- Bitcoin might begin October on a bullish word, supported by a hidden sample.

- The likelihood leans strongly in favor of this situation.

Bitcoin [BTC] had a bullish weekend, briefly testing the $60K mark earlier than pulling again. At press time, it traded at $58,272, reflecting a momentary retreat after the surge.

With costs retracing, hope hinges on the approaching Fed fee reduce—but it surely’s not the one issue. As BTC enters its 148th day post-halving, a hidden sample suggests the breakout could also be nearer than anticipated.

Historical past suggests rebound chance

The chart highlights a recurring pattern within the Bitcoin cycle rising after every halving season. For context, Bitcoin halving is a deflationary mannequin occurring each 4 years, lowering the Bitcoin provide by half.

From an financial standpoint, a decreased provide will increase the worth of every coin. Consequently, every cycle usually sees an upward pattern start after a median of 170 days.

For example, following the halving on eleventh Could, 4 years in the past, BTC first examined the $40K ceiling on the each day worth chart roughly 170 days later. A extra vital peak pushed BTC above $50K roughly 480 days after, round early August.

An analogous sample has been noticed after every halving interval. If this pattern holds, BTC would possibly attain $70K within the first week of October earlier than dealing with resistance. Moreover, the upcoming FOMC assembly might additional affect this speculation.

Though the historic pattern seems to be promising, actuality have to be factored in—so, is a possible rebound simply 23 days away?

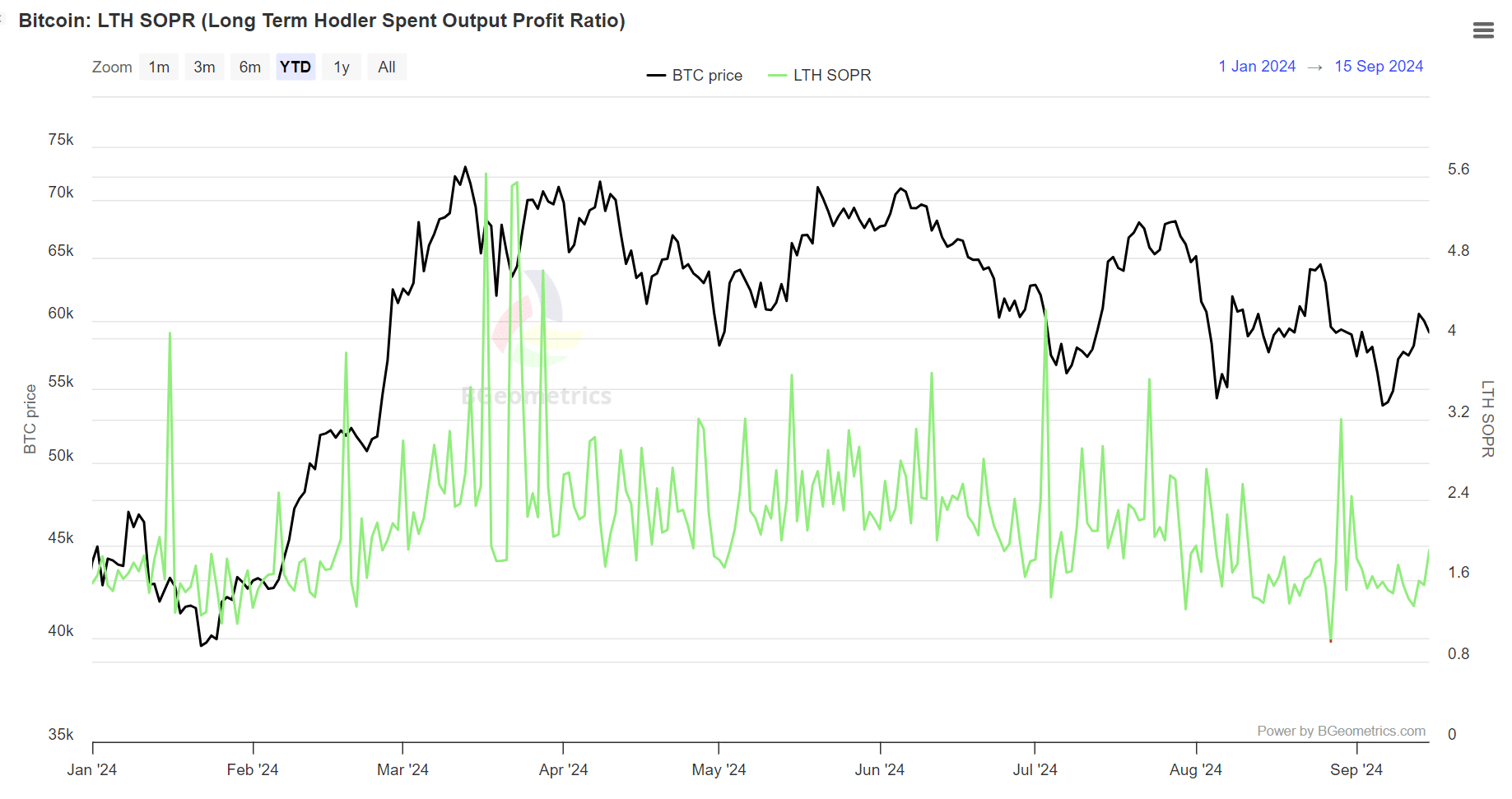

LTH strengthened their assist for Bitcoin

Seasoned buyers are assured in a possible worth correction. Traditionally, a rising LTH SOPR helps every bull rally, indicating long-term holders are realizing income.

Whereas the uptick is an indication of optimism, if the worth doesn’t match the rise, it might undermine the anticipated correction. This will likely immediate long-term holders to promote at a revenue somewhat than danger losses.

Put merely, long-term holders realizing income alerts power in Bitcoin’s present market worth. If this pattern persists, a reversal might be imminent. Nonetheless, a worth retrace under $57K would possibly sign concern.

The LTHs signify a good portion of buyers, however they alone don’t totally seize market confidence in an October upward pattern.

That mentioned, analyzing futures merchants can present higher insights.

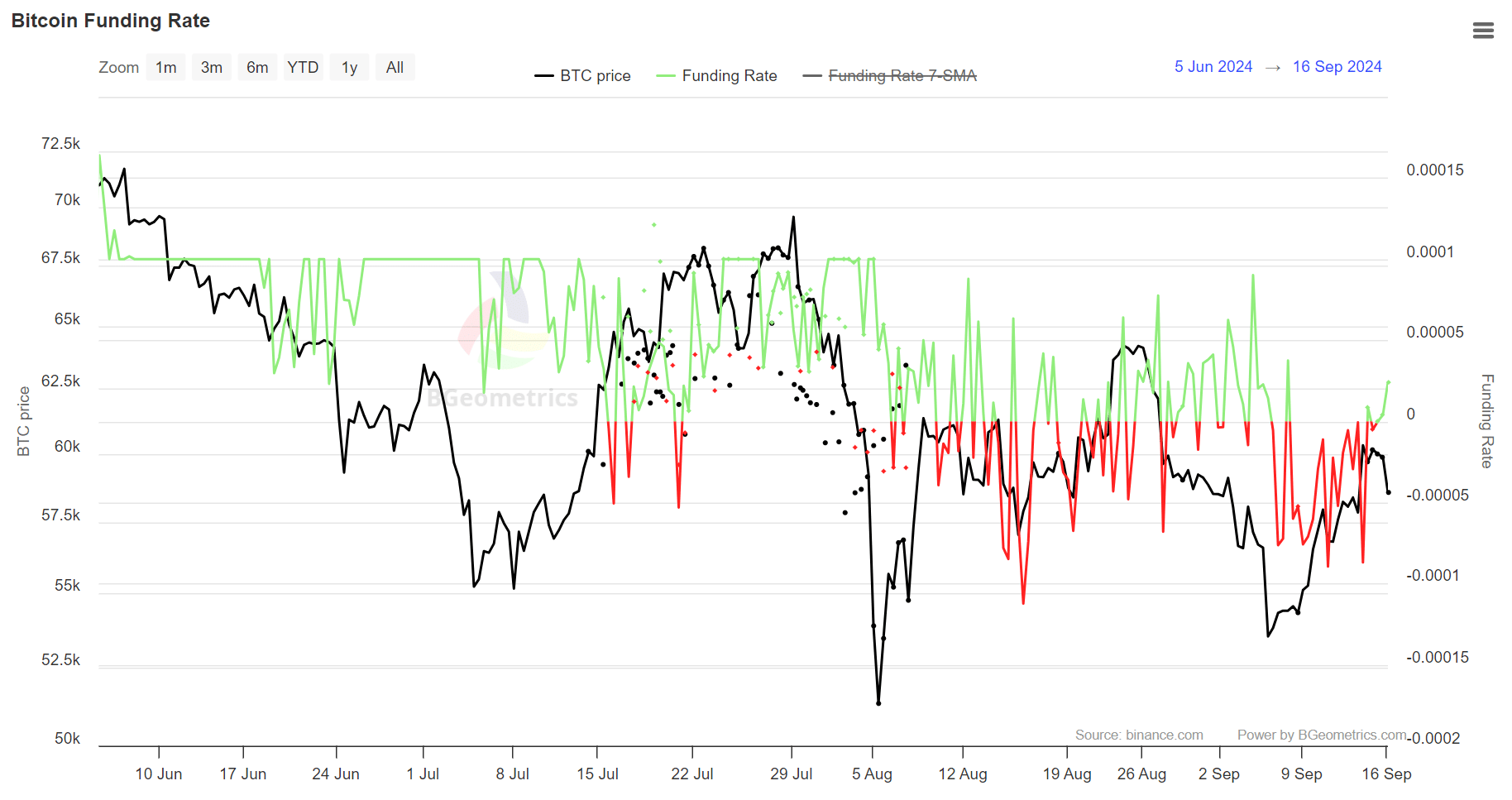

Renewed confidence amongst Bitcoin future merchants

Whereas shorts have dominated derivatives for some time, longs have just lately elevated their presence, as proven by the constructive funding fee. Traditionally, a constructive funding fee signifies confidence amongst futures merchants, suggesting they count on BTC costs to rise.

Furthermore, this aligns with AMBCrypto’s earlier projections, which famous {that a} constructive sentiment typically precedes BTC testing essential worth ranges.

Although appreciated, a extra constantly constructive funding fee might enhance the probabilities of a Bitcoin rebound within the subsequent two weeks.

Surprisingly, regardless of renewed dominance, BTC fell under $60K, suggesting potential third-party involvement.

Whereas this means a slight divergence, different components could neutralize its long-term affect. The query stays: Will the downtrend maintain?

What now?

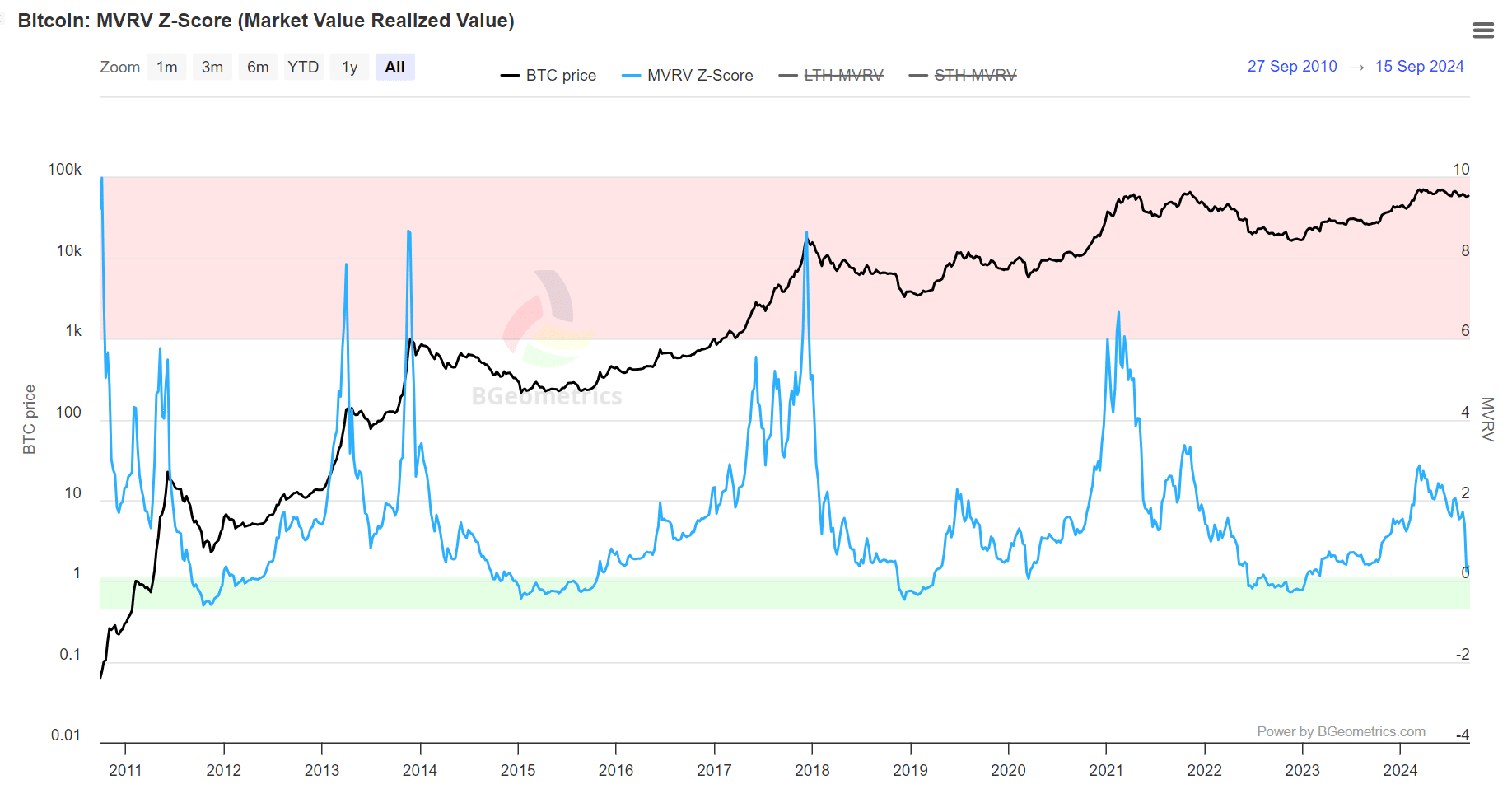

The chart under reveals the MVRV-Z rating approaching the inexperienced field, a zone that traditionally alerts undervaluation. Shopping for Bitcoin throughout these durations has usually resulted in outsized returns, with BTC costs rallying afterward.

Nonetheless, if the halving pattern holds true, the present MVRV mirrors the mid-September worth from 4 years in the past—simply earlier than the Z-score entered the pink field, which alerts the market cycle high. The above talked about charts assist this situation.

Learn Bitcoin (BTC) Value Prediction 2024-25

In accordance with AMBCrypto, October might begin with Bitcoin testing the market high round $70K, supplied latest profit-takers chorus from promoting, LTH continues to carry, and longs preserve dominance within the perpetual market.

If this performs out, the halving impact speculation can be confirmed as “true.”