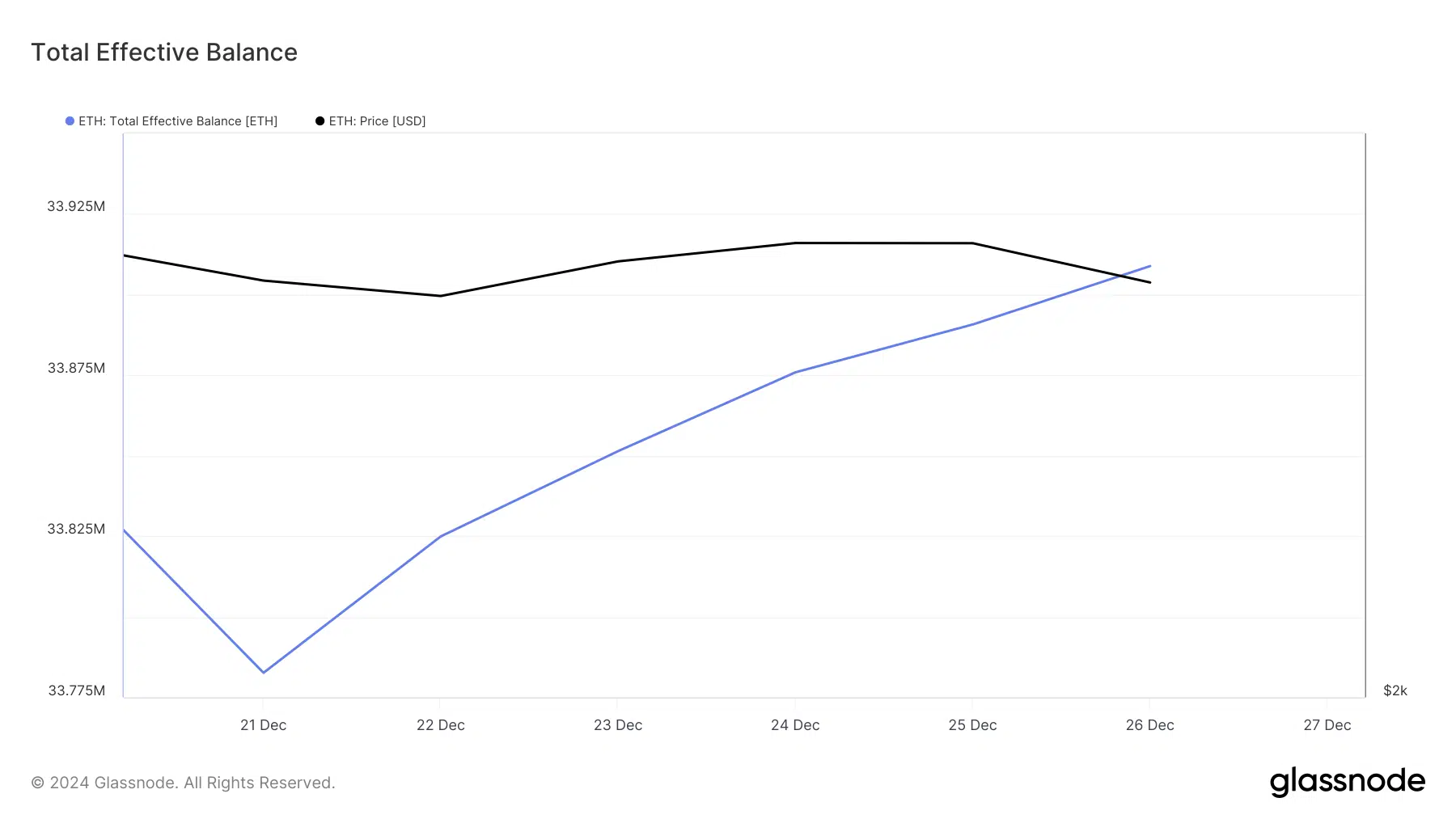

Actually, AMBCrypto’s evaluation of Glassnode’s knowledge revealed that associated datasets additionally moved up within the final seven days. For example, Ethereum’s whole efficient steadiness shot up. The overall staked steadiness is that which is actively collaborating in Proof-of-Stake consensus.

What’s occurring with ETH’s value?

Whereas all this occurred, ETH’s value was considerably consolidating. On the time of writing, the token’s day by day and weekly charts remained crimson. Ethereum was buying and selling at $3.38k with a market capitalization of over $406 billion.

CryptoQuant’s knowledge revealed that ETH’s alternate reserve has been dropping, that means that purchasing stress on the token was excessive. Nevertheless, regardless of declining alternate reserves, the blockchain’s lively addresses and switch quantity declined within the current previous.

Nonetheless, Ethereum’s funding price has been rising. Within the crypto market, a rise in funding charges can imply that merchants are optimistic concerning the market and anticipate the value to rise. This will additionally imply that the market is overheated. Funding charges can improve market volatility, inflicting value adjustments to be extra dramatic.

Subsequently, AMBCrypto checked the token’s day by day chart to seek out out extra about which method the token could also be heading. As per our evaluation, ETH’s value had already touched and rebounded from the decrease restrict of the Bollinger Bands.

At any time when that occurs, it hints at a value hike. Moreover, the Relative Power Index (RSI) additionally registered a slight uptick, additional suggesting a value hike within the coming days. If that occurs, then ETH may first check its resistance on the 20-day SMA.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

A profitable breakout may lead the altcoin to $4k as soon as once more. Nevertheless, a failed check can pull the token all the way down to $3k.