- Bernstein projected a BTC goal of $50K for a Harris win and $90K if Trump wins.

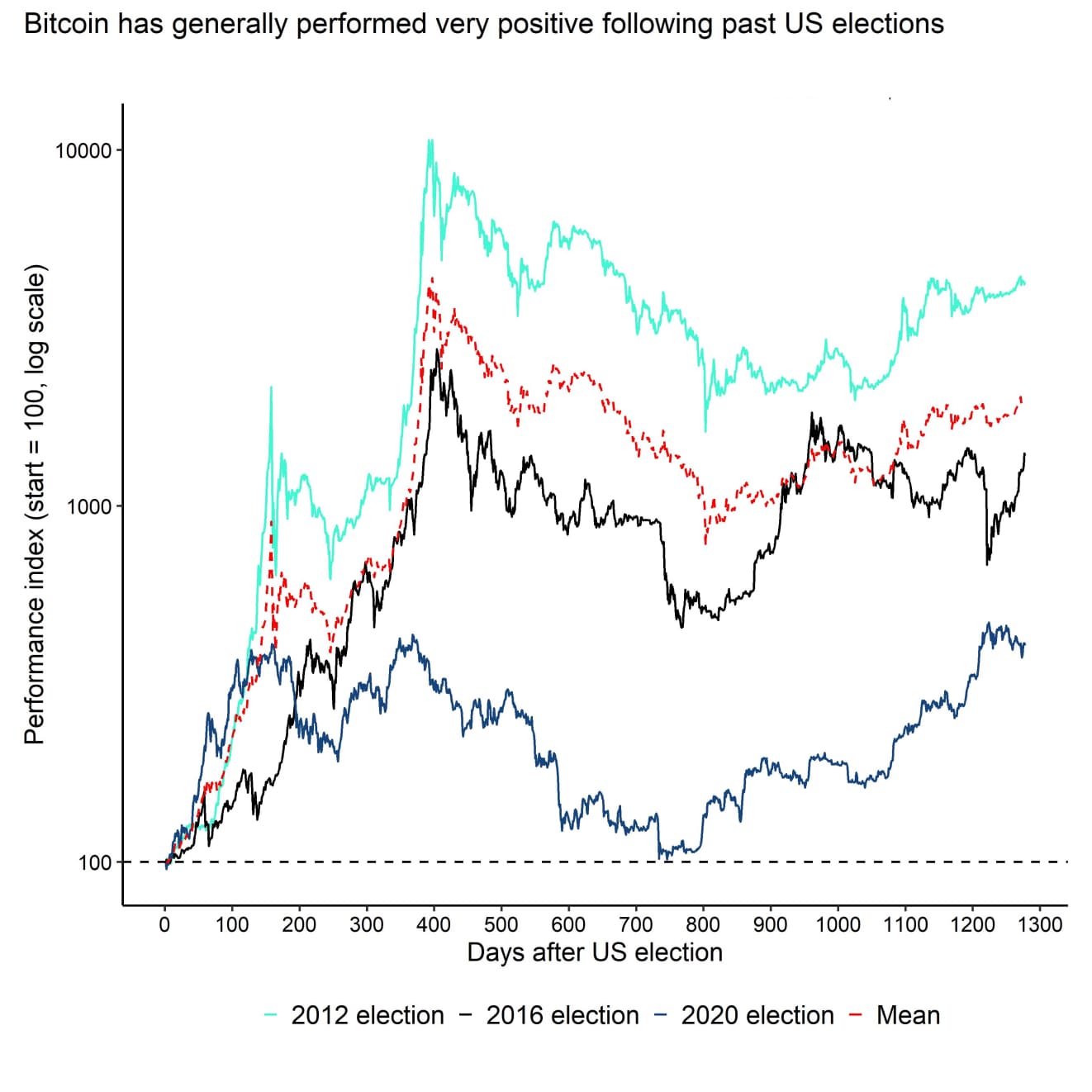

- Past short-term noise, BTC has at all times seen constructive development in previous elections.

Bitcoin might see ‘$90K or $50K’ primarily based on U.S. election final result, evaluation says…

The D-Day for U.S. elections is right here, and the short-term impression of the end result on Bitcoin [BTC] might be large.

In line with the most recent Bernstein outlook, a Harris win might drag BTC to $50K, whereas Trump’s victory might rally it to a variety between $80K-$90K.

The analysis and brokerage agency cited Harris’s comparatively hawkish stance as the rationale for BTC’s $50K goal.

But when Trump emerges because the winner, the analysts projected that BTC might hit a brand new ATH, citing the previous president’s pro-crypto stance.

BTC’s election value targets

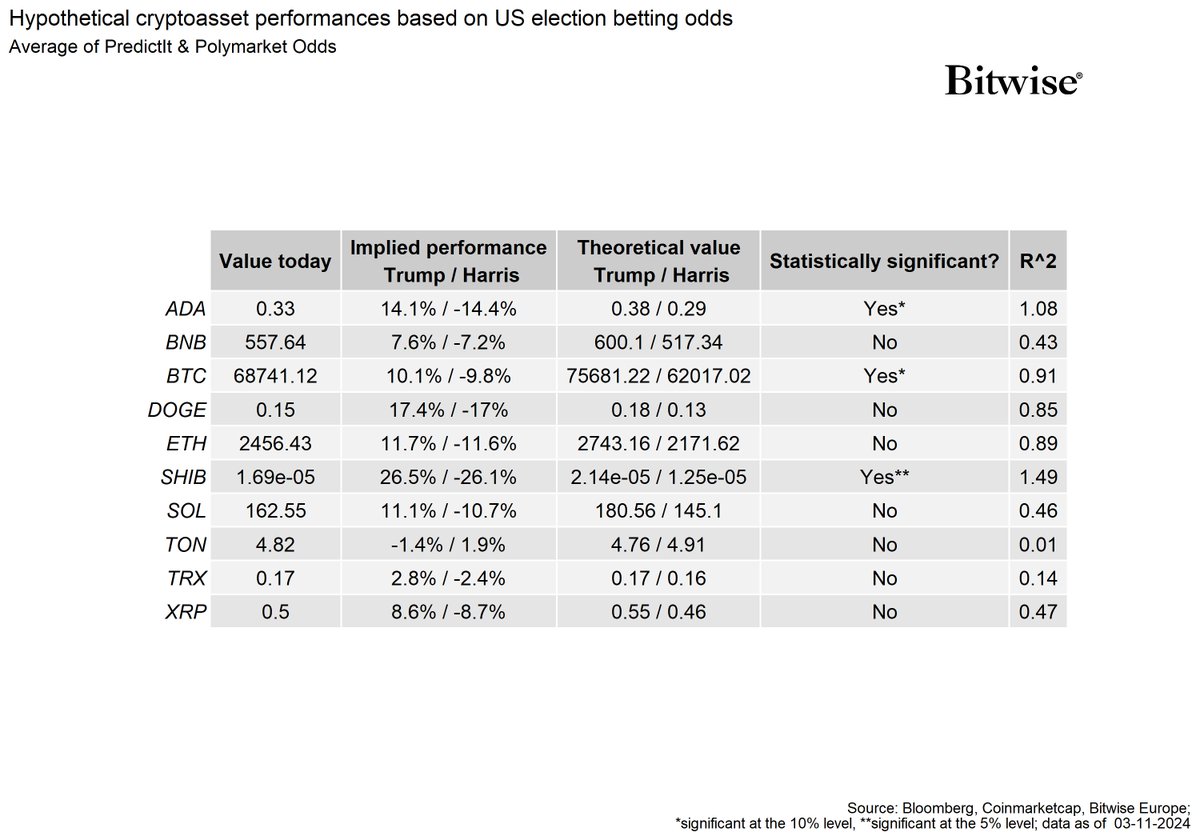

Amberdata, a blockchain insights agency, and asset supervisor Bitwise, echoed the identical projection, though with barely totally different targets.

In line with Amberdata analysts, there might be a $6K-$8K value swing relying on who wins the U.S. elections.

A part of its report learn,

“Therefore, major price levels are $60k (A Kamala win dip) or a $75k/$77k a Trump win that brings spot right back to the ATHs then THROUGH them, as election enthusiasm breaks the high seen last week.”

This was according to latest motion by hedge funds for potential bullish outcomes whereas masking for doubtless wild BTC value swings.

Primarily based on BTC’s sensitivity to Trump’s odds on Polymarket, Bitwise analysts discovered BTC might surge 10% if Trump wins. Conversely, BTC might drop by practically 10% if Harris wins.

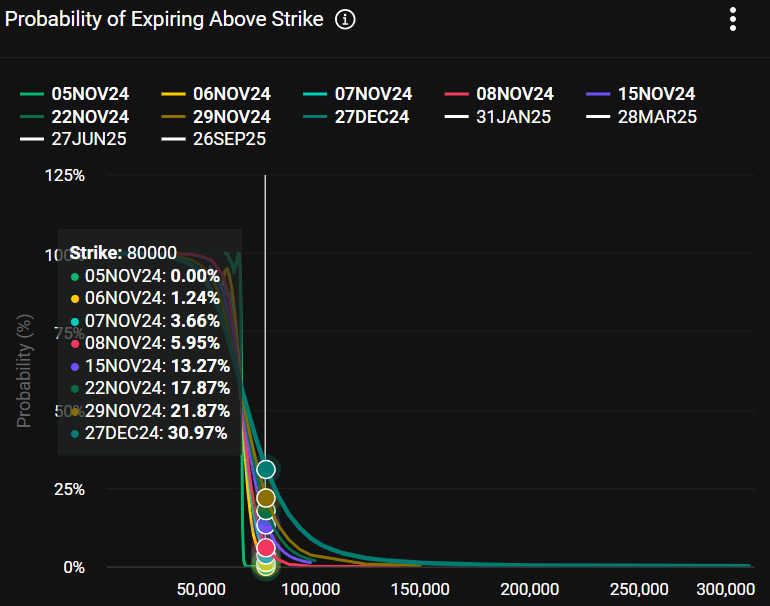

That stated, at press time, Deribit knowledge confirmed choices merchants had been pricing a 21% probability of BTC hitting $80K by the tip of November.

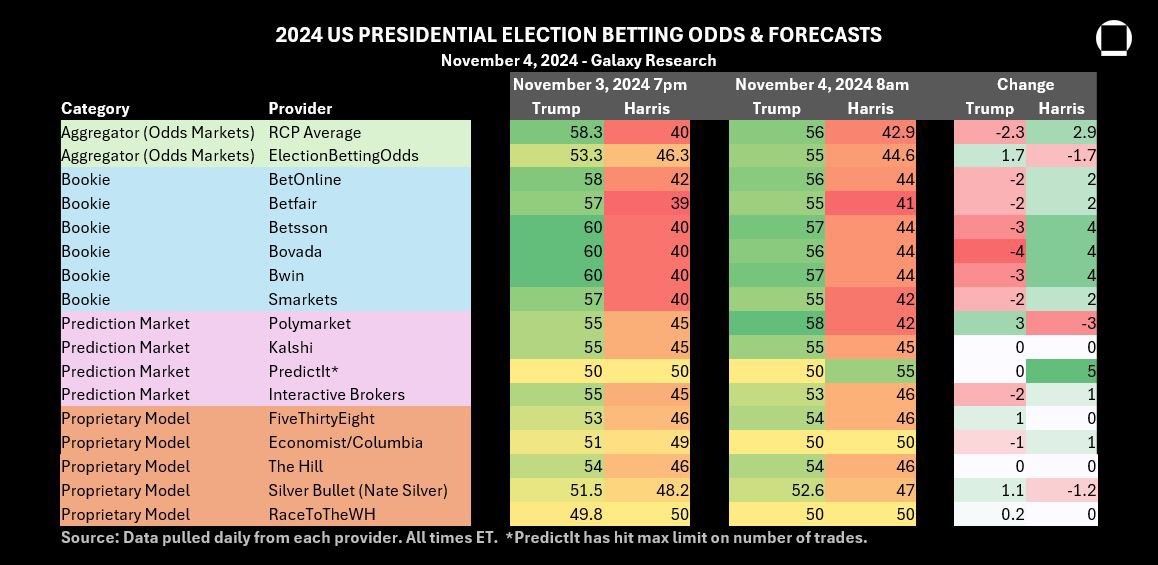

That wasn’t far-fetched provided that as of the 4th of November, Trump was nonetheless main amongst most election fashions and prediction websites per the most recent knowledge from Galaxy Digital.

When zooming out from the short-term U.S. election noise, BTC’s long-term impression has at all times been constructive prior to now three election cycles, with Bernstein projecting $200K by 2025.

Sharing her ideas on the identical, Maria Carola, CEO of crypto trade StealthEX, advised AMBCrypto {that a} doubtless constructive situation might play out after the elections. She stated,

“The statistics show an interesting pattern – after each election, there was impressive growth. After the 2016 elections, the price soared to $1,110, and in 2020, Bitcoin set a historical record, exceeding $40,000.”

Nevertheless, she cautioned that the short-term volatility might spike if the outcomes are contested.

“BTC is unlikely to see a rise in volatility ahead of the election, but volatility could increase after the U.S. presidential election, especially if the results are controversial.”