- BTC has not too long ago hit one other ATH.

- There was extra scramble to get BTC, driving up its demand.

Bitcoin has surged to a brand new all-time excessive of $106,000, pushed by an unprecedented surge in institutional demand and a tightening provide throughout OTC desks.

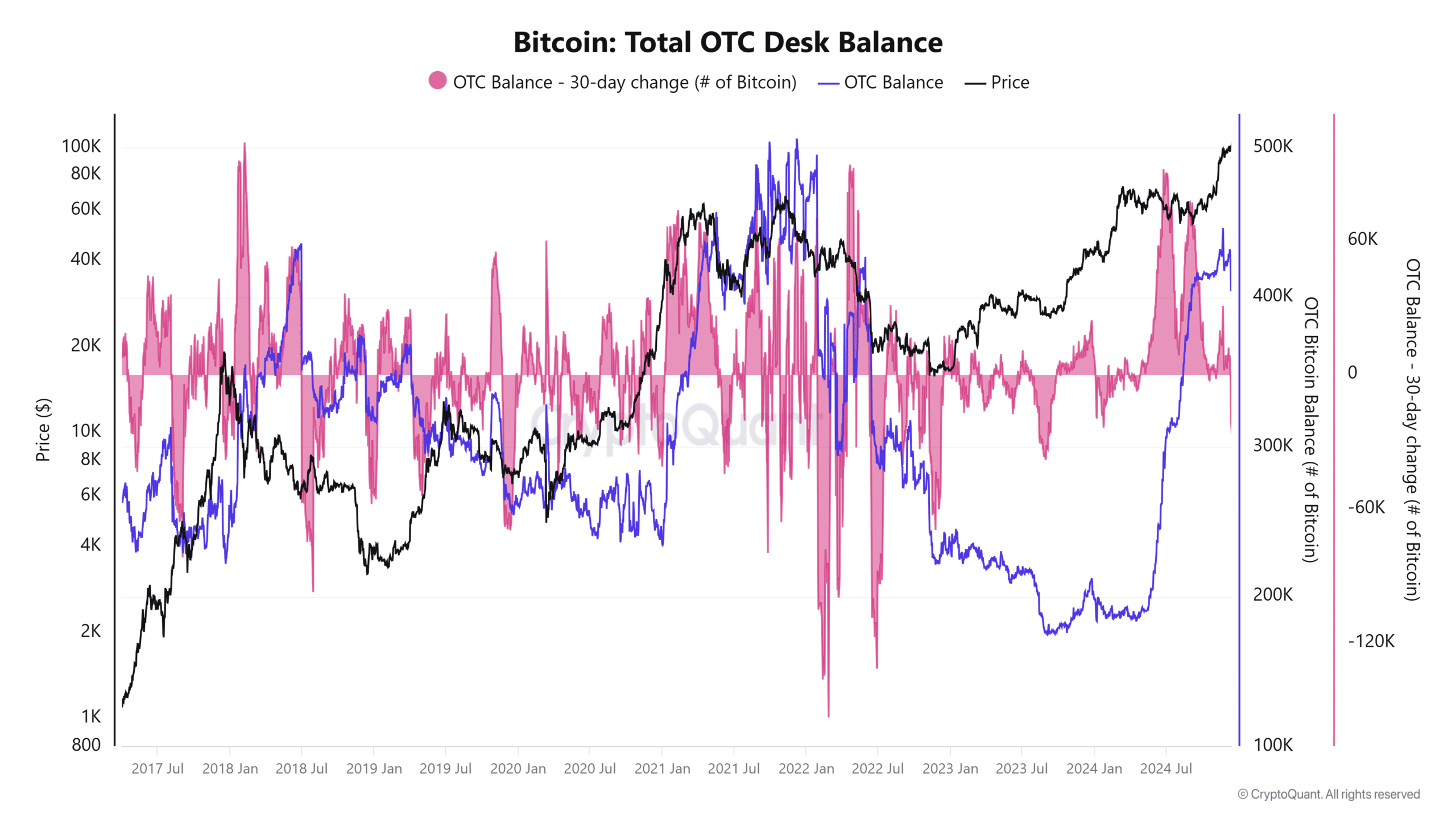

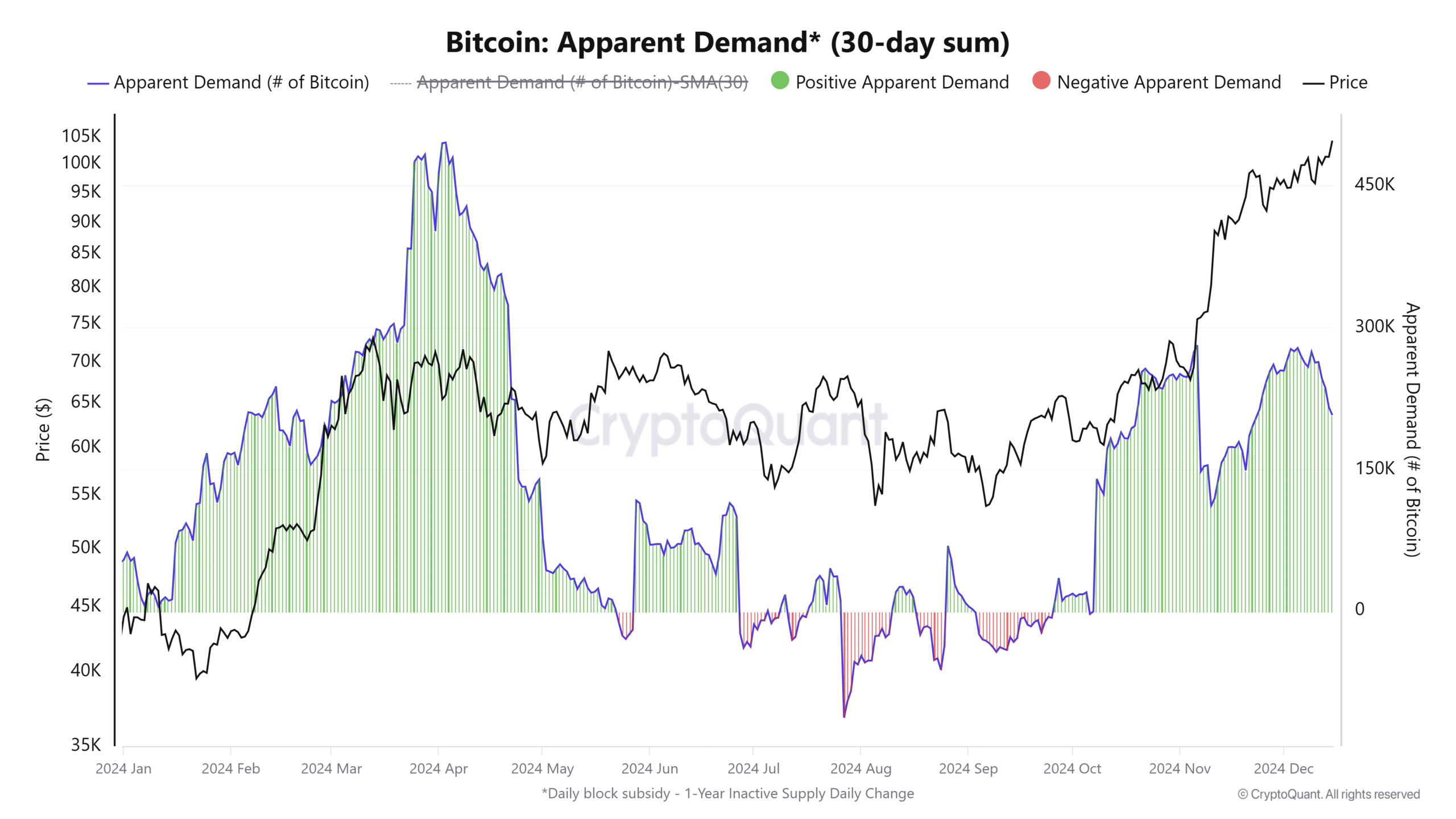

On-chain knowledge reveals a big decline in OTC desk balances, whereas obvious demand has continued to outpace provide over the past month. This mix has created a provide squeeze that has fueled Bitcoin’s sharp worth momentum.

Bitcoin institutional accumulation grows

Evaluation of the Bitcoin OTC Desk Stability chart, per CryptoQuant, reveals a pointy decline in OTC balances, marking the steepest drop this yr. Up to now 30 days alone, OTC desk balances have fallen by 25,000 BTC, whereas a complete of 40,000 BTC has left these desks since November 20.

Institutional buyers and high-net-worth people usually use OTC desks to buy giant quantities of Bitcoin with out impacting spot market costs. This depletion indicators that establishments are aggressively accumulating, lowering the obtainable provide for broader market contributors.

The dwindling OTC reserves coincide with Bitcoin’s rally to new highs, illustrating how institutional demand has fueled upward momentum whereas making a provide scarcity out there.

Demand outpaces provide, fueling worth momentum

Evaluation of the Bitcoin Obvious Demand chart reinforces the narrative of accelerating demand. Obvious demand, which tracks web Bitcoin absorption, has surged since November, displaying constant progress because the market rally gained momentum.

Optimistic obvious demand has dominated, reflecting a market setting the place BTC inflows considerably outpace outflows.

As demand surged, Bitcoin broke by vital resistance ranges, reaching its present excessive of $106,000.

The decline in OTC balances, mixed with this rise in demand, triggered a provide squeeze, creating the right setting for BTC’s record-breaking efficiency.

Bitcoin worth motion confirms robust bullish sentiment

The value chart confirms Bitcoin’s bullish momentum. The value has shaped a transparent uptrend, characterised by larger highs and better lows, indicating market power. Bitcoin stays comfortably above its 50-day and 200-day shifting averages, signaling ongoing help for the rally.

Moreover, buying and selling volumes have elevated throughout key upward actions, indicating that worth positive aspects are supported by robust participation from each institutional and retail buyers.

The Relative Power Index (RSI) is at present close to 70, reflecting robust momentum. Nonetheless, it additionally suggests the potential for short-term consolidation because the market absorbs current positive aspects.

Institutional demand and provide squeeze drive BTC larger

Bitcoin’s surge to $106,000 instantly outcomes from growing institutional demand and tightening provide. The depletion of OTC desk balances highlights aggressive accumulation by giant buyers, whereas obvious demand continues to exceed obtainable provide.

These elements have created the situations for a big provide squeeze, pushing Bitcoin to new all-time highs.

– Learn Bitcoin (BTC) Value Prediction 2024-25

Whereas short-term consolidation might happen, the long-term outlook stays firmly bullish as institutional confidence and demand for Bitcoin present no indicators of slowing.